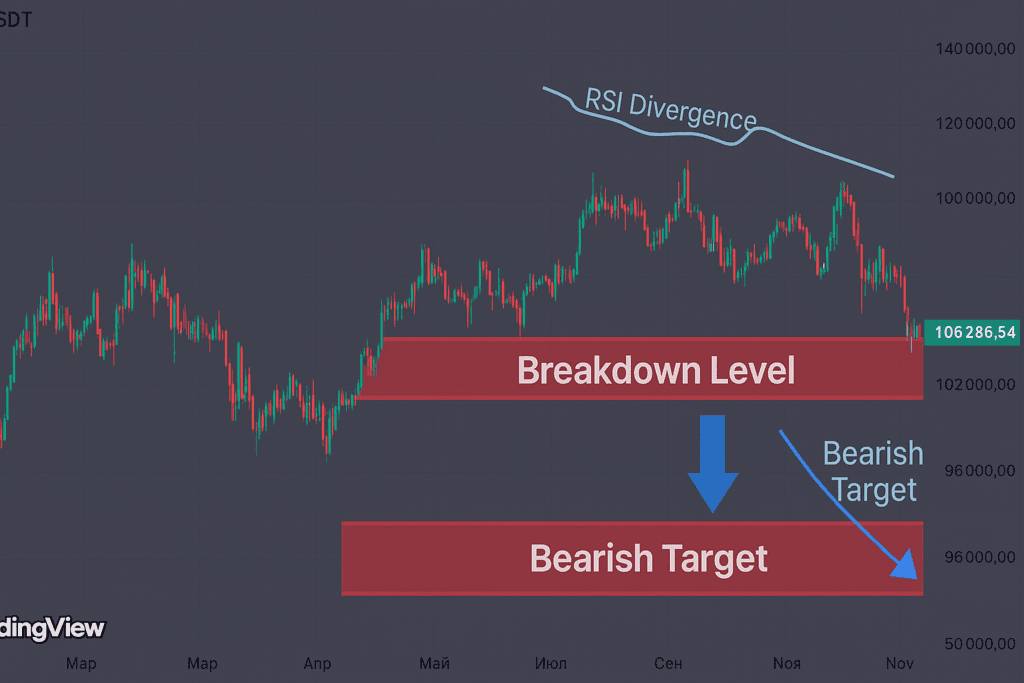

Weekly Crypto Price Forecast | Bitcoin Faces Breakdown Risk Below $106K (Nov 10–17, 2025)

The first week of November begins under mounting selling pressure as Bitcoin (BTC) struggles to maintain support near $106K.

After several failed recovery attempts above $111K, market sentiment has shifted cautiously bearish. Analysts warn that if BTC closes decisively below $106K, a deeper retracement toward $100K–$96K could follow — marking one of the most significant corrections since mid-2025.

Market Overview

Bitcoin continues to consolidate after rejecting the $111K resistance last Friday, with prices oscillating near $107K–$108K over the weekend.

Technical and on-chain data now indicate potential weakness beneath the surface:

Online advertising service 1lx.online

- RSI (1D): slipping below 45, showing declining momentum.

- MACD: forming a bearish divergence on 4H and 1D timeframes.

- Volume: increasing slightly on red candles — a sign of supply dominance.

- EMAs (20/50): nearing a bearish crossover, suggesting trend fatigue.

- Order Blocks: major supply remains heavy near $111K–$113K, while demand thins around $104K–$106K.

According to CryptoQuant, exchange inflows have risen notably over the last 48 hours, signaling potential distribution by larger holders. Glassnode data also reveals declining stablecoin reserves, typically associated with lower buy-side liquidity.

Prominent analysts such as @rektcapital caution that “a daily close under $106K may activate deeper downside targets,” while @CryptoTony_ adds that “this setup mirrors prior fakeouts that preceded larger sell-offs.”

Bearish Setup: Breakdown Toward $100K–$96K

If Bitcoin fails to defend $106K, a cascade of stop-loss triggers could send the price rapidly lower, filling liquidity gaps down to $102K and even $96K.

This scenario aligns with CME gap closures and historical support zones established during the early summer accumulation phase.

Why This Could Happen

- RSI drops below 45 — confirming weakening momentum and short-term exhaustion.

- MACD turns negative with expanding histogram — early signal of a sustained downtrend.

- Exchange inflows rise, hinting at increased sell pressure from whales.

- Macro sentiment deteriorates as global equity markets cool and risk assets retreat.

Key Technical Levels

- Breakdown Zone: $105K–$106K

- Targets: $102K → $100K → $96K (“Bearish Target”)

- Indicators: MACD bearish divergence, RSI downtrend, 50-EMA roll-over

Invalidation: A swift recovery above $108K with acceptance beyond $110K would neutralize this view and reopen a neutral or bullish scenario.

Online advertising service 1lx.online

Technical Risk Zones

The chart highlights the critical breakdown area around $106K, where volume clusters show heavy historical activity.

Below this level, liquidity thins rapidly until $100K — a zone that often acts as a magnet during panic-driven retracements.

RSI’s downward slope reinforces the bearish bias, while MACD’s crossover deepens the conviction that momentum has turned negative.

Weekly Summary

Bitcoin structure has weakened after failing to reclaim $111K, leaving bulls vulnerable below the $106K line.

If sellers press below this critical threshold, momentum could accelerate toward the $100K–$96K zone in a fast-moving liquidation event.

Cautious traders are watching the daily close near $105K as the pivot between short-term stabilization and potential breakdown.

Online advertising service 1lx.online

For live updates and scenario tracking, follow our

Weekly Crypto Price Forecast section on BTCNews.space — updated daily with fresh technical signals, sentiment metrics, and analyst insights.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)