Learn how to calculate, report, and manage your cryptocurrency taxes in 2025 — a simple guide for beginners.

📘 Table of Contents

- Introduction: Why Crypto Taxes Matter in 2025

- Are Cryptocurrencies Taxable Assets?

- The Main Types of Taxable Events

- How to Calculate Crypto Gains and Losses

- Tools and Platforms That Simplify Tax Reporting

- How Different Countries Tax Crypto

- Common Mistakes Beginners Make

- Forecast: The Future of Crypto Taxation

- Conclusion: Paying Taxes Without Losing Freedom

Online advertising service 1lx.online

Introduction: Why Crypto Taxes Matter in 2025

For years, cryptocurrencies were seen as a gray area — outside the reach of tax authorities. But that era is over.

By 2025, crypto is fully integrated into global financial systems, and tax agencies across the world now require reporting of digital asset transactions.

If you’ve ever bought, sold, or swapped Bitcoin, Ethereum, or TON — you’ve likely triggered a taxable event.

Understanding how and when taxes apply is key to avoiding future headaches.

“Crypto might live on the blockchain — but your taxes live in the real world.”

Are Cryptocurrencies Taxable Assets?

Yes.

In nearly every country that recognizes crypto, digital currencies are classified as taxable assets, not currency.

This means that when you sell, trade, or even use crypto to buy goods, you may owe capital gains tax — just as if you’d sold stock or property.

Most tax authorities consider:

- Buying crypto: Not taxable.

- Selling crypto for fiat: Taxable event (capital gains/loss).

- Trading one coin for another: Taxable event.

- Using crypto to buy goods/services: Taxable.

- Mining or staking rewards: Taxable as income.

Online advertising service 1lx.online

“Owning crypto is easy. Reporting it is where things get real.”

The Main Types of Taxable Events

1. Capital Gains Tax

Online advertising service 1lx.online

When you sell crypto for more than you paid, that profit is taxable.

Example: You bought 1 BTC for $30,000 and sold it at $50,000 — you owe tax on the $20,000 gain.

- Short-term gains: Held under 12 months (taxed higher).

- Long-term gains: Held over 12 months (taxed lower).

2. Income Tax

Earnings from mining, staking, airdrops, or play-to-earn games are treated as ordinary income.

3. Gift or Inheritance Tax

In some regions, gifting crypto may trigger taxes, especially for large amounts.

“In crypto, even a swap between coins can count as selling one and buying another — and that means taxes.”

How to Calculate Crypto Gains and Losses

Each transaction has a cost basis — the original amount you paid for your coins.

Subtract the cost basis from the sale price to determine profit or loss.

Formula:

Capital Gain/Loss = Selling Price − Purchase Price

Example:

- Buy 2 ETH for $2,000 each → $4,000 total.

- Sell both at $3,000 each → $6,000 total.

- Capital gain = $2,000.

Keep accurate records of:

- Purchase price and date.

- Sale price and date.

- Fees paid to exchanges.

This data ensures your tax reports are both compliant and optimized.

Tools and Platforms That Simplify Tax Reporting

Thankfully, beginners don’t have to calculate everything manually.

Several platforms now automate crypto tax reporting:

- Koinly — integrates with major exchanges and wallets.

- CoinTracking — detailed analytics with DeFi support.

- Accointing — simple dashboards for beginners.

- ZenLedger — used by accountants and institutions.

Most connect via API to exchanges like Binance or Coinbase, automatically importing transactions and generating tax forms.

“Automation turns crypto chaos into compliance.”

