Arbitrum Eyes Profitability with Timeboost Auctions and Nova Fee Sweep Amid Rising Costs

Arbitrum explores new revenue models like Timeboost auctions and Nova Fee Sweep to offset rising expenses and build a resilient financial future in Web3.

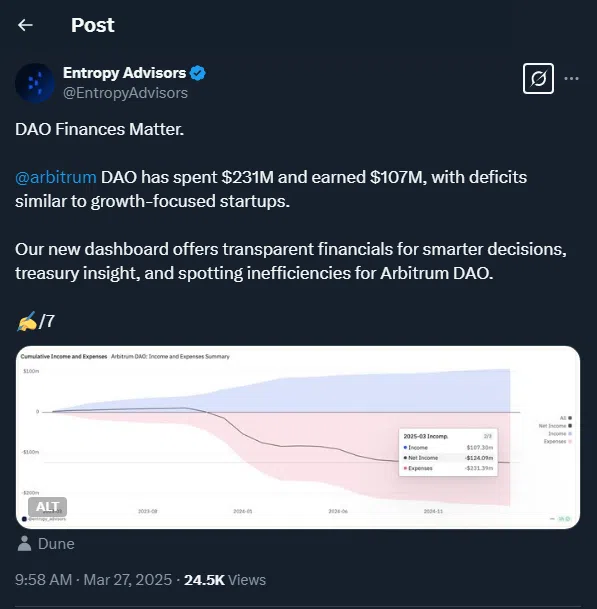

Arbitrum, one of Ethereum’s leading Layer 2 scaling solutions, is reshaping its financial architecture in the face of a widening operational deficit. Despite incurring $231 million in expenses against just $107 million in income, the Arbitrum DAO is choosing growth over austerity—a classic strategy borrowed from traditional tech startups. However, unlike centralized companies, Arbitrum’s roadmap is crafted by a decentralized, community-driven voting system, adding a unique layer of governance to its financial evolution.

A recent report by Entropy Advisors revealed that 95% of Arbitrum’s current earnings are derived from transaction fees, specifically Layer 2 surplus fees. Although gross revenue has dropped, operational efficiency has surged, allowing the DAO’s profit margin to expand from 25% to an impressive 80%. This improvement is largely attributed to declining incentive costs, which had previously consumed the bulk of spending.

Online advertising service 1lx.online

🚀 New Revenue Channels in the Works

To ensure sustainability and reduce its dependence on transaction fees, Arbitrum is turning to innovative monetization tools. One such solution is Timeboost, a system introduced in 2024 that lets users bid in auctions for transaction priority. This model creates a “fast lane” for on-chain activity, enabling higher-value users to move to the front of the line. With a DAO vote currently in progress and a decision expected by March 29, 2025, Timeboost could soon become a central pillar of Arbitrum’s future earnings.

Parallel to Timeboost, Arbitrum Nova is piloting the Nova Fee Sweep, a similar mechanism designed to aggregate small fees across the network, creating an additional revenue stream that could prove pivotal in the coming months.

📈 Toward a Sustainable Future

Despite previous criticism regarding its lavish incentive spending—which accounted for $141 million or 85% of total expenditures—Arbitrum’s community remains optimistic. Proponents argue that aggressive incentives were necessary to secure Arbitrum’s dominance in both the DeFi and real-world asset (RWA) sectors. As incentive outlays are now being scaled back, projections suggest that the DAO could achieve profitability in 2025, ushering in a new era of fiscal sustainability.

At its core, Arbitrum is betting big on the future: forgoing immediate profits to position itself as the essential infrastructure layer powering Web3. As the crypto ecosystem continues to mature, such strategic investments may well distinguish Arbitrum as not just a tech innovator, but a model for decentralized economic planning.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)