Binance Coin Surges Past $523: Analyzing This Week Uptrend and Market Sentiment.

Binance Coin (BNB) saw a positive recovery, breaking past $523 despite resistance ahead. Indicators suggest cautious optimism as traders navigate market volatility.

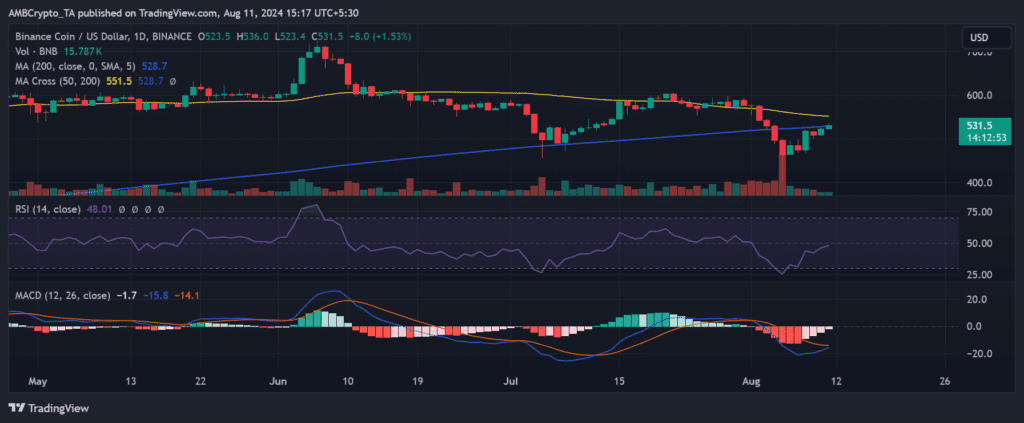

Binance Coin (BNB) concluded its trading week with a strong performance, signaling resilience in the face of recent market challenges. The cryptocurrency, which initially faced a 6% decline earlier in the week, managed to recover and end the week on a high note, closing around $523 with a 2.83% increase. This momentum carried into the new week, with BNB trading at approximately $531, marking an additional gain of over 1%.

One of the most significant aspects of this recovery is BNB’s successful break above its long-moving average, a level that had previously served as a resistance point. This breakthrough suggests a potential shift in market sentiment, moving from a bearish outlook to a more neutral or cautiously bullish stance in the short term.

Online advertising service 1lx.online

However, BNB is not out of the woods yet, as it faces resistance at around $553, marked by its short-moving average. This resistance level will be critical for the coin’s continued upward trajectory.

Technical Indicators and Market Sentiment

An analysis of BNB’s technical indicators provides insight into the current market dynamics. The Relative Strength Index (RSI) for BNB is at 48.01, placing it near the neutral zone. This indicates that the asset is neither overbought nor oversold, reflecting a lack of strong momentum in either direction. As a result, recent price recoveries may face resistance if buying pressure does not increase.

Moreover, the Moving Average Convergence Divergence (MACD) line has crossed above the signal line, which is often interpreted as a sign of a potential bullish reversal or a reduction in bearish momentum. The shrinking negative histogram bars further support this, suggesting that the downward momentum is weakening. However, with the MACD still in negative territory, the overall momentum remains slightly bearish, albeit with signs of a shift.

Cautious Approach Among Traders

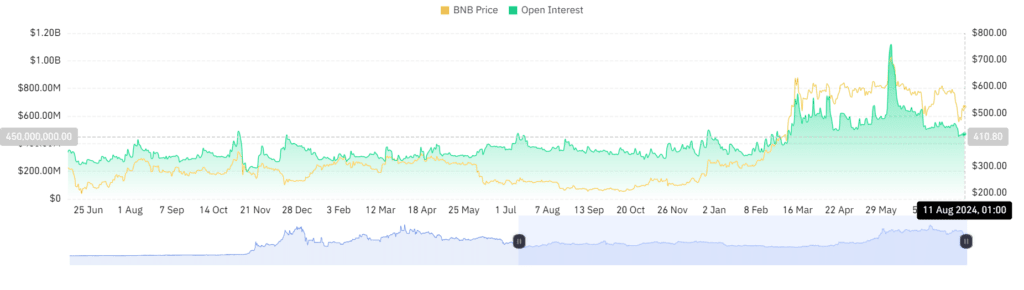

The recent trends in Binance Coin’s open interest also indicate a more cautious approach from traders. Data from Coinglass shows that BNB’s open interest fell from approximately $500 million to around $400 million recently, before stabilizing at about $470 million. This decline in open interest suggests that while there is still significant engagement in BNB derivatives, the momentum has somewhat cooled compared to previous highs.

The reduction in open interest could indicate a decrease in leverage within the market, possibly reflecting trader caution due to ongoing market uncertainty or recent price volatility in BNB.

Online advertising service 1lx.online

As Binance Coin navigates these challenges, its ability to break through key resistance levels will be crucial in determining its next move. Traders and investors alike will be watching closely to see if BNB can maintain its upward momentum or if the current resistance will prove too strong to overcome.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)