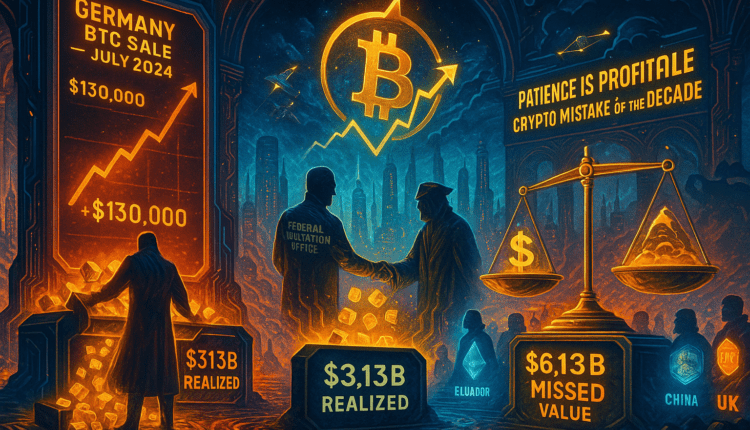

Germany $6.6B Bitcoin Blunder Shows Why Timing Is Everything in Crypto

Germany sold its seized Bitcoin stash for $3.13B just before BTC doubled in price. Now, experts are calling it the worst crypto decision of the decade.

In 2024, Germany made a decision that may go down as one of the biggest crypto missteps in history. The government sold its entire stash of 50,000 Bitcoins—originally seized during a major anti-piracy operation—for $3.13 billion. At the time, BTC was trading near $62,600, and the liquidation seemed like a smart fiscal move.

However, just one year later, the Bitcoin market experienced a meteoric rise. With BTC now trading above $130,000, those same assets would be worth more than $6.6 billion. That’s over double the revenue Germany actually secured—an irreversible opportunity cost that’s ignited criticism across the crypto space.

Online advertising service 1lx.online

Adding to the irony, Germany is one of the most progressive EU nations in terms of crypto regulation, having spearheaded MiCA licensing and maintained an open approach to blockchain finance. Yet it chose to exit the market completely instead of leveraging Bitcoin as a long-term strategic asset.

This decision becomes even more puzzling when compared to countries like El Salvador and Bhutan, which were actively accumulating BTC during the same timeframe. Meanwhile, Germany’s crypto wallet today holds just 0.0069 BTC—barely a few hundred dollars—according to Arkham Intelligence, and is mostly composed of random trace donations.

Germany wasn’t the only country to offload Bitcoin in 2024. The United States and Ukraine also sold some or all of their crypto holdings, causing a 12% drop in state-owned BTC reserves. But while others were selling, some nations like China and the UK continued to hold, and Donald Trump even proposed forming a U.S. national Bitcoin reserve.

Crypto analysts and the wider community haven’t held back in their criticism. One user on social media put it bluntly: “Among all the bad decisions being made for the country at the moment, this turns out to be the worst.”

The lesson? Timing is everything. Selling in haste during uncertain market cycles can lead to regret—especially when dealing with assets like Bitcoin. In a world where digital currencies are increasingly viewed as sovereign reserves, Germany’s early exit serves as a case study in caution.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)