4 Signs Point to a $130K Bitcoin Rally by October — Is the Final Push Underway?

Analysts say Bitcoin may soon break out to $130K, driven by the 4-year cycle, global liquidity trends, Pi Cycle signals, and altcoin capitulation.

Despite a slight dip following the Federal Reserve’s decision to delay rate cuts, Bitcoin appears to be preparing for a significant breakout. According to crypto analysts, four powerful indicators are aligning — all pointing toward a massive rally this October. From historical patterns and global money supply data to technical signals and altcoin market behavior, the evidence suggests Bitcoin’s final explosive move for this cycle may be just around the corner.

Saint Pump, a well-known crypto analyst, highlights the Bitcoin 4-year halving cycle as a primary bullish indicator. Historically, Bitcoin’s market peaks tend to occur 18 to 20 months after a halving event. In this cycle, that timeline aligns with October 20, 2025, placing the next major price surge squarely within reach. Add to that Bitcoin’s impressive track record in October — with gains in 10 of the last 12 years and an average return of 21.9% — and the outlook grows even stronger.

Online advertising service 1lx.online

Another key signal: global liquidity. Analysts often point to global M2 (money supply) as a leading indicator for risk-on assets like crypto. Saint Pump notes that M2 is expected to peak around September 23, and Bitcoin typically tops before this metric does — adding further credibility to the October rally narrative.

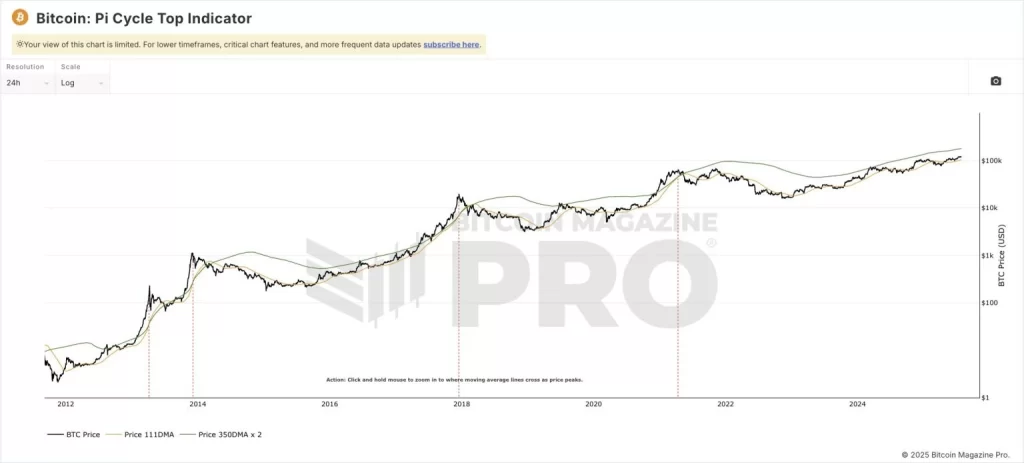

Meanwhile, the Pi Cycle Top Indicator — a technical model that has successfully predicted several previous Bitcoin tops — is now flashing early warning signs. The widening gap between its short- and long-term moving averages typically indicates growing momentum and a potential approach to a market peak. While not perfect in timing, this tool has become a favorite among long-term BTC watchers.

The altcoin market is also sending strong signals. As Bitcoin continues to hold near $118,000, many altcoins are bleeding, losing both value and market dominance. This behavior mirrors past cycles, where Bitcoin’s final surge triggered a major shift in capital away from smaller tokens. Data shows growing fear in the altcoin space — historically a prelude to Bitcoin’s parabolic moves.

As all four of these signals converge, the charts show Bitcoin in a healthy consolidation phase, primed for breakout. With $130,000 now appearing as the next realistic upside target, traders and investors alike are watching closely for confirmation of what could be the final leg of this bull cycle.

If the timing and historical patterns hold, October could mark one of the most explosive months in Bitcoin’s history.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)