US Regulators Call for More Proactive Approach to Crypto

Fed Michelle Bowman urges U.S. regulators to adopt proactive crypto policies. Impact on Bitcoin, Ethereum, and Ripple explained.

Table of Contents

- Introduction

- Why Regulators Are Shifting Their Tone

- Michelle Bowman’s Call for Action

- Impact on Bitcoin, Ethereum, and Ripple

- Potential Scenarios and Forecasts

- Conclusion

Online advertising service 1lx.online

Introduction

For years, U.S. regulators have been accused of dragging their feet when it comes to cryptocurrency oversight. Now, Federal Reserve Governor Michelle Bowman has urged financial watchdogs to “not be too cautious” and instead adopt a more flexible, forward-looking stance.

Her remarks come at a critical time when Bitcoin, Ethereum, and Ripple are shaping global finance, while U.S. policymakers face the challenge of balancing innovation with consumer protection.

Why Regulators Are Shifting Their Tone

Historically, U.S. regulation has leaned on the side of caution, often reacting only after crises occur. But the rapid growth of digital assets is forcing a shift.

Key factors behind the new regulatory push:

- Explosive growth of digital assets — With trillions locked in cryptocurrencies, waiting too long could risk systemic disruption.

- Global competition — Other economies, such as China with its yuan stablecoin, are moving fast. The U.S. risks being left behind.

- Innovation pressure — From decentralized finance (DeFi) to NFTs, financial products are evolving faster than existing legal frameworks.

“Being proactive does not mean being reckless. It means recognizing innovation before it outruns our ability to manage risks.”

Michelle Bowman Call for Action

Online advertising service 1lx.online

In a recent speech, Bowman urged regulators to adopt dynamic policies that can adapt to new realities. She stressed that crypto should not be dismissed as a passing trend.

Her key points:

- Balance between safety and growth: Too much caution could stifle innovation and push talent abroad.

- Stronger collaboration: Agencies like the SEC, CFTC, and Federal Reserve must coordinate rather than overlap.

- Clearer rules for stablecoins: With projects like USDC, Tether, and even China’s yuan-stablecoin, the U.S. must set global standards.

This message marks a shift in tone, signaling that policymakers are beginning to view crypto as an integral part of the future financial system.

Impact on Bitcoin, Ethereum, and Ripple

Online advertising service 1lx.online

The implications of Bowman’s remarks extend across the cryptocurrency market:

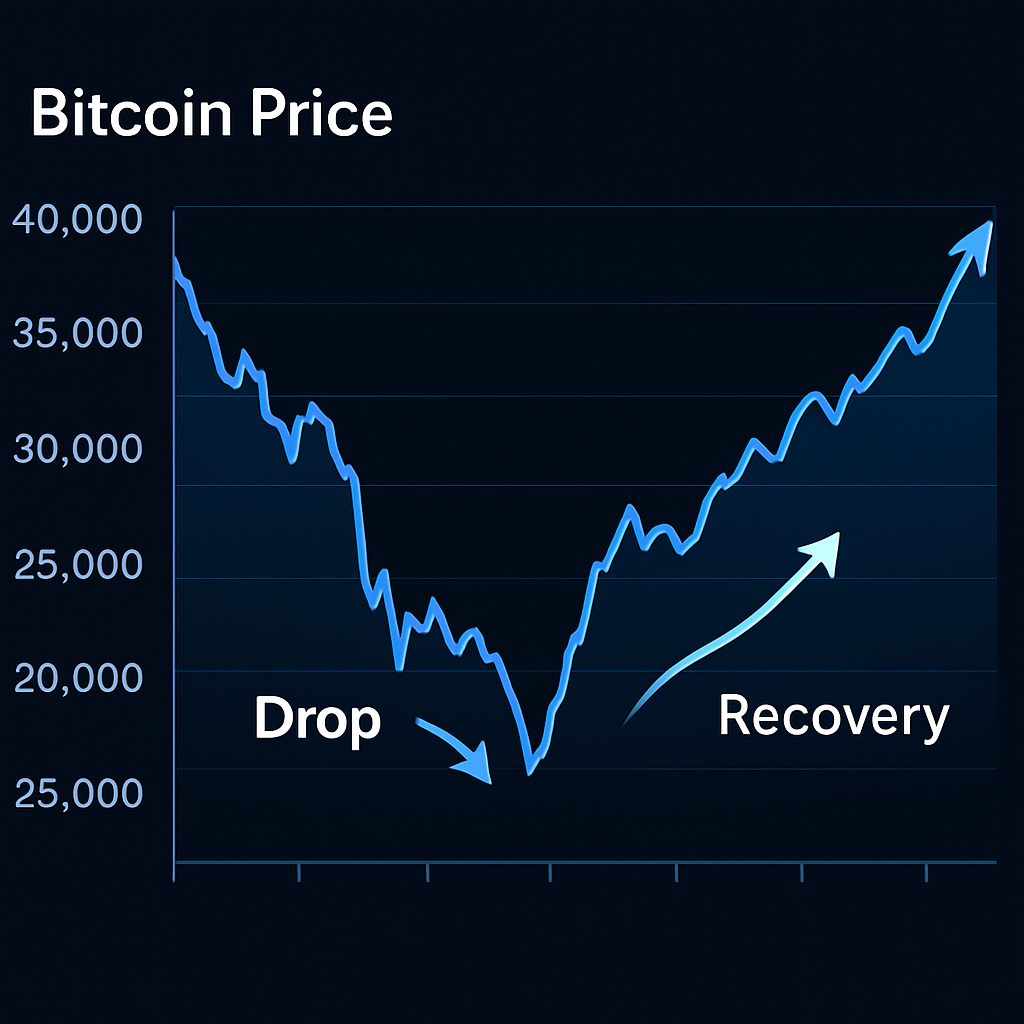

Bitcoin (BTC)

As the flagship asset, Bitcoin stands to benefit the most from regulatory clarity. Investors often hesitate due to uncertainty, but clearer rules could accelerate institutional adoption.

Ethereum

Ethereum’s smart contracts and DeFi ecosystem could thrive if U.S. regulation embraces innovation rather than hinders it. Proactive policies may allow Ethereum-based projects to expand into mainstream finance.

Ripple (XRP)

Ripple, already entangled in legal battles with the SEC, represents the other side of the coin. Clearer frameworks might finally resolve ongoing disputes and give Ripple a more stable path for international payments.

Potential Scenarios and Forecasts

Analysts see three possible outcomes from a more proactive U.S. regulatory approach:

- Positive Scenario

- Clear rules boost institutional trust.

- Bitcoin and Ethereum attract more adoption.

- Ripple resolves regulatory challenges and scales globally.

- Neutral Scenario

- Incremental progress but continued fragmentation between agencies.

- Market growth continues but at a modest pace.

- Negative Scenario

- Conflicts between federal and state regulators.

- Excessively complex compliance pushes innovation offshore.

Conclusion

Michelle Bowman’s call to “not be too cautious” could mark a turning point in U.S. crypto regulation.

If regulators adopt a proactive and cooperative stance, the future may hold clearer frameworks, stronger innovation, and greater global leadership.

For investors in Bitcoin, Ethereum, and Ripple, this shift represents both an opportunity and a test: whether the U.S. can balance safety with progress in the digital era.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)