SEC Pushes Back Solana ETF — Approval Wave Now Expected in Fall 2025

Fidelity application for a spot Solana ETF has been delayed by the SEC, signaling a broader postponement of altcoin ETFs until the new regulatory framework is finalized. Approval might not arrive until Q4 2025.

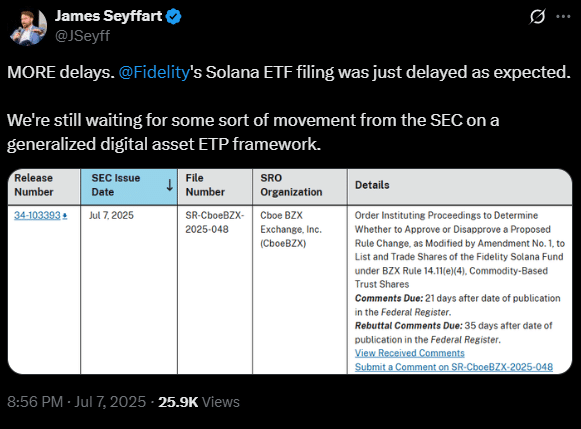

The U.S. Securities and Exchange Commission (SEC) has postponed its decision on Fidelity’s highly anticipated spot Solana [SOL] ETF. The application, officially acknowledged on July 7, now enters a comment and rebuttal phase under Commodity-Based Trust Share rules.

This delay doesn’t just affect Solana. It casts a shadow over all pending altcoin ETF proposals that were originally projected for summer approval. The SEC’s inaction is tied to its ongoing development of a broader digital asset ETP (Exchange-Traded Product) framework, as noted by Bloomberg ETF analyst James Seyffart. He emphasized that the hold-up was expected, but the lack of a finalized structure continues to push timelines further out.

Online advertising service 1lx.online

“We’re still waiting for some sort of movement from the SEC on a generalized digital asset ETP framework,” Seyffart posted on X, formerly Twitter.

As of now, issuers have been requested to refile their amended ETF applications by the end of July. While Q3 approval remains technically possible, Seyffart cautioned against expecting imminent movement. He suggested that regulatory clearance might not materialize until fall.

His outlook was echoed by Nate Geraci of the ETFStore, who warned that several crypto issuers believe the new framework won’t be implemented until early Q4. “Some issuers don’t believe this framework will be fully implemented until early fall. So no spot crypto ETF approvals until then,” Geraci said.

The SEC also revealed on July 1 that the upcoming framework would introduce additional disclosure requirements for issuers. As a result, even the previously approved conversion of the Grayscale multi-crypto index into an ETF has been paused until the framework is live.

