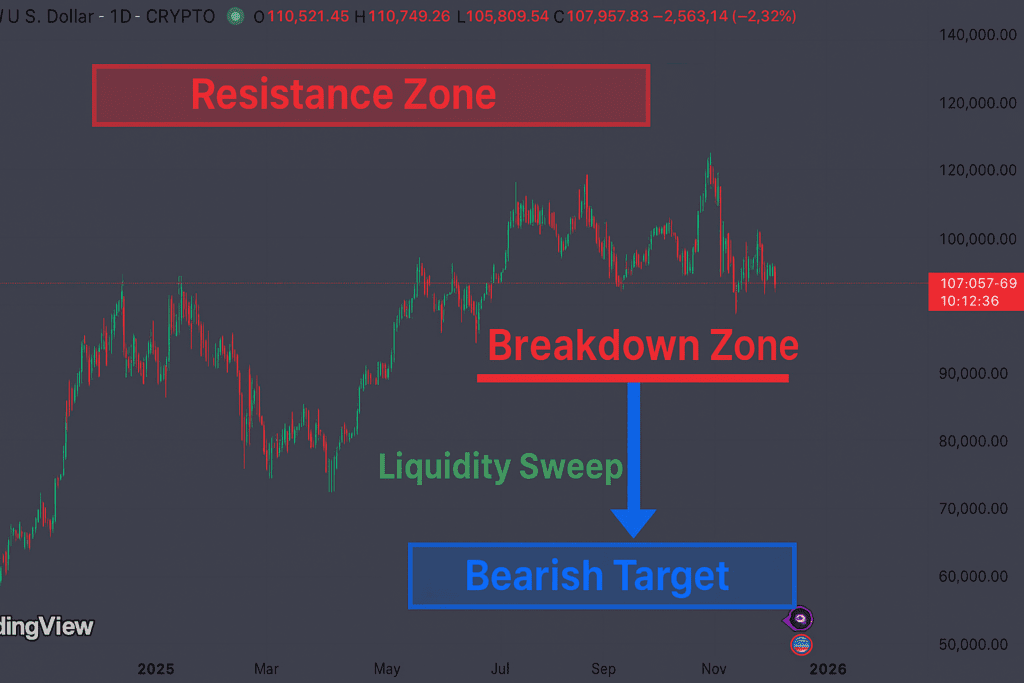

Weekly Crypto Price Forecast | Bitcoin Faces Risk of Drop Below $106K (Nov 3–10, 2025)

The start of November brings a cautious tone to the crypto market as Bitcoin (BTC) once again tests its critical $106K support zone. After weeks of sideways movement, bearish pressure appears to be mounting — with traders warning that a decisive breakdown could open the door to deeper corrections toward $100K or even $96K.

Market Overview

Bitcoin consolidation between $105K and $112K may be approaching its breaking point. The failure to maintain momentum above the $110K–$111K zone has led to lower highs forming across the 4-hour chart, signaling exhaustion among buyers.

Online advertising service 1lx.online

Technical indicators now lean bearish:

- RSI (daily) has slipped below 45, showing weakening momentum and loss of mid-range structure.

- MACD (4H/1D) displays a bearish divergence — histogram widening below the signal line.

- Volume has begun rising on downswings, often a precursor to a deeper retracement.

According to @CryptoQuant, increased exchange inflows from large wallets indicate growing intent to sell. Combined with declining ETF inflows and cautious risk sentiment in broader markets, the setup tilts toward downside continuation.

Bearish Setup: Liquidity Sweep Down to $100K–$101K

Bitcoin’s $105K–$106K level has served as a key demand area for weeks — but repeated retests have weakened it. A confirmed breakdown below this region could trigger a cascade of stop-losses, sending BTC swiftly into the next support zone near $102K–$100K.

Why this move could unfold:

- Bearish RSI divergence forming on intraday rallies, showing fading buying power.

- Exchange inflows rise, signaling distribution from whales.

- Breakdown trigger: daily close below $106K, confirming structural failure of range support.

Key Technical Levels

- Breakdown Level: $105K–$106K

- First Bearish Target: $102K–$103K (initial reaction)

- Main Bearish Target: $100K–$101K

- Extended Target: $96K if liquidation cascade accelerates

Online advertising service 1lx.online

Indicators Supporting the View

- 4H MACD cross-down with widening histogram.

- RSI trending below 45.

- Volume spike confirming momentum shift.

- Negative delta dominance in intraday order flow.

Invalidation Scenario:

If Bitcoin reclaims $108K quickly and consolidates above $110K, this bearish view becomes invalid, flipping structure back to neutral.

Technical Risk Zones

The chart shows a red breakdown zone below $106K, marking the final line of defense before a potential selloff into the $100K region.

This zone aligns with a CME gap and prior high-volume node, suggesting some temporary bounce potential around $101K–$102K.

Online advertising service 1lx.online

However, failure to find strong demand there could lead to a steeper slide toward the June 2025 demand block near $96K.

Traders should watch for volume confirmation — if selling pressure remains elevated through midweek, momentum could accelerate sharply.

Weekly Summary & Outlook

For the week of November 3–10, Bitcoin faces a heightened risk of downside continuation.

Market sentiment remains cautious, with analysts on X calling for patience until a clear reclaim of $110K confirms strength.

Until then, the path of least resistance appears lower.

Short-term traders should monitor intraday RSI and MACD for continuation signals, while swing traders may look for reactions at $102K–$100K as potential stabilization zones.

For ongoing analysis and technical updates, visit our

Weekly Crypto Price Forecast section — your hub for real-time Bitcoin market insights and weekly scenario forecasts.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)