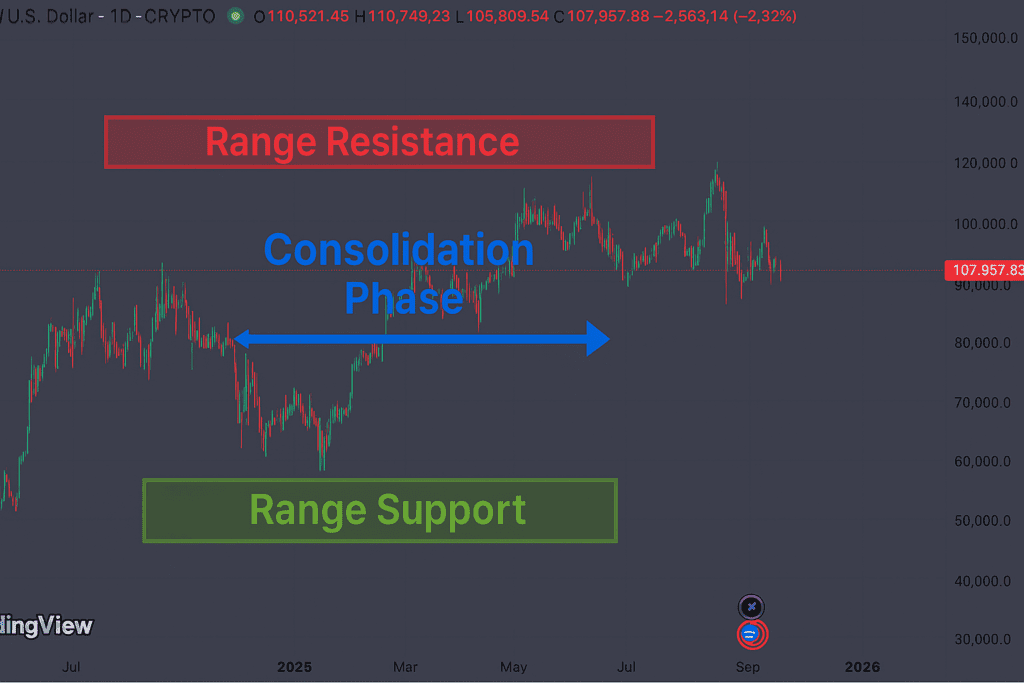

Weekly Crypto Price Forecast | Bitcoin Consolidates Between $105K–$112K (Nov 3–10, 2025)

As November trading begins, Bitcoin (BTC) continues to move within a narrow corridor between $105K and $112K. Market participants show a clear lack of conviction, with volume dropping and traders awaiting new macro or ETF-related catalysts. The sentiment across exchanges and derivatives remains balanced — neither strongly bullish nor bearish — suggesting that Bitcoin is taking a breather before its next major directional move.

Market Overview

After several volatile months, Bitcoin has entered a consolidation phase. The price has repeatedly tested both the $105K and $112K boundaries but failed to establish a breakout in either direction.

According to TradingView and Glassnode data, realized volatility has declined by nearly 20% week-over-week, while on-chain activity shows reduced whale accumulation and minimal exchange outflows — a classic hallmark of a neutral, indecisive market.

Online advertising service 1lx.online

Momentum indicators further support this view:

- RSI (daily): Flat near the 50 level, reflecting equilibrium between buyers and sellers.

- MACD: Whipsaws around the zero line without a clear momentum signal.

- Volume: Subdued, with intraday spikes being quickly absorbed, typical of range-bound conditions.

Traders across X (formerly Twitter) echo this sentiment — @rektcapital refers to “a healthy mid-cycle pause,” while others like @CryptoTony_ describe it as “a coiled spring waiting for a catalyst.”

Neutral Range Setup: Compression Between $105K and $112K

This week’s base case projects continued horizontal consolidation as Bitcoin builds a value area near $108K.

Why it could happen:

- Balanced liquidity: Order books remain symmetric with no visible accumulation bias.

- Absence of catalysts: ETF inflows stagnate, and macroeconomic data (CPI, yields) are scheduled later in the month, limiting directional bets.

- Market psychology: Traders prefer fading the edges of the range rather than initiating new trends.

Key Technicals

- Range: $105K (lower band) – $112K (upper band)

- Signals: Declining realized volatility; RSI steady near 50; MACD flat around zero

- Strategy Notes: Range traders continue to buy dips near $105K–$106K and sell rallies into $111K–$112K.

- Risk to View: A confirmed breakout with volume expansion beyond either boundary could rapidly shift structure into a trending regime.

Online advertising service 1lx.online

Technical Structure

The technical chart displays a clear consolidation phase with progressively tighter candles and contracting Bollinger Bands.

The 20-day EMA runs flat near the mid-range (~$108K), confirming equilibrium.

No strong divergence signals are present; however, declining volatility suggests that a larger move could emerge once this compression resolves.

Summary & Weekly Outlook

Bitcoin remains in equilibrium as the market digests prior volatility. The most probable short-term path is continued sideways trading within the $105K–$112K corridor.

A breakout above $112K could revive bullish energy, while a loss of $105K might trigger a quick flush to $100K — but until then, neutrality dominates.

Online advertising service 1lx.online

For continuous coverage and weekly scenario updates, visit our Weekly Crypto Price Forecast section and track evolving setups in real time.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)