How Different Countries Tax Crypto

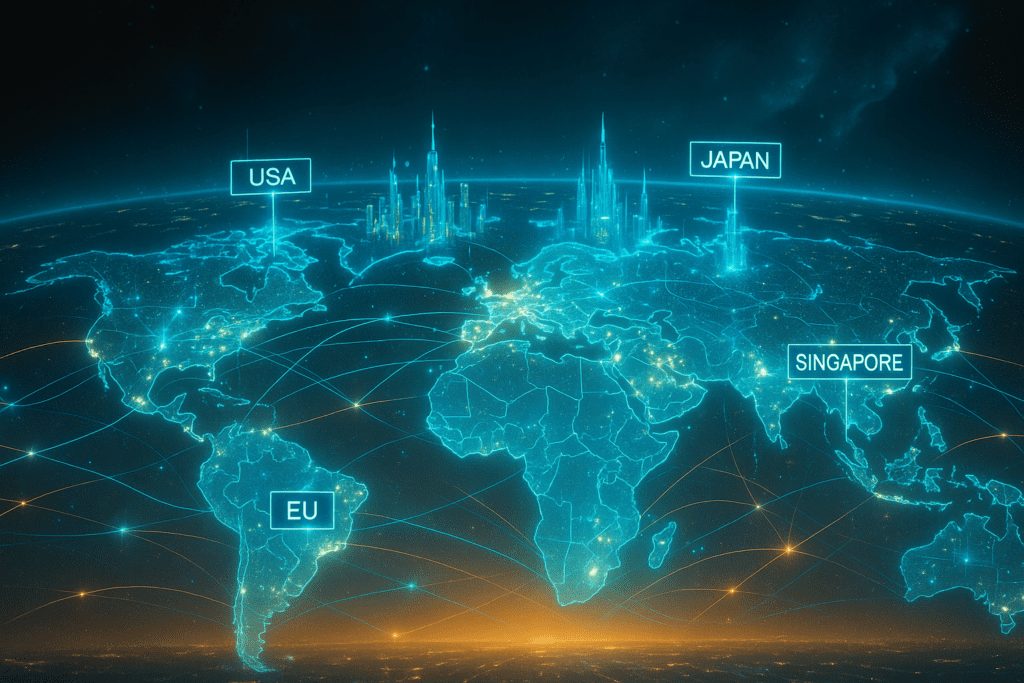

🇺🇸 United States

Crypto is treated as property. Capital gains apply to every sale, swap, or purchase. The IRS now requires wallet disclosures on tax returns.

🇪🇺 European Union

Under the MiCA framework, taxation aligns with investment rules — profits are taxed, but long-term holding may enjoy lower rates.

🇬🇧 United Kingdom

HMRC requires crypto investors to report every disposal, including coin-to-coin trades.

🇸🇬 Singapore & UAE

No capital gains tax — making them crypto havens for long-term investors.

🇯🇵 Japan

Crypto income is heavily taxed, up to 55%.

“Where you live can define how much you keep — or lose.”

Common Mistakes Beginners Make

- ❌ Ignoring small trades: Even minor swaps can be taxable.

- ❌ Forgetting transfer fees: Gas fees can affect cost basis.

- ❌ Using multiple wallets without records: Harder to track total gains.

- ❌ Thinking “crypto is anonymous”: Blockchain analytics tools make all movements traceable.

- ❌ Missing deadlines: Late filing can lead to fines or audits.

Keeping good records and using tax software prevents most of these errors.

Forecast: The Future of Crypto Taxation

As crypto becomes mainstream, expect AI-driven tax automation integrated directly into wallets and exchanges.

Governments will likely move toward real-time reporting and smart-contract tax collection.

By 2030, you might not fill out tax forms manually — your wallet could calculate and submit them automatically.

“The future of taxation is programmable — just like money itself.”

Conclusion: Paying Taxes Without Losing Freedom

Crypto and taxation are finally learning to coexist.

For beginners, the key is to understand the basics — what counts as income, what counts as gains, and how to record every move.

Regulation may seem restrictive, but it also marks progress — the world recognizing crypto as a legitimate economy.

You can stay compliant and still stay free — that’s the new definition of financial literacy.

“The blockchain gave us financial freedom. Knowledge keeps it legal.”

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)