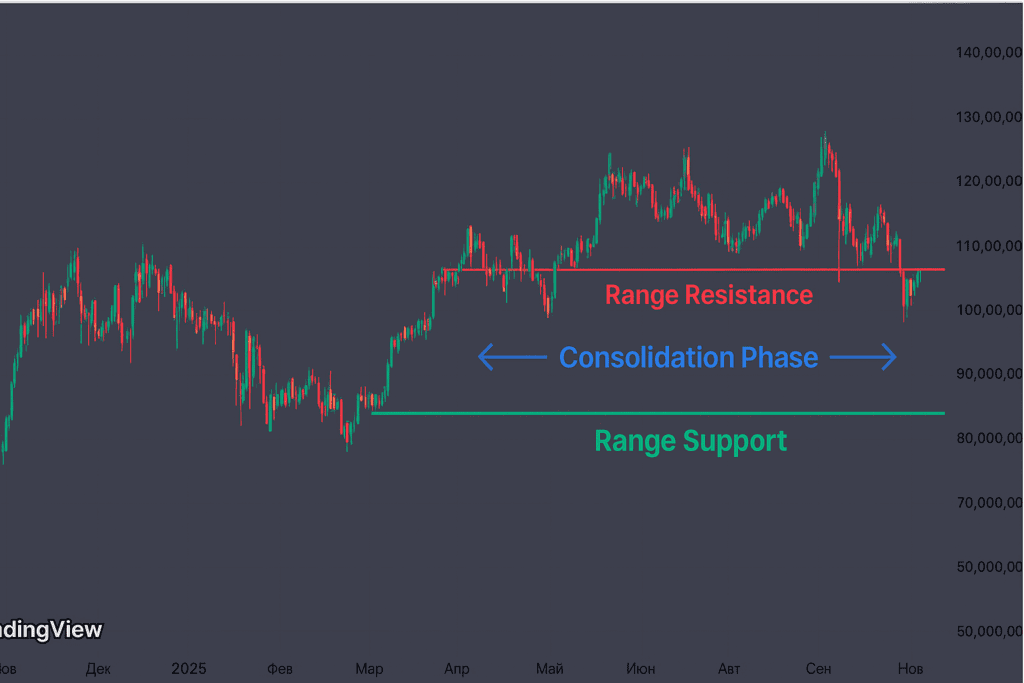

Weekly Crypto Price Forecast | Bitcoin Consolidates Between $105K–$112K (Nov 10–17, 2025)

Bitcoin enters the first full week of November in a state of equilibrium, with BTC trading tightly between $105K and $112K. Market participants remain cautious as the asset awaits stronger catalysts from macroeconomic developments and ETF inflows. Despite brief volatility spikes, both bulls and bears seem hesitant — keeping the trend locked in a narrow range for the third consecutive week.

Market Overview

Bitcoin continues to consolidate after rejecting the $111K resistance last Friday, with prices oscillating near $107K–$108K over the weekend.

On-chain and technical data reflect a fragile balance between buyers and sellers:

Online advertising service 1lx.online

- RSI (1D): hovering around 48–50, showing neutral momentum.

- MACD: flattening near the zero line with fading histogram amplitude.

- Volume: still below the 30-day average, confirming low participation.

- EMAs (20/50): tightly coiled, signaling indecision and a potential volatility breakout soon.

- Order Blocks: major supply rests near $111K–$113K, while demand sits at $104K–$106K.

According to Glassnode, exchange inflows have slightly increased, while CryptoQuant reports a minor rise in miner outflows — both indicative of cautious distribution without strong conviction.

Meanwhile, @rektcapital highlights a “mid-range compression identical to the pre-breakout structure of early 2024,” while @CryptoTony_ adds that “Bitcoin is coiling tighter — one decisive candle could determine the next $10K move.”

Neutral Range Setup: Sideways Between $105K–$111K

The most probable near-term scenario is a continuation of sideways trading as the market awaits macro triggers such as upcoming U.S. inflation data and yield reports.

This period of balance keeps liquidity evenly distributed while short-term traders fade the edges of the range.

Why This Could Happen

- Balanced order flow: No major accumulation or distribution; liquidity remains even.

- Declining volume: Participation is down nearly 15% week-over-week, suggesting apathy.

- RSI near 50: Reflects true neutrality — neither buyers nor sellers are dominant.

- Stable funding rates: Indicate low leverage and absence of directional bias.

Technical Range

- Lower Band: $105K–$106K (range support)

- Upper Band: $111K–$112K (range resistance)

- Mid-Range: $108K (short-term value area)

Trading Bias

Online advertising service 1lx.online

Range traders continue to buy near support and sell near resistance, with stops just beyond each boundary.

A confirmed breakout accompanied by at least 2× average daily volume would signal trend transition and invalidate the neutral view.

Technical Structure

On the daily chart, Bitcoin displays a horizontal consolidation pattern, with price compressing between the 20- and 50-day EMAs. Bollinger Bands have narrowed to their tightest since mid-July, suggesting imminent volatility expansion.

The RSI remains flat around 50, while MACD shows near-zero momentum — classic indicators of indecision.

Summary & Weekly Outlook

Online advertising service 1lx.online

Bitcoin’s neutral stance reflects a mature consolidation phase — neither bullish nor bearish, but tightly balanced. Until the market breaks beyond $105K or $112K with strong volume, sideways conditions are likely to persist.

This “calm before the storm” environment offers limited opportunity for trend traders but remains favorable for scalpers and range strategies.

For ongoing analysis and scenario updates, visit our

Weekly Crypto Price Forecast section for daily chart updates and macro-linked insights.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)