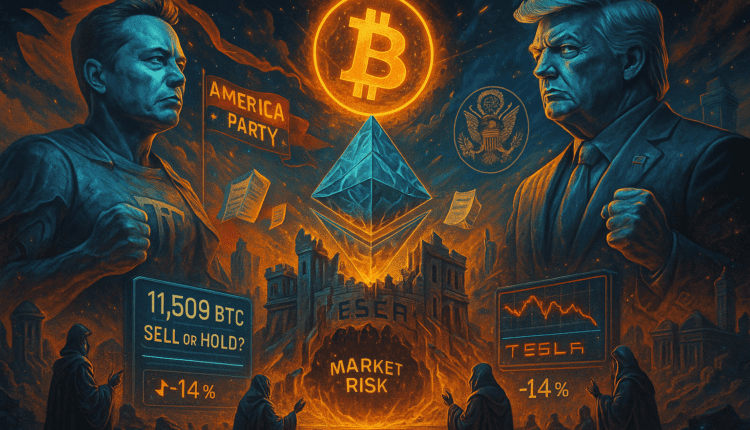

Musk vs. Trump Feud May Trigger Tesla Selloff and Bitcoin Crash

Tesla stock tumbles 14% amid Elon Musk political clash with Trump. Could Tesla Bitcoin stash be next?

Elon Musk intensifying feud with former President Donald Trump has crossed into financial territory, sparking turbulence in both the traditional stock market and the crypto space. As tensions rise, investors are bracing for potential fallout that could impact Tesla’s valuation—and the fate of Bitcoin.

Following Musk’s harsh critique of Trump’s $5 trillion spending bill in June and the controversial launch of his new political venture, the America Party, Tesla stock has plunged 14%. The latest blow came on July 7, when the company’s shares dropped another 6.8%, erasing $79 billion in market capitalization.

Online advertising service 1lx.online

With Republicans holding control across all major branches of U.S. government, concerns are growing that Tesla could lose vital government backing for electric vehicles. Moreover, SpaceX, a Musk-led venture heavily reliant on $22 billion in federal contracts, may also face policy headwinds if political hostility continues to grow.

Beyond stock volatility, Tesla’s Bitcoin holdings are also drawing scrutiny. The company currently holds 11,509 BTC—purchased for roughly $1.2 billion—now valued at about $951 million after a 12% dip in Bitcoin’s price. Investors fear that if Tesla’s financial position weakens further, Musk may be forced to liquidate some of those crypto assets, potentially triggering a cascade effect in the already fragile crypto markets.

Thanks to the Financial Accounting Standards Board’s (FASB) new rules implemented in 2025, Tesla is now required to mark-to-market its Bitcoin holdings quarterly. When Bitcoin dipped to $93,000 earlier this year, Tesla faced unrealized losses. However, the company posted a $600 million windfall in Q4 2024 when Bitcoin surged to $106,000.

Amid this turmoil, market watchers are split on what comes next. Analyst Nic Puckrin noted that the Musk-Trump feud was foreseeable, but its implications for investor confidence are more significant than expected. Anthony Pompliano offered a strategic view, suggesting that Musk could leverage Tesla’s Bitcoin holdings to hedge against potential cuts in EV subsidies. He emphasized that the America Party appears to be Bitcoin-friendly and that Musk may actually increase crypto exposure to maintain financial autonomy.

Yet, investors are questioning Musk’s focus. While political ambitions grow, Tesla is preparing to launch its robotaxi fleet in Austin and faces escalating competition from China’s BYD. Some shareholders argue that Musk should prioritize innovation and market leadership over politics.

Meanwhile, SpaceX and Musk’s AI project xAI remain insulated from public stock market drama, but Tesla’s board may soon demand a shift in focus if political controversies start affecting long-term growth.

In essence, Musk’s handling of Tesla’s Bitcoin holdings will send a strong signal to the market. A decision to hold could restore confidence. A sell-off, however, may ignite fresh waves of volatility. With crypto markets hanging in the balance, all eyes are on Musk’s next move.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)