Deep Correction in the Crypto Market: BTC, ETH and ETF Outflows

Crypto market correction deepens as Bitcoin, Ethereum, and ETFs face heavy outflows. ETH drops 12% in a week. What’s next?

Table of Contents

- Introduction

- Why Is the Crypto Market Correcting?

- Bitcoin’s Role in the Current Decline

- Ethereum’s 12% Weekly Loss

- ETF Outflows and Institutional Behavior

- Market Sentiment and Investor Reactions

- Forecasts: What Happens Next?

- Conclusion

Online advertising service 1lx.online

Introduction

The cryptocurrency market is undergoing a deep correction.

Total capitalization has dropped sharply, Ethereum lost 12% in a week, and both Bitcoin (BTC) and Ethereum ETFs recorded significant outflows.

For many new investors, this downturn raises urgent questions: is this the beginning of a larger bear cycle or simply a temporary correction before the next rally?

This article breaks down the correction in detail, covering Bitcoin, Ethereum, Ripple, and institutional ETF flows to provide a clear picture of what’s happening.

Why Is the Crypto Market Correcting?

Corrections are a normal part of any financial market, but the scale of the current drop has alarmed many traders.

Main drivers behind the correction include:

- Macroeconomic pressure: rising yields in traditional markets draw capital away from risk assets.

- ETF outflows: large-scale withdrawals from Bitcoin and Ethereum funds signal declining institutional appetite.

- Profit-taking: after months of gains, many investors are locking in profits.

“Corrections are the market’s way of resetting leverage and creating space for the next growth cycle,” notes one senior analyst.

