How a US Stock Market Crash Could Shape the Future of Crypto Markets

The Alpha Research Team explores various scenarios on how the US stock market performance could impact cryptocurrency markets, presenting four possible outcomes for investors.

The ever-evolving relationship between the US stock market and cryptocurrency markets has sparked debate among experts. The Alpha Research Team has examined several possible scenarios regarding the stock market’s performance for the remainder of the year and how these could influence the crypto market.

Online advertising service 1lx.online

Stock Market Grows

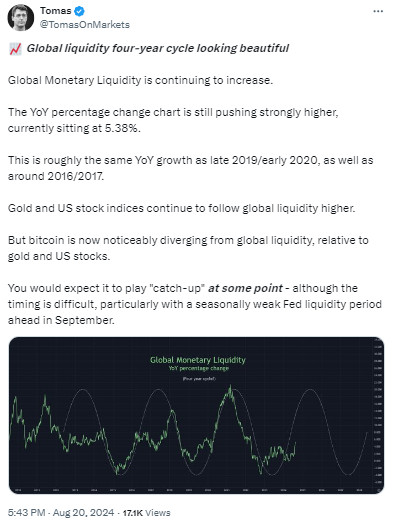

- Grow, Grow: One perspective suggests that both the stock market and crypto markets will experience growth. The key driver behind this scenario is global liquidity. As central banks continue to inject money into the economy, investors seek assets that outpace inflation, which could include stocks, high-value real estate, luxury collectibles, and cryptocurrencies. If global liquidity continues to rise, this scenario could lead to a bullish outcome for both markets.

- Grow, Shrink: Another scenario posits that while the stock market may grow, the crypto market might not follow suit. This divergence could occur if institutional investors begin to view crypto as a “risk-on” investment, akin to stocks. Factors such as US economic data and the upcoming presidential election could significantly impact this outcome, particularly if the US economy outperforms others, making stocks more attractive than crypto.

Stock Market Declines

- Decline, Grow: A contrasting scenario suggests that the US stock market could decline while crypto markets thrive. This could happen due to increased adoption in emerging markets, where countries like Vietnam, the Philippines, Brazil, and Venezuela already have significant crypto user bases. If India, with its massive population, continues to embrace crypto, this could lead to substantial growth in the market, independent of US stock market performance.

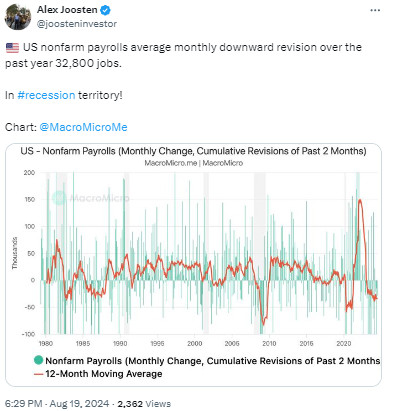

- Decline, Decline: The final scenario considers the possibility that both the stock market and crypto markets could decline simultaneously. A reduction in liquidity, a recession, or other negative economic data could trigger this outcome. Additionally, unexpected legislation or geopolitical events could also lead to market downturns in both sectors.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)