Crypto-crime under the spotlight — 90% of crimes are flowing into the crypto space.

90% of cybercrimes now involve cryptocurrency. Experts warn global cooperation is vital to curb rising crypto-crime trends.

Table of Contents

- Introduction: A New Face of Cybercrime

- The Scale of the Problem: 90% of Crimes Tied to Crypto

- Why Criminals Prefer Cryptocurrency

- Anonymity and Decentralization

- Cross-border Ease

- The Role of DeFi and Dark Web Markets

- Insights from the Institute of Forensic Sciences of India

- Recent High-Profile Crypto-Crime Cases

- The Need for Global Cooperation

- Predictions: The Future of Crypto Regulation

- Conclusion

Online advertising service 1lx.online

Introduction: A New Face of Cybercrime

In recent years, cryptocurrency has evolved from a niche innovation to a global financial phenomenon. While digital assets have unlocked opportunities for millions, they have also opened doors to a darker side of the internet.

Experts from the Institute of Forensic Sciences of India report that 90% of cybercrimes are now linked to cryptocurrency platforms, a figure that has sparked global debate about regulation, enforcement, and the future of digital finance.

This article explores the scope of crypto-crime, the factors driving its growth, and the urgent calls for international cooperation.

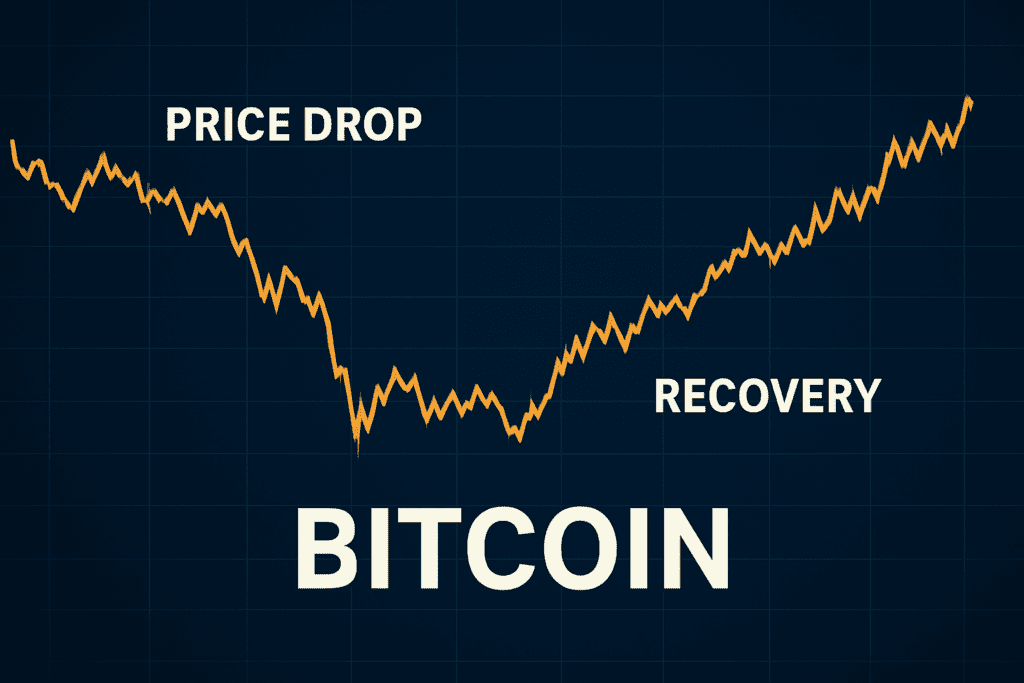

The Scale of the Problem: 90% of Crimes Tied to Crypto

The statistic is alarming: nine out of ten reported cybercrimes in India now involve cryptocurrency in some form — whether through fraud, ransomware, illicit marketplaces, or money laundering.

Globally, blockchain analytics firms like Chainalysis estimate billions of dollars flow through criminal crypto wallets every year. While traditional banking systems remain subject to regulations and oversight, crypto platforms are more fragmented, with varying degrees of compliance.

