Bitcoin Under Pressure: $80K Threat Looms as Bearish Indicators Dominate Market Sentiment

Bitcoin struggles below key resistance at $88,800, with DMI and Ichimoku Cloud data hinting at a potential dip under $80,000.

Bitcoin (BTC) is showing increasing signs of bearish momentum, struggling to sustain gains after failing to overcome the critical resistance at $88,800. Within the last 24 hours, the price fell below $87,000, suggesting a potential trend reversal that could threaten the psychological support level of $80,000.

🔎 DMI Signals a Shift in Market Control

Online advertising service 1lx.online

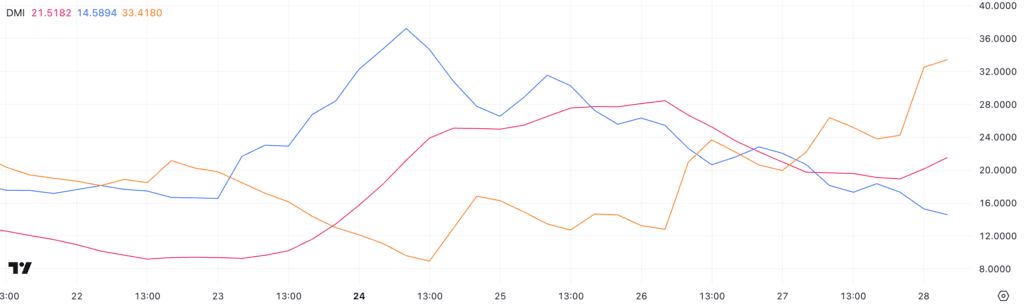

The Directional Movement Index (DMI) now illustrates that bearish momentum is outweighing bullish strength. The ADX—used to gauge the strength of a trend—currently stands at 21.51, placing BTC in a transitional phase. While not yet reflecting a strong trend, it does indicate a growing directional bias.

A deeper dive into the data reveals the +DI (bullish directional indicator) plummeting from 26.33 to 14.58, while the -DI (bearish indicator) surged from 13.2 to 33.41. This significant crossover shows a complete sentiment reversal: sellers are increasingly dictating price action, and unless bulls can mount a recovery quickly, the market may face continued downward pressure.

☁️ Ichimoku Cloud Warns of Possible Breakdown

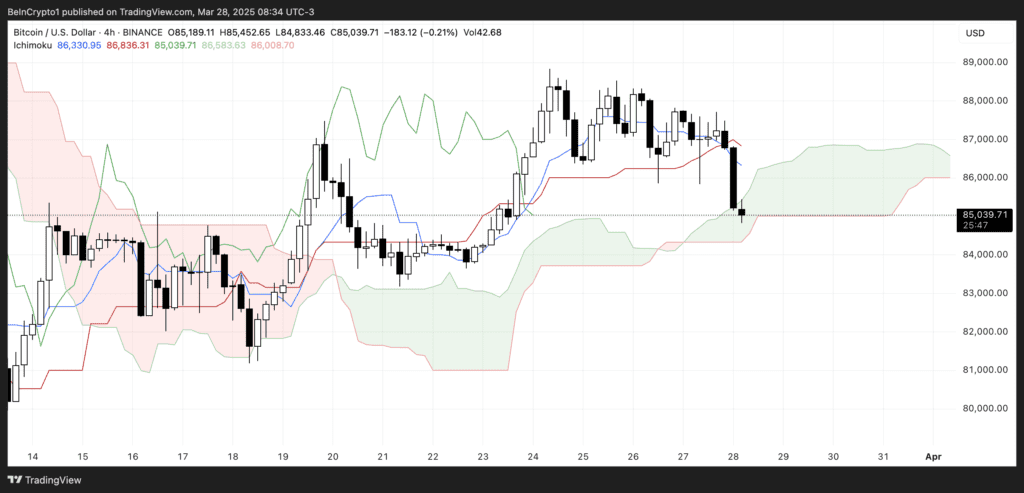

Technical signals from the Ichimoku Cloud further reinforce the bearish scenario. Bitcoin has fallen below both the Tenkan-sen and Kijun-sen trendlines, while also breaching the lower edge of the green Kumo cloud. This marks a short-term bearish signal and may indicate that the cloud, which recently served as a support zone, could now flip into resistance.

As per Ichimoku logic, being under the cloud is an indicator of a bearish trend, especially with the future cloud thinning—suggesting that market momentum is weakening. Without a rapid reversal and a move back above key trendlines, bearish conditions are likely to persist.

📉 Key Levels and the $80K Psychological Mark

After the rejection at $88,800, BTC is now approaching a crucial support at $84,736. If this zone fails to hold, a drop toward $81,162 may unfold. A deeper fall could see Bitcoin trading below $80,000, testing lower support levels at $79,970 and $76,644. The chart structure is leaning bearish, and the market could slide further unless significant buy pressure reemerges.

Online advertising service 1lx.online

Despite the looming risk, macroeconomic developments from the United States—including PMI figures and consumer sentiment data—could act as turning points. Should these factors offer positive surprises, they may provide Bitcoin with enough bullish momentum to recover and potentially retest higher zones in April.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)