$650 BNB Breakout Looms as Traders Bet Big and Shorts Teeter on Liquidation Edge

BNB inflows spike to $4.6M while longs surge past 62%, signaling bullish conviction—but with it comes the risk of a squeeze as shorts pile near $639.

Binance Coin (BNB) recorded significant bullish traction on June 8th, with $4.60 million in spot inflows surpassing the $3.69 million in outflows. This resulted in a positive net flow, suggesting growing investor confidence and momentum. The alignment between retail sentiment and smart money positions paints a rare picture of consensus—an event often associated with strong directional conviction.

Online advertising service 1lx.online

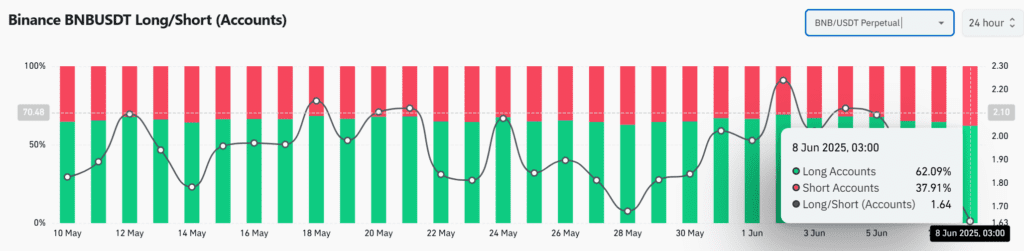

Retail traders appear heavily biased toward upside potential, with 62.09% of BNB/USDT accounts holding long positions, bringing the Long/Short Accounts Ratio to 1.64 at the time of reporting. While this bullish tilt reflects optimism, it also creates vulnerability; an overcrowded long setup increases the risk of rapid unwinding if market momentum falters.

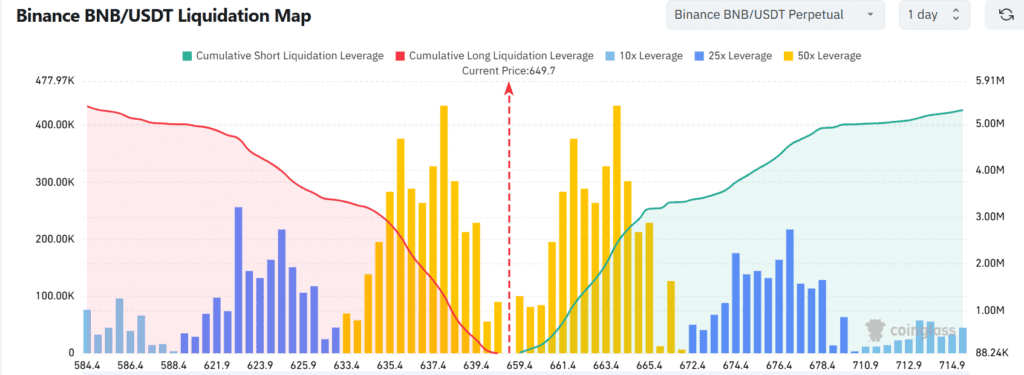

Data from CoinGlass further indicates that a dense cluster of short positions has formed between the $623 and $639 levels. With BNB now hovering near $649.7, most of those shorts are underwater. Should buyers succeed in holding ground above $650, these trapped shorts could be forced to exit, triggering a cascading liquidation squeeze to the upside.

Historically, such setups—where price cuts through heavy short zones—often lead to accelerated moves, as automated stop-losses and liquidation orders are tripped.

Meanwhile, derivatives data tells a mixed story. BNB’s overall derivatives volume plummeted by 42.48%, now standing at $341.42 million, while futures Open Interest declined by 1.16%. However, in contrast, Options Open Interest surged 12.29%, hinting that traders may be anticipating volatility and positioning via non-directional strategies like straddles and strangles.

Additionally, the Funding Rate remained negative at -0.0042%, showing that short positions continue paying to stay open. This discrepancy between negative funding and long-heavy positioning may be a precursor to a short squeeze.

In summary, with spot inflows increasing, longs dominating retail accounts, and a build-up of vulnerable shorts just beneath current price levels, BNB appears poised for a breakout. However, success hinges on sustained momentum and the market’s ability to chew through critical liquidity layers around $650.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)

Online advertising service 1lx.online