“Crypto-crime is no longer a niche concern. It is the backbone of cybercrime worldwide.” — Institute of Forensic Sciences of India

Why Criminals Prefer Cryptocurrency

Online advertising service 1lx.online

Anonymity and Decentralization

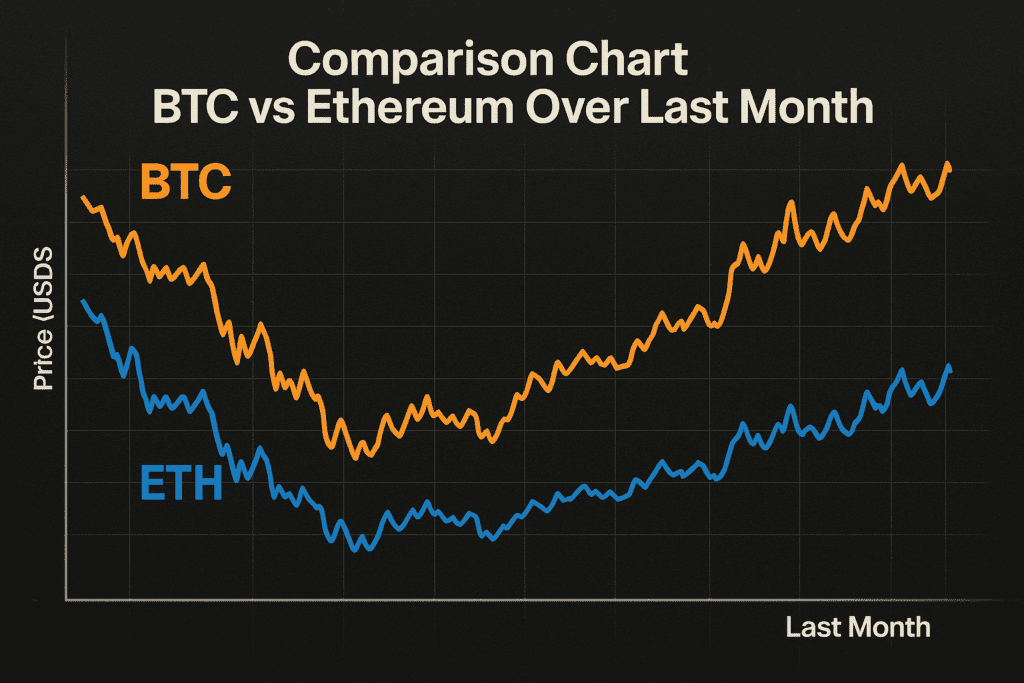

Cryptocurrency transactions, while technically public on blockchains, can mask the identity of users. Criminals exploit this by using multiple wallets, mixers, and privacy-focused coins like Monero.

Cross-border Ease

Unlike traditional wire transfers, which involve banks and regulatory oversight, crypto moves instantly across borders. This makes it attractive for ransomware groups and international fraud networks.

The Role of DeFi and Dark Web Markets

Online advertising service 1lx.online

Decentralized Finance (DeFi) protocols offer peer-to-peer lending, swapping, and staking — but they also create loopholes. Hackers exploit vulnerabilities in smart contracts, while darknet vendors increasingly request payments in Bitcoin or Ethereum.

Insights from the Institute of Forensic Sciences of India

The Institute highlights a troubling pattern: as crypto adoption grows in India, cybercrime cases have risen proportionally. From romance scams to elaborate Ponzi schemes, fraudsters use the promise of quick profits to lure victims.

The report stresses that most crimes rely on exchanges with weak Know Your Customer (KYC) standards. Without robust identification systems, tracing stolen funds becomes nearly impossible.

Recent High-Profile Crypto-Crime Cases

Some notable examples include:

- Ransomware attacks: Major corporations forced to pay Bitcoin to restore systems.

- Crypto Ponzi schemes: Fraudulent projects promising unrealistic returns before vanishing.

- Money laundering: Cartels converting illicit cash into Bitcoin to evade banks.

Each case underscores the same theme — crypto’s flexibility is a double-edged sword.

The Need for Global Cooperation

Indian forensic experts argue that no single country can fight crypto-crime alone. Because blockchain transactions are borderless, criminals exploit jurisdictions with weaker regulations.

The Institute calls for:

- International task forces linking law enforcement agencies.

- Unified AML/KYC standards across exchanges.

- Information sharing between regulators and blockchain analysis firms.

Predictions: The Future of Crypto Regulation

Looking ahead, analysts predict several trends:

- Tighter global rules: G20 nations are drafting frameworks for crypto taxation and anti-crime measures.

- Rise of CBDCs: Central Bank Digital Currencies may reduce reliance on anonymous crypto.

- Advanced analytics: AI-powered blockchain forensics will make tracking illicit flows easier.

While regulation may dampen innovation temporarily, experts agree it is essential for crypto’s long-term survival.

Conclusion

Cryptocurrency has changed the financial world forever. But with 90% of cybercrime now linked to digital assets, governments cannot afford to ignore the risks. The report from India’s forensic experts is a wake-up call: without international cooperation, crypto-crime will continue to thrive.

For newcomers in crypto, education is key: always use regulated exchanges, practice safe storage, and remain skeptical of promises that seem too good to be true.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)