Why BNB Defies the Leverage Frenzy While BSC Perps Skyrocket 800%

While Binance Smart Chain dominates perpetual markets with record volumes, BNB’s own performance stays spot-driven—suggesting a structural divergence amid the leverage rush.

In a surprising market shift, Binance Smart Chain (BSC) has surged into dominance in the perpetual futures landscape. Within just two months, BSC’s perps market share jumped by a staggering 800%, now representing nearly 15% of the total market among leading Layer-1 chains. This explosive growth suggests a dramatic influx of speculative capital—but the question remains: is Binance Coin (BNB) part of that high-risk rotation, or is it being left out?

Online advertising service 1lx.online

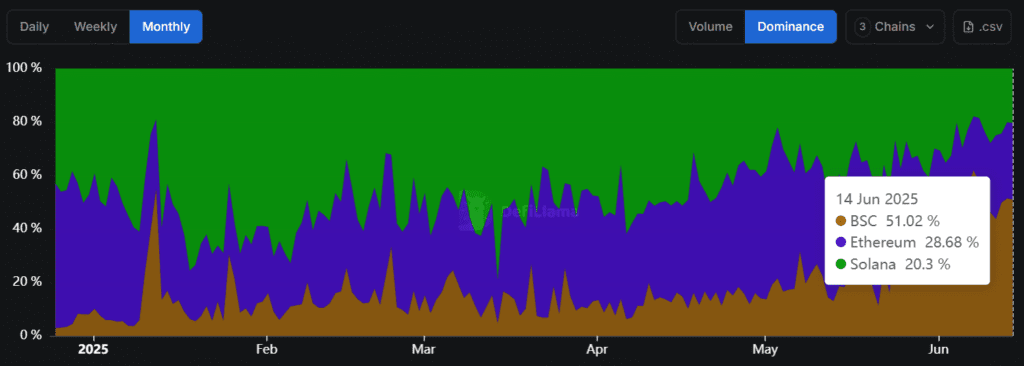

According to data from DeFiLlama, BSC is now the top performer in 30-day perpetual trading volume, bringing in an impressive $31.75 billion. Not only has it overtaken Ethereum (ETH) and Solana (SOL) in monthly volume, but BSC is also leading the charge on daily timeframes. Currently, BSC holds a commanding 51.2% share of perp trading volume among the top chains.

This shift signals that traders are increasingly attracted to the high-volatility environment of BSC-based altcoins, deploying leverage to chase outsized returns. But despite this aggressive flow into perps, the spotlight on BNB itself appears more nuanced.

BNB, as the native token of Binance Chain, still benefits from the surge in network activity. More trades on BSC mean more gas usage, translating into higher demand for BNB. Indeed, BNB’s daily trading volume has risen 12% month-over-month. Simultaneously, the total stablecoin supply on BSC just reached a two-year high of over $10.3 billion, climbing nearly 7% in the last month—indicating substantial on-chain liquidity inflows.

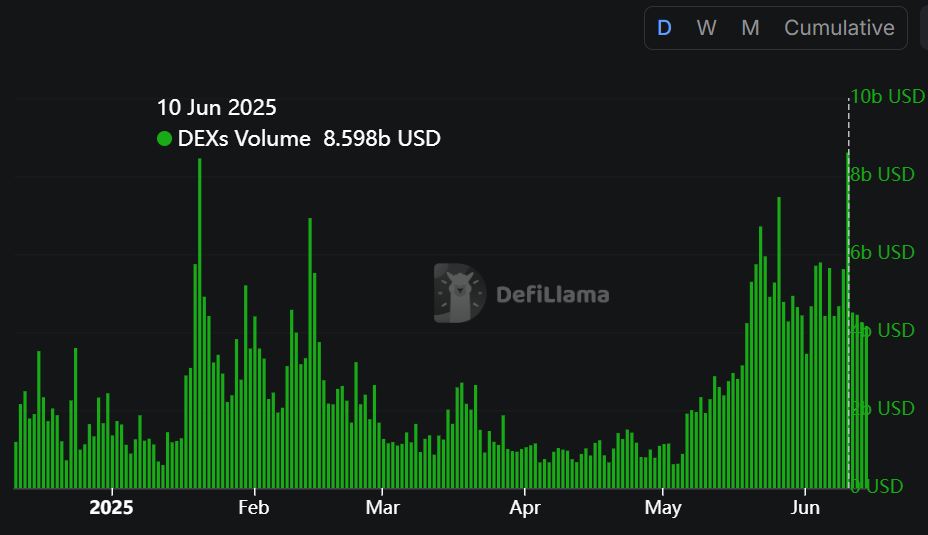

Zooming into BNB-specific data paints a clearer picture: BNB’s decentralized exchange (DEX) volume recently hit a yearly peak of $8.598 billion on June 10, coinciding with a local price high of $674. However, BNB’s Futures Open Interest tells a different story. It remains below $800 million—well short of the $1.4 billion seen in December 2023, when BNB touched its all-time high of $750.

According to AMBCrypto, this indicates a structural divergence. While BSC is thriving as a leverage-driven ecosystem, BNB itself isn’t absorbing the same speculative pressure. The capital seems to be rotating into spot markets, not into BNB-based perpetual products.

Yet, this may not be a bad thing. BNB is showing resilience. It continues to outperform major market caps on a monthly basis, holding its ground while others have suffered 15–20% corrections amidst widespread liquidation cascades.

In essence, while BSC becomes ground zero for high-risk leveraged plays, BNB is quietly benefiting from steady, fundamental growth—backed by real network activity, organic liquidity, and strong spot demand.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)

Online advertising service 1lx.online