Ethereum Surge Sparks Power Moves—Trump Buys, Whales Shift $1B+

Ethereum breaks past $3,400 as Trump, SharpLink, and whales load up billions in ETH. Even hackers and ETFs join the action.

Ethereum (ETH) is powering through the charts in one of its strongest runs yet, smashing above $3,400 and eyeing $3,500. The second-largest cryptocurrency has surged 23% in just seven days, stirring fresh excitement across the market. While Bitcoin cools down from its all-time high of $123K to below $118K, Ethereum’s momentum is stealing the spotlight—and igniting altcoin season chatter.

One of the biggest surprises comes from Donald Trump’s World Liberty Financial (WLF), which converted $10 million USDC into 3,007 ETH at an average of $3,326. This is just the latest in WLF’s ETH buying spree, which started in November. The fund now controls 70,505 ETH, valued at $230 million, with $7 million in unrealized gains. Between late 2024 and March 2025, they amassed 66,275 ETH at $3,243 average—suggesting this isn’t a short-term move.

Online advertising service 1lx.online

Joining the ETH party, SharpLink Gaming devoured 20,279 ETH ($68.38M) in five hours, boosting its total haul over 8 days to 111,609 ETH ($343M). Meanwhile, a mysterious whale known only as 0x35fb quietly acquired 7,980 ETH from Kraken and has bought nearly 88,292 ETH in just a week—over $290 million in off-exchange movement that suggests insider confidence or strategic accumulation.

Not all whales are bullish, though. Trend Research, a major institutional ETH buyer, has begun profit-taking. After purchasing 184,115 ETH between February and June at $2,118 average, they sold 79,470 ETH for $250M but still retain 105,664 ETH. Another whale that profited $30M on past ETH trades dumped 98,000 ETH recently but still holds 35,000 in reserve—perhaps waiting for another leg up.

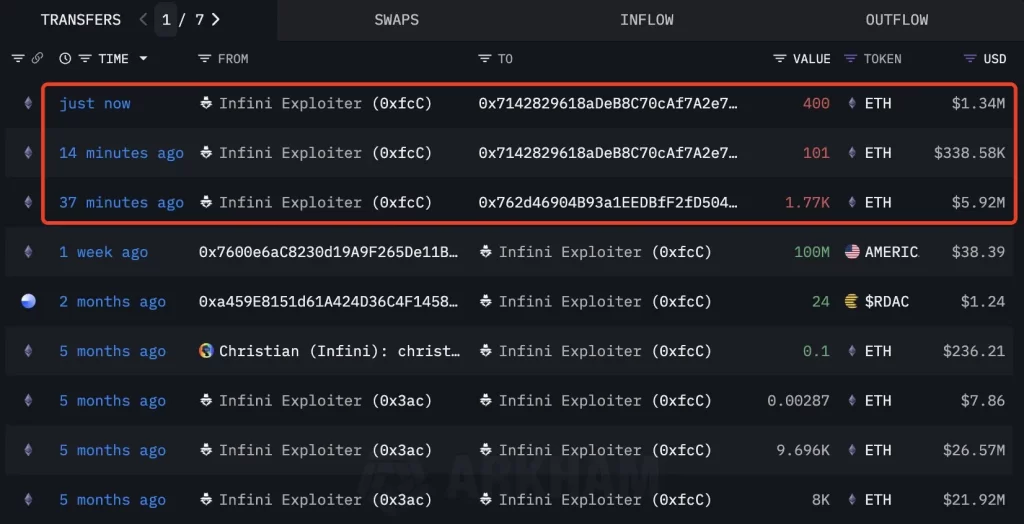

Even the infamous Infini hacker has entered the scene. After exploiting $49.5M in February and converting it into 17,696 ETH at $2,798, the attacker’s holdings grew to $59.6M. They just offloaded 1,770 ETH for nearly $6M—capitalizing on the pump.

But it’s not just whales and hackers benefiting. ETH ETFs had their best day ever on Wednesday, raking in $726.74 million in net inflows. ETHA from BlackRock led the charge with $500M, followed by Fidelity’s FETH with $113M. Total ETH ETF assets now exceed $16.41 billion. July alone has seen $2.27 billion in ETH ETF inflows—an all-time high since these instruments launched.

At the time of writing, Ethereum trades at $3,463, up 22% in July and an eye-popping 117% in the past 90 days. With momentum this strong, and without even touching its ATH, Ethereum’s summer rally is far from over.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)