Industry Players: Tether Hires Ex-White House Advisor

Tether hires ex-White House adviser Beau Hines to boost U.S. influence. What this means for Bitcoin, Ethereum, Ripple, and stablecoins.

Table of Contents

- Introduction

- Who Is Beau Hines?

- Why Tether Made This Move

- Impact on the US Crypto Market

- Bitcoin, Ethereum, and Ripple: Broader Market Implications

- Forecasts and Expert Opinions

- Conclusion

Online advertising service 1lx.online

Introduction

Tether, the world’s largest stablecoin issuer, has taken a significant step to strengthen its foothold in the United States.

The company recently hired Beau Hines, a former White House adviser on digital assets, to help expand its presence and navigate the complex regulatory landscape of the American market.

This move highlights the growing importance of Bitcoin, Ethereum, Ripple, and stablecoins in U.S. financial policy. It also underscores how industry players are adapting to tighter regulation and institutional scrutiny.

Who Is Beau Hines?

Beau Hines is a well-known figure in U.S. politics and digital asset policy.

He previously served as an adviser in the White House, focusing on blockchain regulation, cryptocurrency adoption, and digital asset strategies.

Key points about his background:

- Extensive experience in U.S. financial regulation.

- Strong political connections within Washington, D.C.

- Known advocate for balanced digital asset policies that encourage innovation while protecting consumers.

“Tether’s decision to bring in Beau Hines shows how seriously the company is taking its U.S. expansion,” notes one market strategist.

Why Tether Made This Move

Online advertising service 1lx.online

Tether (USDT) dominates the global stablecoin market with billions in daily trading volume.

However, the U.S. remains a challenging environment due to evolving regulations, particularly around stablecoin reserves and transparency.

Tether’s strategic goals with this hire include:

- Building stronger relationships with U.S. policymakers.

- Anticipating and influencing stablecoin legislation.

- Increasing credibility with institutional investors.

Impact on the US Crypto Market

Online advertising service 1lx.online

The presence of a former White House adviser gives Tether both legitimacy and influence.

Potential outcomes for the U.S. market:

- Regulatory clarity: stablecoin rules could become more structured.

- Institutional adoption: banks and funds may feel more confident engaging with Tether.

- Competition: rivals like Circle (issuer of USDC) will face new pressure.

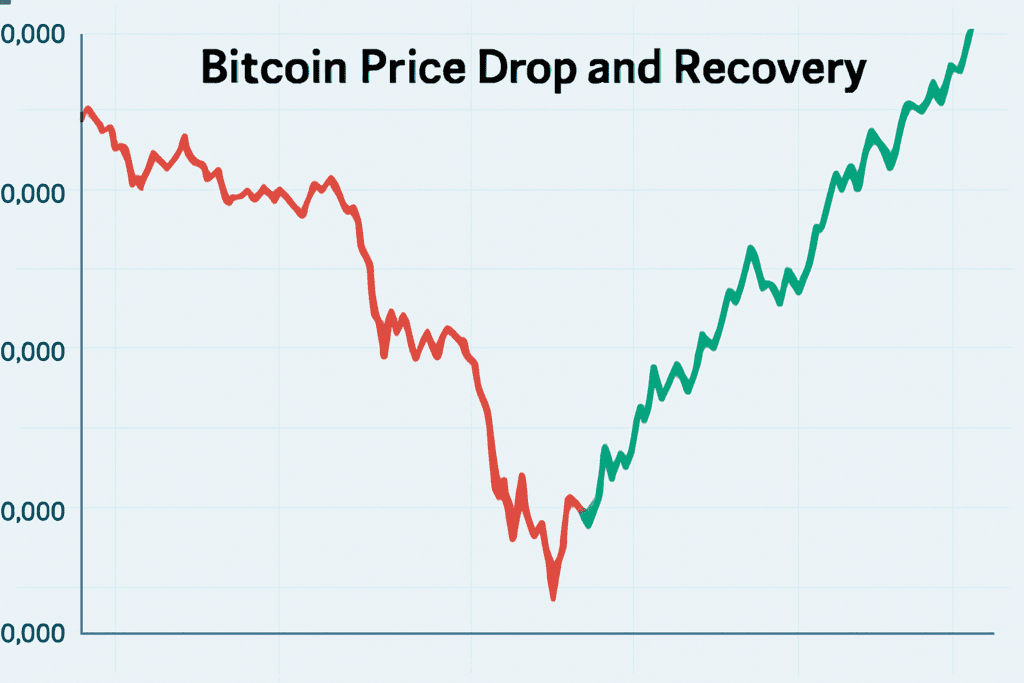

This move could also impact the wider crypto landscape, influencing Bitcoin and Ethereum liquidity, as Tether is heavily used in trading pairs.

