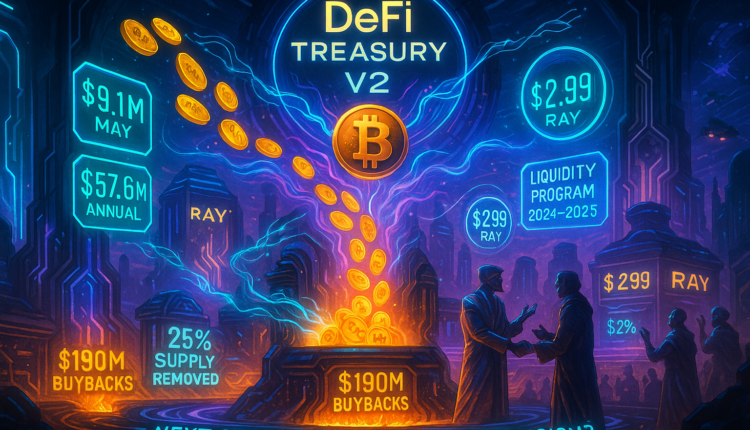

Raydium $190M Token Buybacks Signal DeFi New Capital Strategy on Solana

Solana leading DEX Raydium has executed over $190 million in RAY token buybacks. This signals a shift toward corporate-style DeFi treasury management.

Raydium, the top decentralized exchange on the Solana blockchain by trading volume, has revealed it has repurchased over $190.4 million worth of its native token, RAY. According to a recent protocol update shared on X by contributor 0xINFRA, this initiative has seen 69.1 million RAY removed from circulation—nearly 25% of its total supply.

At its last trading price of approximately $2.99, RAY’s market capitalization stands at around $800 million, though the float-adjusted cap drops closer to $593 million after accounting for the repurchased tokens. This strategic move is part of a sustained buyback initiative that began in early 2024, aiming to reward long-term holders and tighten circulating supply by recycling a portion of revenue into token repurchases.

Online advertising service 1lx.online

May 2025 alone saw $4.8 million worth of buybacks, which if annualized would equate to $57.6 million in capital returned to holders. Raydium also reported $9.1 million in protocol revenue that same month, suggesting over $109 million in yearly fees if the trend holds. With just 1.9 million new RAY tokens emitted each year and a treasury holding over $60 million in assets like SOL and USDC, Raydium appears to be striking a sustainable balance between growth and reward.

Although critics sometimes dismiss token buybacks as superficial, Raydium’s model has been positioned as fundamentally different from protocols that dip into reserves simply to reduce supply. Instead, the buybacks are being funded directly from rising revenues, demonstrating a corporate-like approach in capital deployment.

The trend appears to be catching on across the DeFi landscape. Pump.fun, a Solana-based memecoin launchpad, has also begun repurchasing its native tokens as part of a possible profit-sharing mechanism. Similarly, perpetual exchange Hyperliquid is using about 97% of trading fee income to buy back its token, HYPE.

These developments point toward a broader evolution in decentralized finance—where traditional business finance concepts like buybacks and capital efficiency are being remixed into the crypto-native playbook.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)