Gemini Launches First Tokenized MSTR Stock to Modernize EU Access to Bitcoin Equities

Gemini brings Michael Saylor Bitcoin strategy onchain with a tokenized MSTR stock for EU users.

The first step in democratizing access to crypto-native traditional finance.

Crypto exchange Gemini has launched a tokenized version of MicroStrategy (MSTR) stock — the company famously led by Bitcoin evangelist Michael Saylor — offering direct onchain access for investors in the European Union.

This innovative product enables users to gain exposure to MSTR without ever leaving the crypto space. According to Gemini, it’s part of a broader rollout designed to bring traditional financial instruments like stocks and ETFs fully onchain. The goal? To modernize access to legacy markets through the flexibility and openness of blockchain.

Online advertising service 1lx.online

“Legacy financial systems are outdated and difficult to reach,” Gemini said in an official statement. “They’re restricted by geography, high international fees, and limited trading windows.” With tokenized stocks, these limitations begin to fade. Investors can now manage both crypto and equities in a unified, onchain platform — no bridges, no barriers.

To power this offering, Gemini partnered with Dinari, a U.S.-based firm that specializes in tokenized public securities. Dinari’s model allows Gemini to replicate the economic rights of underlying assets — meaning holders of the tokenized MSTR receive the same financial exposure as they would with the real stock, where regulations allow.

“We’re providing enhanced liquidity, transparency, and equivalent economic benefits,” Gemini noted.

Currently, only MSTR is available in tokenized form. But more stocks and ETFs are expected soon, as Gemini confirmed a multi-asset expansion in the coming days.

Why choose MicroStrategy as the first? It’s a strategic move: the company is the largest corporate Bitcoin holder globally. Its executive chairman Michael Saylor is a vocal BTC maximalist, and MSTR’s stock price often moves in tandem with Bitcoin’s market performance.

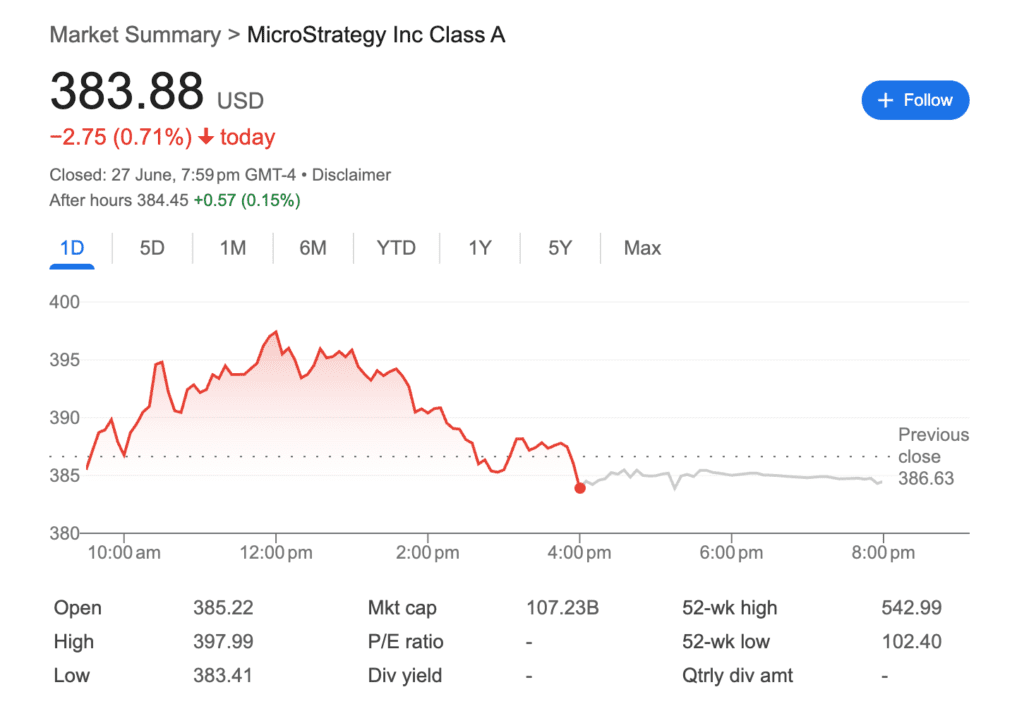

On Friday, MSTR closed at $383.88, marking a nearly 4% gain over the past month. Some analysts, like Jeff Walton, believe it may even qualify for inclusion in the S&P 500 — if Bitcoin remains above $95,240 through Q2’s end.

The Bigger Picture: Tokenized Stocks Gain Traction Across Europe

Gemini isn’t the only player in this growing trend. The European market, with its more welcoming regulatory frameworks, is rapidly becoming a hub for tokenized equity experiments.

Online advertising service 1lx.online

Last month, Kraken announced plans to offer tokenized U.S. equities to users outside the U.S. Meanwhile, reports from May suggest Robinhood is building a blockchain-based platform to let Europeans trade U.S. stocks. Even Coinbase is pushing for SEC approval to offer tokenized securities in the United States — underscoring just how fast the crypto-traditional finance merger is accelerating.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)