Bitcoin, Ethereum, and Ripple: Broader Market Implications

Stablecoins like Tether (USDT) are central to the functioning of the crypto ecosystem.

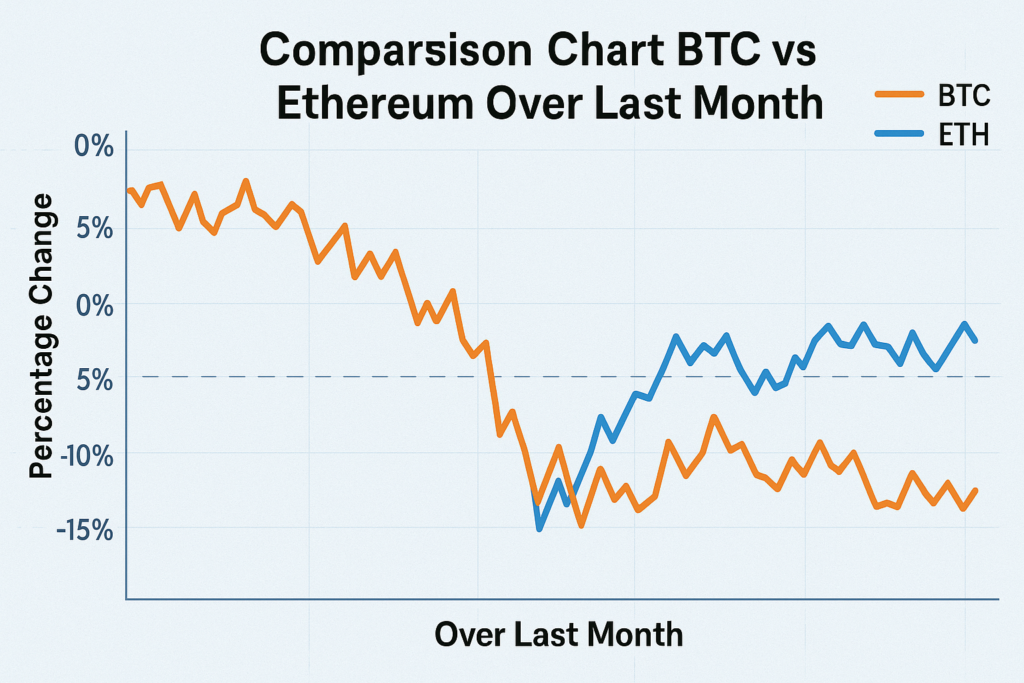

By reinforcing its U.S. presence, Tether indirectly affects demand for major assets such as Bitcoin, Ethereum, and Ripple:

- Bitcoin (BTC): A strong, liquid stablecoin market provides traders with faster on-ramps and off-ramps.

- Ethereum (ETH): Many DeFi protocols depend on stablecoin liquidity, making USDT a crucial part of the ecosystem.

- Ripple (XRP): As a cross-border settlement asset, Ripple could benefit from smoother dollar-pegged stablecoin usage.

Forecasts and Expert Opinions

Experts remain divided about the long-term implications of Tether’s U.S. expansion strategy.

Optimistic view:

- Stronger ties with regulators will make Tether more trustworthy.

- Institutional adoption of USDT could grow rapidly in 2025.

Cautious view:

- Regulatory hurdles may remain high despite Hines’ connections.

- Competitors like USDC or government-backed stablecoins could challenge Tether’s dominance.

“This is not just about compliance. It’s about shaping the future of money in the digital age,” says a crypto policy analyst.

Conclusion

Tether’s decision to hire Beau Hines is more than a human resources move — it’s a strategic step to strengthen its U.S. influence.

With the stablecoin market under intense scrutiny, bringing in a seasoned Washington insider could help Tether shape regulatory policy and expand adoption.

For investors in Bitcoin, Ethereum, and Ripple, the implications are clear: as stablecoins gain legitimacy, the overall crypto market could benefit from greater liquidity, stronger institutional participation, and clearer rules of the game.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)