ETH Treasuries Top $10B as Corporations Outpace Ethereum Foundation in Holdings

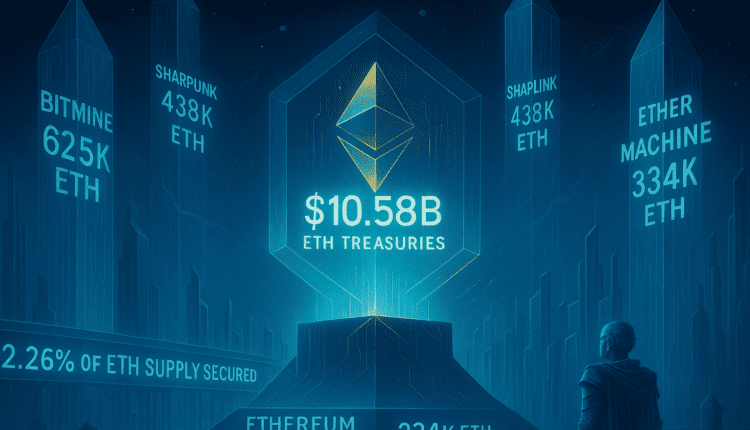

Ethereum treasuries have surpassed $10.58 billion, with 64 entities now controlling over 2.26% of ETH’s supply — overtaking even the Ethereum Foundation’s reserves.

Ethereum continues to gain traction in corporate finance as new data reveals that ETH treasury holdings have exceeded $10.58 billion, reflecting a strategic shift in how major entities treat the world’s second-largest cryptocurrency.

According to a report from StrategicETHReserve published on July 31, a total of 64 organizations now hold over 100 ETH each, representing 2.26% of Ethereum’s total circulating supply. These ETH treasuries include holdings from publicly traded corporations, centralized and decentralized crypto platforms, non-profit institutions, and even governmental bodies — underscoring the expanding institutional embrace of Ethereum.

Online advertising service 1lx.online

Leading the list is Bitmine Immersion Tech, which has pivoted from its original focus on Bitcoin mining to become the largest known ETH holder. Bitmine currently owns 625,000 ETH, valued at approximately $2.42 billion. Company chairman Tom Lee has publicly stated that their goal is to acquire and stake up to 5% of the entire ETH supply, further emphasizing Ethereum’s potential as a yield-generating treasury asset.

SharpLink Gaming, headed by Ethereum co-founder Joseph Lubin, holds the second-largest ETH treasury with 438,200 ETH. On July 30, Ether Machine joined the leaderboard by acquiring 15,000 ETH, bringing its total to 334,800 ETH and placing it in third position among corporate holders.

Notably, these three entities now hold more ETH than the Ethereum Foundation itself — the nonprofit organization at the heart of Ethereum’s ongoing protocol development and ecosystem coordination. The Foundation’s reserve currently stands at 234,600 ETH, marking a symbolic shift in the ETH power balance toward corporate stakeholders.

Industry analysts view this milestone as a sign of Ethereum’s maturing role as a financial instrument. Geoffrey Kendrick, Global Head of Digital Assets Research at Standard Chartered, projected that ETH treasuries could eventually control as much as 10% of the total token supply. He emphasized Ethereum’s advantage over Bitcoin for treasury use due to its native staking capabilities and the broader utility within the DeFi ecosystem.

While the rise of ETH treasuries promises additional yield opportunities, it’s not without its risks. Analysts at Bernstein cautioned that staking strategies introduce unique challenges, including potential liquidity issues and exposure to smart contract vulnerabilities.

Still, the current momentum suggests a paradigm shift. Companies are no longer simply holding ETH for speculative purposes — they’re actively integrating it into their operational and financial infrastructure. As institutional participation deepens, Ethereum’s role as a cornerstone asset in the digital economy seems increasingly inevitable.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)