Online advertising service 1lx.online

Bitcoin Role in the Current Decline

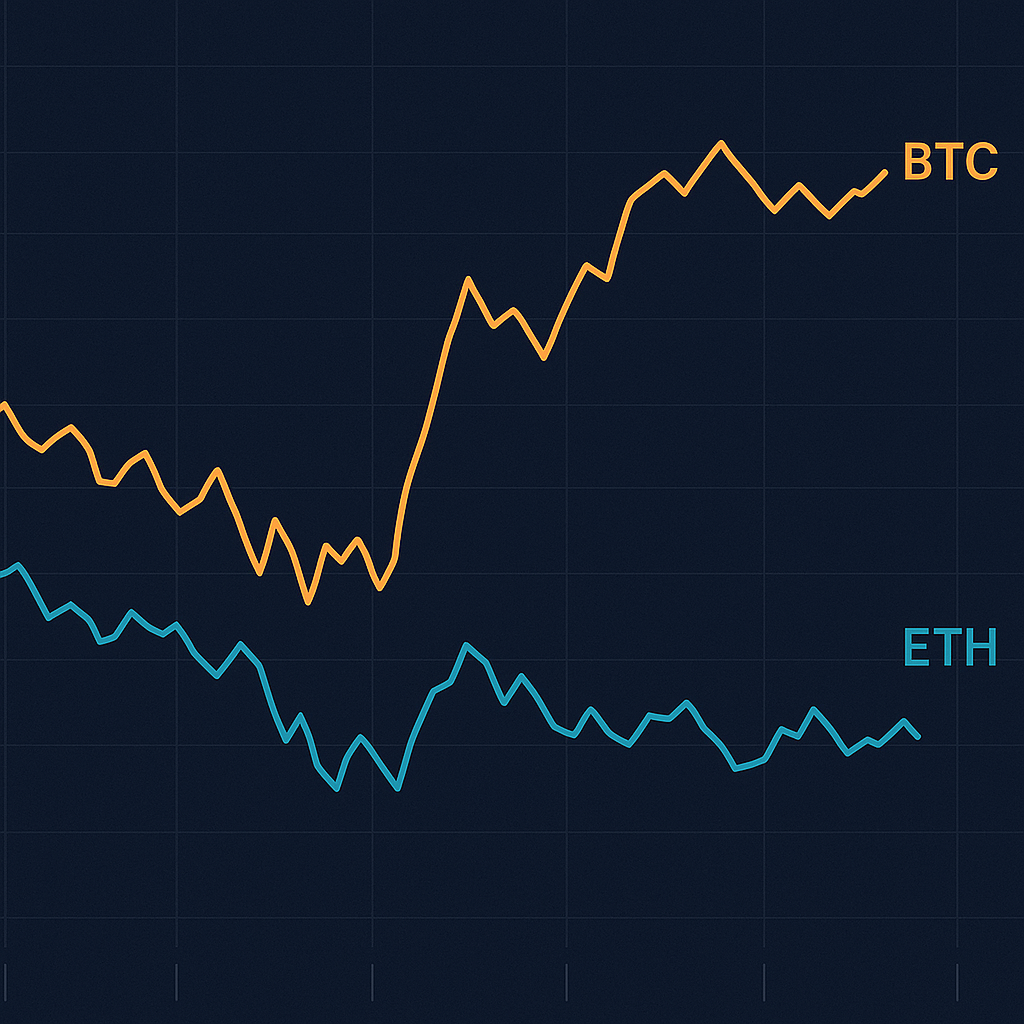

Bitcoin (BTC), the flagship cryptocurrency, has fallen back after testing recent highs.

Despite maintaining strong long-term fundamentals, BTC is facing heavy selling pressure, partly due to ETF outflows and broader market risk aversion.

Key points for Bitcoin:

- Still trading well above its 2024 average price, but momentum has weakened.

- Whale activity indicates distribution — large wallets selling into strength.

- Support levels between $110,000 – $115,000 remain critical for short-term direction.

Ethereum 12% Weekly Loss

Online advertising service 1lx.online

Ethereum has been hit even harder, posting a 12% decline in just one week.

This has raised concerns about whether ETH can maintain its position as the second-largest crypto by market cap.

Factors impacting Ethereum:

- ETF outflows: Ethereum ETFs are experiencing record redemptions.

- Network activity: despite high usage in DeFi and NFTs, price action suggests weak demand.

- Competition: Layer-2 solutions and rival chains are absorbing liquidity.

Ripple (XRP), although less volatile than ETH, has also lost ground, mainly due to weaker liquidity inflows.

ETF Outflows and Institutional Behavior

One of the most important signals in this correction is the ETF outflows.

Institutions that once drove momentum with strong inflows into Bitcoin and Ethereum ETFs are now reversing course.

Why this matters:

- ETFs act as a gateway for traditional investors into crypto.

- Outflows indicate reduced institutional confidence in short-term performance.

- This behavior amplifies market corrections, especially when combined with retail panic selling.

Market Sentiment and Investor Reactions

Investor psychology is playing a huge role in this correction.

- Fear Index: Crypto Fear & Greed Index has shifted toward “Fear.”

- Retail traders: many small investors are selling at losses to avoid deeper drawdowns.

- Long-term holders: HODLers remain confident, seeing the correction as a buying opportunity.

“Corrections shake out weak hands but give patient investors new entry points,” explains a market strategist.

Forecasts: What Happens Next?

There are three possible scenarios for the market:

- Recovery Scenario

- Bitcoin stabilizes above $115,000.

- Ethereum recovers once ETF selling slows.

- Altcoins regain momentum, following BTC’s lead.

- Extended Correction

- BTC drops toward $100,000 support.

- Ethereum continues under pressure, possibly losing another 10%.

- ETFs record sustained outflows, limiting new capital inflows.

- Bullish Reversal

- Macroeconomic easing (rate cuts, lower bond yields) sparks renewed risk appetite.

- Institutions return, flipping ETFs back to inflows.

- BTC could retest previous highs faster than expected.

Conclusion

The deep correction in the crypto market highlights the fragility of investor sentiment.

Bitcoin, Ethereum, and Ripple are facing pressure, while ETF outflows add fuel to the downturn.

Yet history shows that corrections are not the end of the story — they are often the setup for the next wave of growth.

For new investors, the key lesson is not to panic but to understand the drivers behind the decline and prepare for potential opportunities that follow.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)