Table of Contents

- Introduction

- What Is a Stablecoin and Why China Is Changing Course

- Impact on the Global Financial Market

- Bitcoin, Ethereum, and Ripple: Market Reactions

- Possible Scenarios and Forecasts

- Conclusion

Introduction

Online advertising service 1lx.online

China is preparing to launch a yuan-pegged stablecoin in an effort to increase the international use of its currency.

This move signals a major shift in Beijing’s crypto policy, with potential global consequences for trade, finance, and digital assets.

In this article, we’ll break down what this development means, how it could reshape financial competition, and what investors in Bitcoin (BTC), Ethereum, and Ripple should expect.

What Is a Stablecoin and Why China Is Changing Course

A stablecoin is a type of cryptocurrency pegged to a stable asset such as the U.S. dollar, gold, or a national currency.

China’s plan is to create a yuan-based stablecoin, directly tied to its fiat currency.

Key reasons behind the move:

- Global influence: Strengthen the yuan’s role in international trade.

- Reduced dependency on the dollar: Provide an alternative settlement mechanism.

- Tech race: Compete with the digital dollar and other major stablecoins.

“A yuan stablecoin could be the first serious challenge to the dominance of the U.S. dollar,” analysts note.

Impact on the Global Financial Market

The introduction of a yuan stablecoin could reshape global finance in several ways:

- International trade: Exporters and importers may choose the yuan instead of the dollar.

- Financial markets: New hedging opportunities for investors exposed to Asian markets.

- Regulation: Governments will need to address a new semi-centralized, globally accessible currency.

Online advertising service 1lx.online

Bitcoin, Ethereum, and Ripple: Market Reactions

The news of China’s potential stablecoin launch is already sparking debates across the crypto industry.

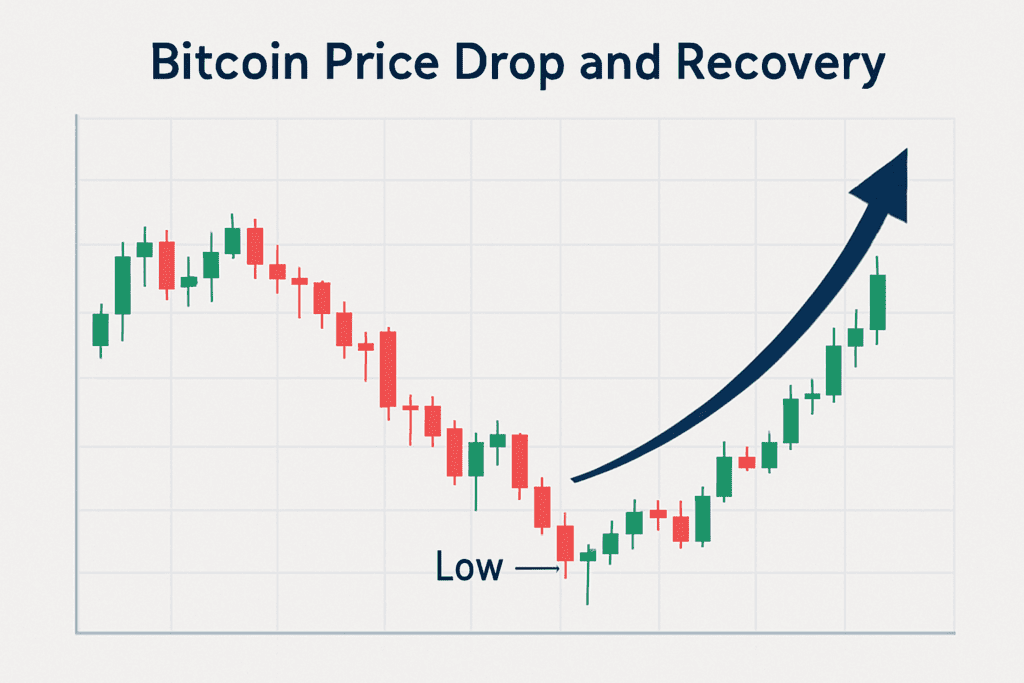

Bitcoin (BTC)

Bitcoin remains the benchmark for digital assets. While it is not directly tied to the yuan, many investors see BTC as a safe-haven asset against geopolitical shifts.

Online advertising service 1lx.online

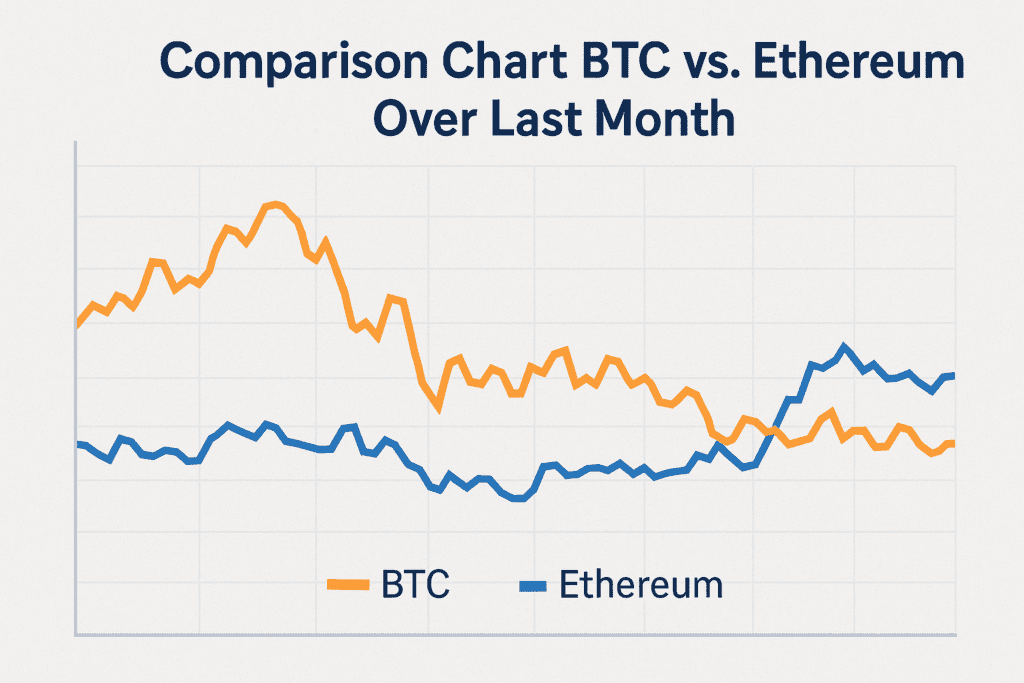

Ethereum

Ethereum dominates the smart contract ecosystem. If China develops its stablecoin on its own blockchain, it could position itself as a rival to Ethereum’s DeFi ecosystem.

Ripple

Ripple (XRP), which specializes in cross-border payments, may face strong competition if a government-backed yuan stablecoin gains adoption in global trade.

Possible Scenarios and Forecasts

Experts highlight three possible outcomes:

- Positive scenario — The yuan stablecoin becomes widely used in international settlements, challenging the U.S. dollar.

- Neutral scenario — Adoption remains limited to Asia, with minor global impact.

- Negative scenario — Sanctions, restrictions, and political resistance reduce its utility.

Conclusion

The launch of a yuan-pegged stablecoin is more than a financial experiment — it is a geopolitical strategy.

Bitcoin, Ethereum, and Ripple remain central to the crypto landscape, but China’s entry into the stablecoin market introduces a new level of competition.

Whether the yuan gains traction as a global digital currency will depend on acceptance from international partners and regulators.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)