Crypto Liquidations Underreported: K33 Research Unveils Alarming Gaps in Exchange Data Accuracy

K33 Research reveals that major crypto exchanges may be drastically underreporting liquidation data, painting an unclear picture of market risks and leverage, with potential severe impacts on traders.

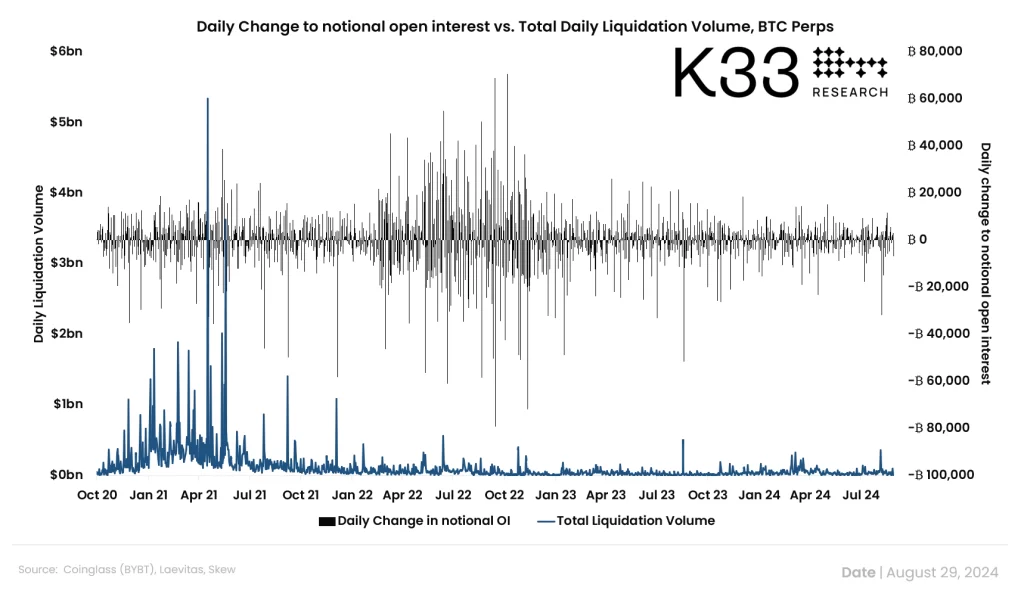

Recent findings by K33 Research have raised concerns that the scale of cryptocurrency market liquidations could be significantly greater than the data provided by leading exchanges like Binance, Bybit, and OKX suggest. On August 29, Vetle Lunde, a senior analyst at K33 Research, reported that since 2021, these major exchanges have altered the way they report liquidation data, leading to a potential underrepresentation of actual liquidation volumes.

According to Lunde, the exchanges now report just one liquidation per second, regardless of the actual number of liquidations occurring during that time frame. This practice has resulted in “bogus” data that fails to accurately reflect the true extent of market liquidations over the past three years. If these findings are accurate, it means that crypto traders and analysts have been operating based on incomplete and potentially misleading data, making it difficult to fully assess market conditions.

Online advertising service 1lx.online

Liquidation data is crucial for gauging risk appetite and understanding leverage ratios on exchanges. However, the discrepancies in reported data suggest that traders may not have a clear picture of these factors, particularly during periods of high volatility. The research also highlighted that open interest, which measures the value of outstanding crypto derivatives, does not always correlate with liquidation data, further complicating the analysis of market trends.

K33 Research speculated that exchanges might be limiting data for public relations reasons or to maintain an information advantage, possibly benefiting associated investment firms. This lack of transparency could have significant implications for traders relying on this data to inform their decisions.

Lunde emphasized that while monitoring changes in open interest can help assess leverage flush-outs, it does not account for new positions opened during volatile periods, making the current liquidation data largely unreliable. “For now, liquidation data are mostly erroneous entertainment and not actionable,” Lunde concluded.

At the time of writing, data from Coinglass, a crypto derivative data analysis platform, indicated that 56,958 traders were liquidated in the past 24 hours, with total liquidations amounting to $156.7 million—83% of which were long positions. However, this information is also derived from the same major exchanges mentioned in the K33 Research report, raising further questions about its accuracy.

Cointelegraph reached out to the exchanges cited in the research for comment but had not received a response by the time of publication. Any updates will be provided as they become available.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)