Bitcoin Poised for Short-Term Dip Before Epic $140K Surge, Say Analysts

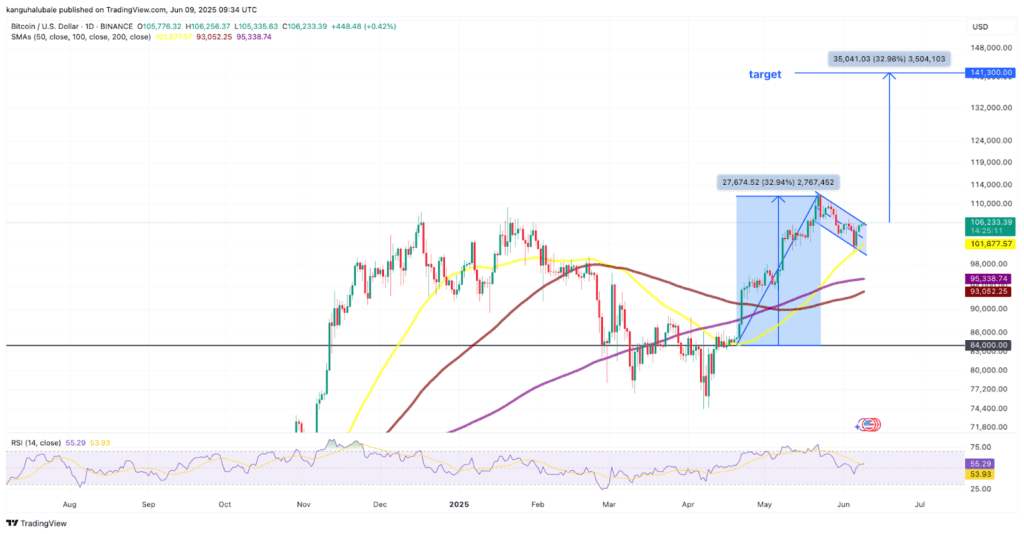

Bitcoin may test $100K support before a breakout to $140K. CPI data and bullish patterns drive volatility.

After intense volatility stirred by the Musk-Trump drama, Bitcoin (BTC) has stabilized between $103,800 and $106,900 in recent days. Yet analysts warn that this calm may be temporary—predicting a dip toward $100,000–$104,000 before the next explosive move.

Online advertising service 1lx.online

Central to this concern is the imminent U.S. Consumer Price Index (CPI) report, scheduled for June 11. Economists anticipate a 0.3% monthly rise and a 2.3% yearly increase. The Core CPI is forecasted to increase by 0.3% monthly and 2.9% annually—figures that could cool hopes for Federal Reserve rate cuts and pressure BTC price action.

Swissblock analysts noted in a June 9 post on X that “Inflation data in the week ahead could unleash volatility,” adding that Bitcoin bulls are “rebuilding structure” but a short-term dip toward $104,000 is likely.

Similarly, market analyst Mickybull Crypto flagged a bearish head-and-shoulders pattern on the daily BTC chart, targeting a drop to $101,500. He summed it up clearly:

“Short-term correction, then new all-time highs.”

Technical indicators support this cautious optimism. Popular analyst Daan Crypto Trades stated on June 8:

“Bitcoin has reclaimed its bull market support band. High time frame trend remains clean.”

He emphasized the importance of holding above $95,000, the support band critical to BTC’s long-term rally.

Technical analyst SuperBro echoed these sentiments, highlighting that Bitcoin has maintained levels above its 2021 weekly close and stayed above the 5-week EMA since May.

“Once it breaks the 2021 trendline, expect $140–$150K quickly,” he said.

Chart patterns are flashing green. Bitcoin has been building a classic cup-and-handle formation, suggesting a breakout above $109,000 with a potential target around $143,000—a projected 35% rally.

Online advertising service 1lx.online

The weekly bull flag pattern also reinforces this outlook, aiming at $143,300.

As previously reported by Cointelegraph, Bitcoin’s path toward $140,000 appears increasingly plausible, backed by a convergence of technical, on-chain, and macroeconomic signals.

⚠️ This is not financial advice. Always conduct your own research before investing.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)

Online advertising service 1lx.online