El Salvador Crypto Crisis: Bitcoin Remittances Plunge 45% Amid Market Volatility

El Salvador saw a 45% drop in crypto remittances in Q1 2025, raising concerns over Bitcoin role in the nation economy amid ongoing volatility and low adoption.

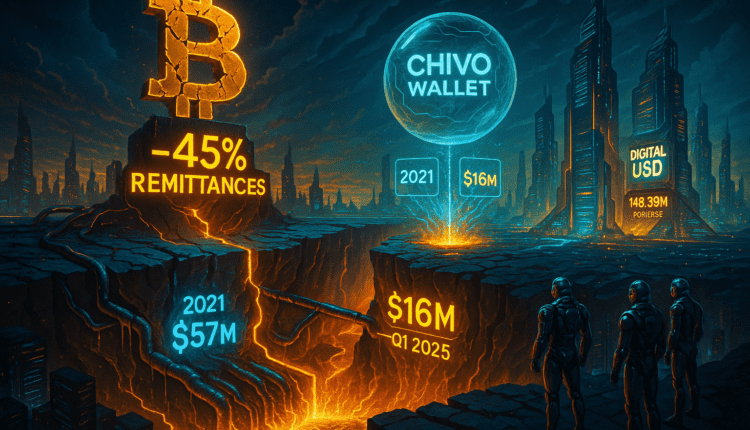

El Salvador bold experiment with Bitcoin as legal tender has hit a major roadblock. Official data reveals that crypto remittances to the country have plunged 44.5% in Q1 2025 compared to the same period in 2024—a dramatic shift that underscores growing doubts over the nation’s crypto-driven economic model.

This decline marks the first significant setback since the country adopted Bitcoin as legal currency in 2021. Back in Q4 2021, the government-backed Chivo Wallet processed over $57 million in crypto remittances. Today, that figure has been slashed to just $16 million in the first quarter of 2025. In 2024, crypto remittances reached $28.83 million across the year, with an average of around $7 million per quarter and 27,000 transactions.

Online advertising service 1lx.online

Crypto-based transfers now make up a mere 0.52% of El Salvador’s total remittance inflows, which hover around $3 billion annually. That’s a steep decline from earlier expectations, raising concerns about both public confidence and the government’s long-term digital finance vision.

Why the sharp fall? Bitcoin volatility is a key culprit. Between January and May 2025, Bitcoin fluctuated wildly between $93,907 and $108,949. For Salvadorans relying on stable income from relatives abroad, these price swings represent an unacceptable level of risk.

In addition, persistent regulatory uncertainty and changing global sentiment toward crypto have reduced its appeal for practical use cases like cross-border money transfers. Despite high-level government campaigns and incentives, the population has shown hesitancy in embracing Bitcoin for everyday financial activities.

Initially, El Salvador’s move into crypto was motivated by a desire to reduce reliance on costly remittance providers like Western Union. The aim was to cut transaction fees and maximize the funds received by families. But this vision has not materialized at scale, and the data now reveals the shortcomings of the crypto remittance strategy.

The economic consequences could be significant. A continued decline in crypto-based remittances may place pressure on GDP growth, foreign reserves, and the country’s balance of payments. These inflows are vital to the nation’s financial stability and support for millions of Salvadoran households.

There is, however, a silver lining. While crypto-based remittances have tumbled, digital remittances overall are expected to grow, with projections pointing to $148.39 million in 2025—a year-over-year increase. This signals that Salvadorans are still open to digital channels, even if crypto isn’t the preferred method.

El Salvador’s situation presents a cautionary tale for countries seeking to integrate crypto into national infrastructure. While innovation is crucial, the real-world use of crypto remains tightly linked to volatility, education, and public trust.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)