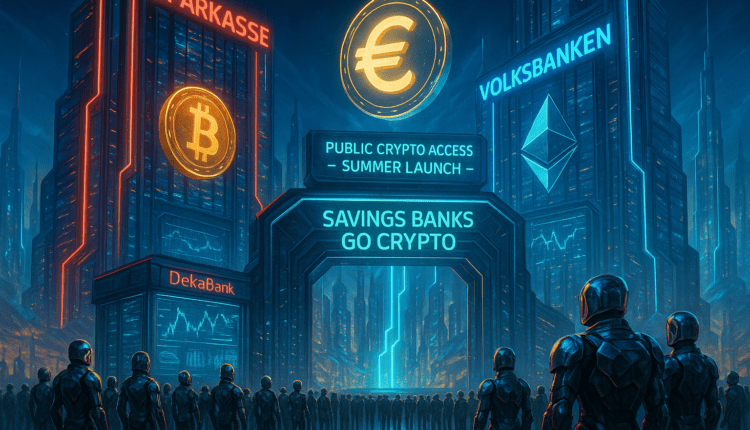

Germany Sparkasse & Volksbanken to Launch Crypto Trading for Millions of Private Clients

Germany largest retail banks, Sparkasse and Volksbanken, are embracing crypto.

The move will open regulated Bitcoin and digital asset trading to everyday clients.

In a landmark shift for traditional banking, Germany’s Sparkasse has officially lifted its long-standing ban on cryptocurrency trading, allowing private clients to directly engage with digital assets such as Bitcoin. The announcement, made by the German Savings Banks and Giro Association (DSGV), marks a turning point for the nation’s oldest and most widespread banking network.

Simultaneously, Germany’s cooperative banking system, the Volks- und Raiffeisenbanken, is pushing forward with its own rollout of crypto trading services, targeting a public launch by summer 2025. This coordinated pivot signals a broader movement across Germany’s banking sector to align with evolving investor demand.

Online advertising service 1lx.online

The DSGV emphasized that Sparkasse’s financial group is committed to offering a secure, fully regulated infrastructure for digital asset transactions. Customers who prefer to manage their investments independently will be able to use the Sparkasse mobile app for crypto trading, supported by DekaBank, a securities services provider owned by Germany’s local savings banks. According to DSGV, DekaBank is currently developing the backend infrastructure, with full functionality expected by summer 2026.

This marks a stunning reversal from Sparkasse’s position just three years ago, when internal committees recommended against entering the crypto space due to regulatory and risk concerns. But in a dramatic policy shift, driven by increased market adoption and growing client interest, the tone has changed.

In April 2025, Matthias Dießl, chairman of the Bavarian Savings Banks Association, told Bloomberg:

“Savings banks must provide cryptocurrency trading opportunities to meet client demand.”

His remarks echo a broader acknowledgment among Germany’s financial leaders that digital assets are no longer fringe — they’re rapidly becoming part of mainstream investment strategies.

By opening the door to crypto trading, Sparkasse and Volksbanken are positioning themselves as pioneers of digital finance in Germany. Their shared commitment to creating regulated, accessible services paves the way for a new chapter in banking — one where Bitcoin and blockchain-based assets sit alongside traditional financial instruments. For millions of German clients, the future of finance just became far more digital.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)