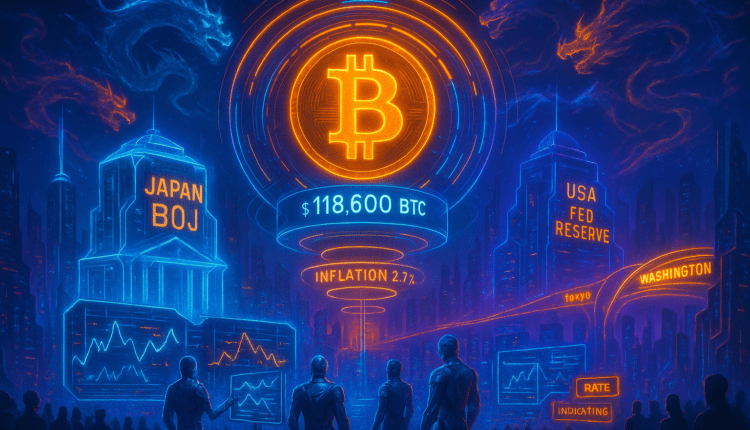

Bitcoin Holds Strong Above $118K as Japan and U.S. Freeze Rates Amid Inflation Fears

Bitcoin stays resilient above $118,600 after both the BOJ and Federal Reserve pause rate hikes, signaling market confidence despite global inflation risks.

Bitcoin continues to demonstrate impressive resilience, holding steady above $118,600 as central banks in both Japan and the United States opt to maintain their current interest rates. The world’s leading cryptocurrency remains buoyant despite growing concerns about inflation and cautious tones from monetary policymakers.

On July 31, the Bank of Japan (BOJ) unanimously voted to keep its benchmark interest rate at 0.5%. At the same time, the BOJ raised its inflation forecast for 2025 to 2.7% — a notable revision that reflects rising domestic price pressures. This announcement followed a similar decision by the U.S. Federal Reserve just one day prior, where Fed Chair Jerome Powell also held rates unchanged while cautioning that inflation from President Trump’s tariff policies was still unfolding.

Online advertising service 1lx.online

Though the BOJ refrained from tightening policy this round, analysts observed a clear shift toward a more hawkish stance. The central bank now anticipates inflation to moderate to 1.8% in 2026 and climb slightly to 2% in 2027 — both higher than previous estimates. These projections have sparked expectations of a potential rate hike as early as October.

Shoki Omori of Mizuho Securities suggested that the updated inflation outlook aligns with a strategic “wait-and-see” approach. Meanwhile, David Chao from Invesco emphasized that the forecast change increases the odds of near-term monetary tightening. Going further, Hirofumi Suzuki of SMBC stated a rate hike is already justified based on the upward inflation trajectory.

Adding to the mix, easing trade tensions between Japan and the United States may reduce external pressure. Khoon Goh of ANZ noted that a newly struck trade agreement lifts a major cloud of uncertainty, possibly allowing the BOJ more room to act on monetary policy in the coming months.

Some economists, such as Masato Koike of Sompo Institute Plus, who previously viewed 0.5% as the terminal rate, now see space for a further shift before the end of 2025.

Despite the evolving macroeconomic backdrop and increasingly hawkish signals from Tokyo, Bitcoin has shown remarkable stability above the $118,000 threshold. The market’s confidence appears unshaken, with many investors possibly viewing the crypto asset as a hedge against fiat volatility amid surging inflation expectations.

As global trade dynamics evolve and inflation pressures mount, both the BOJ and Federal Reserve find themselves navigating uncertain terrain. Crypto traders remain watchful — anticipating whether these monetary currents will push Bitcoin into a new phase of momentu.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)