Coinbase Surpasses $420B AUM, Outpacing the 21st Largest US Bank

Coinbase now manages over $420 billion in assets, making it larger than the 21st largest U.S. bank. CEO Brian Armstrong highlights that Coinbase would rank as the 8th largest brokerage by AUM, signaling growing institutional and retail trust in crypto.

Coinbase AUM Exceeds Major U.S. Banks, Reinforcing Crypto’s Growth

Coinbase, the third-largest centralized cryptocurrency exchange (CEX) by trading volume, now holds over $420 billion in assets under management (AUM), surpassing the total assets of the 21st largest bank in the U.S. This milestone underlines the increasing influence of digital asset platforms in traditional financial markets.

Online advertising service 1lx.online

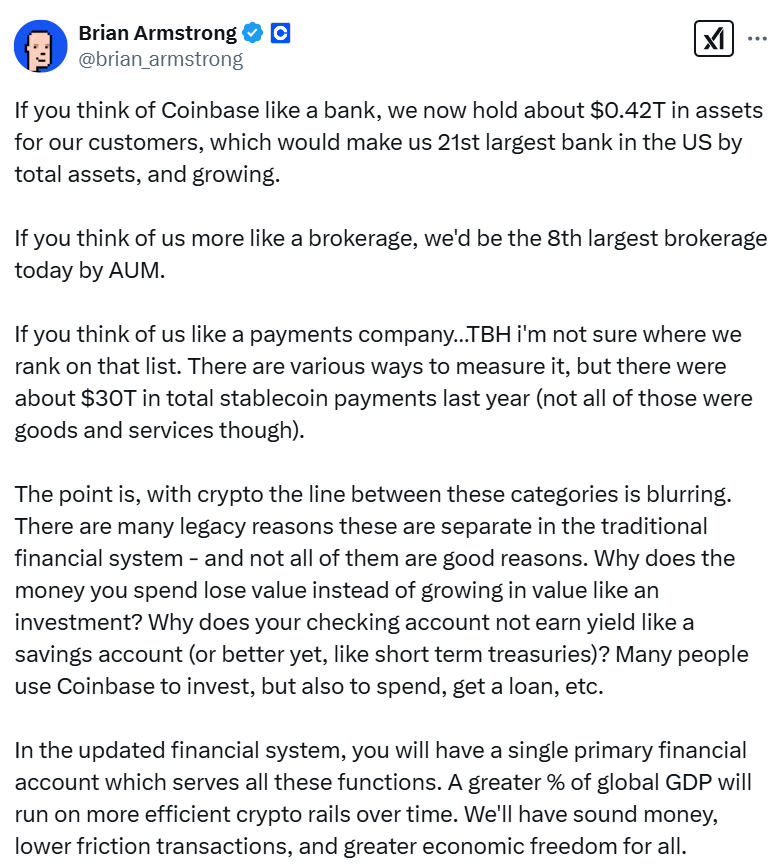

Brian Armstrong, CEO and co-founder of Coinbase, took to X (formerly Twitter) on February 7 to emphasize the significance of this achievement:

“If you think of Coinbase like a bank, we now hold about $0.42T in assets for our customers, which would make us the 21st largest bank in the US by total assets, and growing.”

He further noted that if Coinbase were categorized as a brokerage, it would rank as the 8th largest brokerage firm by AUM, placing it among major financial institutions like Charles Schwab and Fidelity.

Coinbase Financial Strength vs. Traditional Banks

To put this into perspective, New York Community Bancorp (NYCB)—currently the 21st largest bank in the U.S.—manages approximately $112.9 billion in total assets, nearly one-third of Coinbase’s AUM.

NYCB reported a $260 million quarterly loss in Q4 2023, largely due to its acquisition of the now-defunct crypto-friendly Signature Bank. In contrast, Coinbase posted a net profit of $273 million in the same quarter, marking its first positive quarter since Q4 2021.

Coinbase’s financial resilience showcases crypto’s increasing legitimacy, as the exchange continues to outperform traditional financial institutions in terms of profitability and asset management growth.

Online advertising service 1lx.online

Challenges for Mainstream Crypto Adoption

Despite its growing financial strength, Coinbase acknowledges the barriers to mass adoption that continue to hinder the onboarding of new users. Chintan Turakhia, Senior Director of Engineering at Coinbase, highlighted these challenges in an exclusive interview at EthCC:

“If our goal is to bring in the next billion users — and let’s start with just 100 million — we have to take all those friction points out.”

The major friction points that need to be addressed include:

- Complex Wallet Setup – Managing seed phrases remains a challenge for mainstream users.

- Transaction Fees – High gas fees deter users from interacting with blockchain networks.

- Native Token Purchases – Users must buy blockchain-native assets before making transactions, adding unnecessary complexity.

Online advertising service 1lx.online

Armstrong remains optimistic, stating that once these challenges are resolved, crypto adoption will accelerate, enabling sound money, lower friction transactions, and greater economic freedom for all.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)