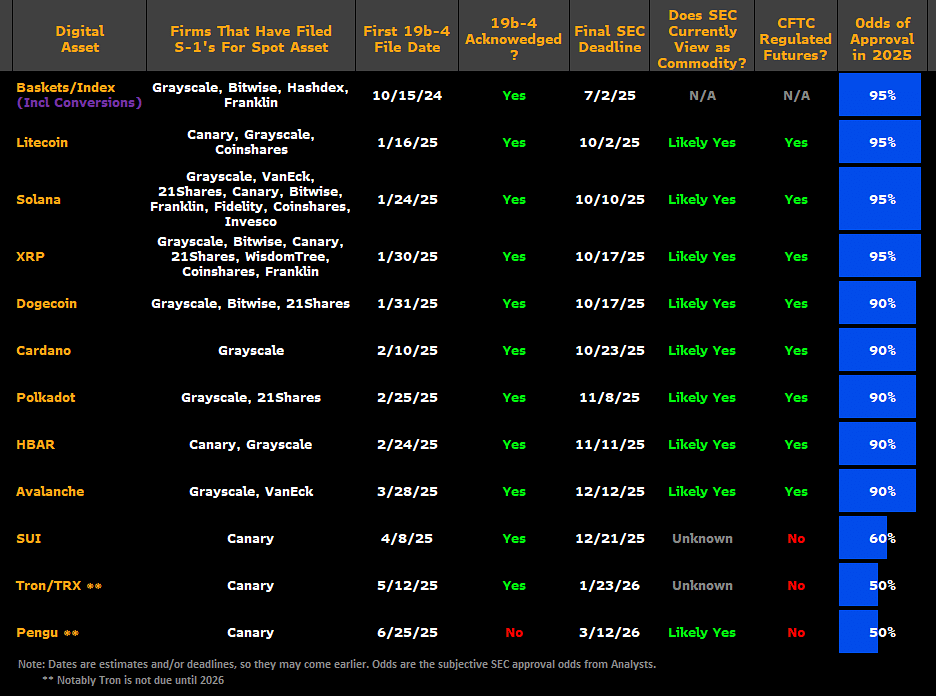

It’s crucial to understand that not all ETF structures are governed by the same legal foundations. While Fidelity’s spot ETF application is filed under the Securities Act of 1933, already approved funds like the REX-Osprey SOL staking ETF fall under the Investment Company Act of 1940. Still, Seyffart predicts that the SEC might greenlight multiple altcoin ETF applications at once once the framework is finalized.

Among the altcoin ETF hopefuls are filings for Litecoin [LTC], Ripple [XRP], Dogecoin [DOGE], and Cardano [ADA], all of which face final SEC deadlines in October.

Online advertising service 1lx.online

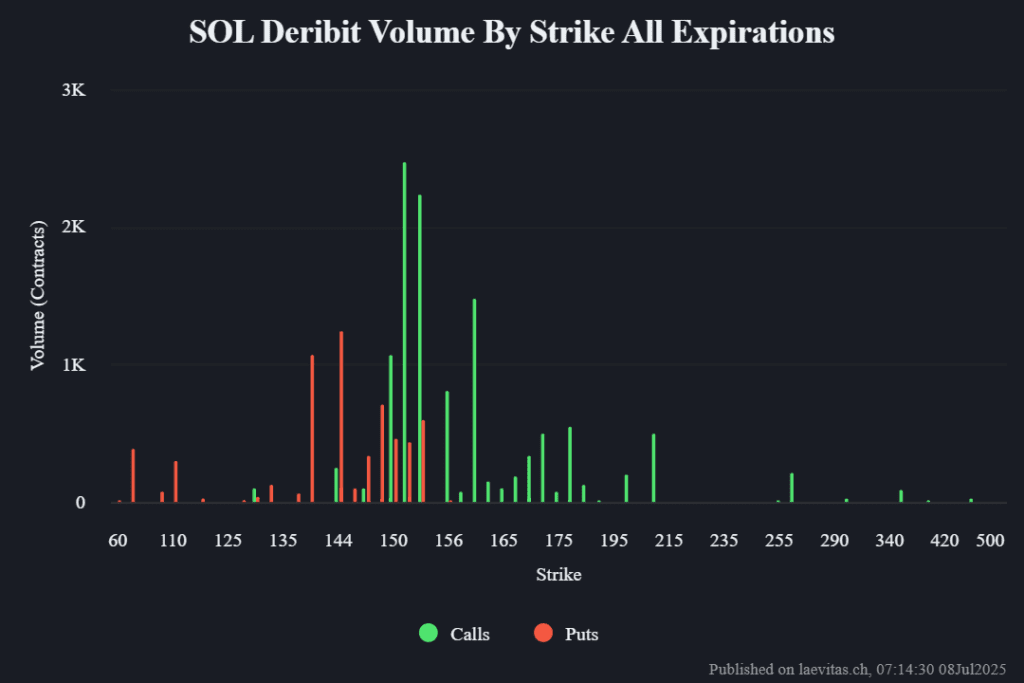

Following the announcement, Solana’s market value experienced a slight dip, falling from $154 to $147. Options data suggested the market remains cautiously neutral, with major call volume concentrated around $152, $154, and $160 — signaling limited near-term bullish momentum. Meanwhile, put options were most active around $140 and $144, suggesting traders expect SOL to remain range-bound between $140 and $160 throughout the summer.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)