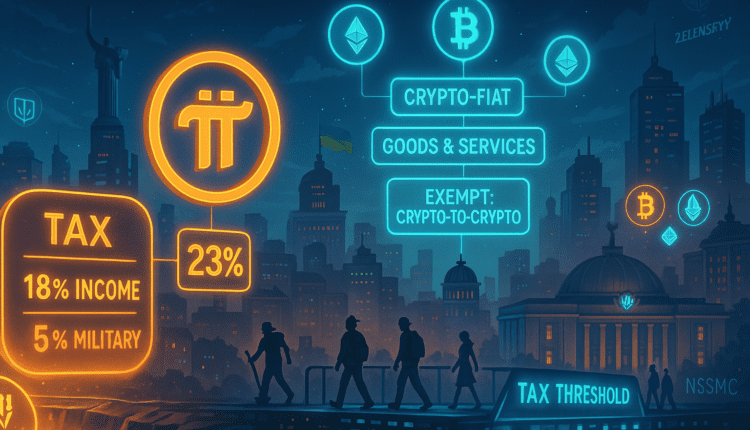

Ukraine Unveils 23% Crypto Tax Plan With Breaks for Small Investors

Ukraine new tax proposal targets crypto profits with a 23% rate, but exempts crypto-to-crypto trades and offers potential tax-free limits for small users and long-term holders.

Ukraine’s Crypto Tax Framework Emerges Amid Push for Regulation

Ukraine’s National Securities and Stock Market Commission (NSSMC) has proposed a sweeping new taxation framework for the country’s crypto economy, introducing a 23% tax on specific crypto transactions. This includes an 18% income tax and a 5% military levy, targeting profits made when cryptocurrencies are exchanged for fiat currencies or used to purchase goods and services.

Online advertising service 1lx.online

The 32-page proposal, released on April 8, sets the stage for structured digital asset regulation and taxation, aligning Ukraine with global crypto-friendly jurisdictions like Austria, France, and Singapore.

Crypto-to-Crypto Remains Untouched—For Now

One of the most notable elements of the plan is the exemption for crypto-to-crypto transactions. Swapping Bitcoin for Ethereum or any other token will not be subject to taxation under the proposed rules. This puts Ukraine among progressive crypto tax frameworks that recognize the complexity and frequency of crypto trading.

Stablecoins could also receive special treatment. The NSSMC classifies foreign-currency-backed stablecoins as comparable to foreign exchange assets—which are already tax-free under Ukrainian law—raising the possibility of full or partial exemptions.

Miners and Stakers in the Spotlight

The proposal outlines how the state might approach taxing mining, staking, airdrops, and hard forks. Mining would be treated as a business, though small miners could be exempted. Staking income may be taxed only upon fiat conversion or potentially recognized as business income.

Meanwhile, airdropped tokens and assets gained through hard forks might be taxed either immediately or only once sold, depending on regulatory approval. The NSSMC notes that tracing the origin of such assets is complex due to decentralized platforms and the anonymous nature of distribution.

Challenges of Documentation and Market Volatility

Another key concern is proving acquisition costs, especially for assets gained through P2P trades or informal channels like airdrops. The fast-changing value of crypto assets could also result in taxes being levied on unrealized “paper profits”—which may vanish after a market dip.

To counteract this, the Commission recommends digital reporting tools and streamlined systems to assist users with compliance and clarity.

User Protections and Potential Exemptions

The white paper includes provisions for small-scale investors. For instance, gifts or donations among family members may be tax-free. Those who HODL long-term could also be spared taxation, and a potential tax-free threshold might be introduced for users with low-volume activity.

However, some of these benefits might not extend to users with non-custodial wallets, a common self-sovereign storage method in crypto, due to enforcement and traceability concerns.

Online advertising service 1lx.online

Zelenskyy’s Pro-Crypto Vision Takes Shape

The crypto tax initiative is part of Ukraine’s broader ambition to establish a fully regulated digital asset ecosystem. President Volodymyr Zelenskyy signed a virtual assets law in March 2022, laying the groundwork for legal crypto activity in the country.

A finalized bill to fully integrate cryptocurrency into Ukraine’s financial system is reportedly in its final stages. According to Daniil Getmantsev, head of the parliamentary tax committee, the new legislation is expected to be ready soon.

Meanwhile, global eyes remain on contrasting tax policies—such as former President Trump’s proposal of zero tax on crypto earnings under $44,626—which adds urgency and nuance to Ukraine’s positioning on the world crypto stage.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)