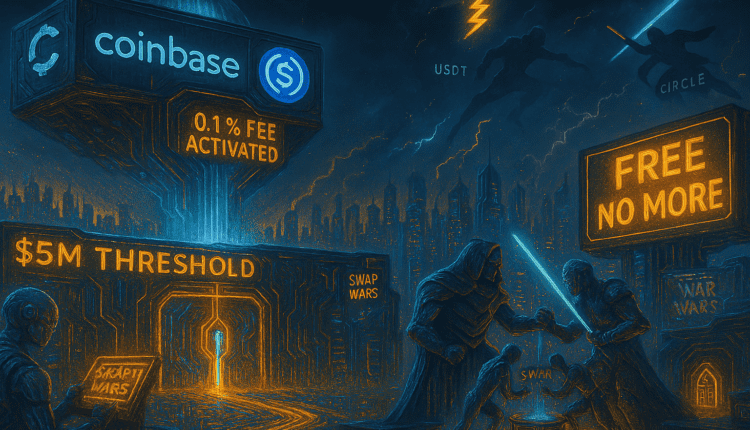

Coinbase Introduces 0.1% USDC Swap Fee to Offset Losses and Control Fiat Outflow

Coinbase will begin charging a 0.1% fee for USDC-to-USD conversions exceeding $5 million, marking a pivotal shift in its previously free stablecoin service. The move comes after disappointing Q2 earnings and growing pressure from the ongoing stablecoin market war.

Coinbase has announced that, beginning August 13, it will implement a 0.1% fee on USDC-to-USD conversions exceeding $5 million over rolling 30-day periods. This marks the first time the company is monetizing what was once a free stablecoin off-ramp service, signaling a strategic shift amid financial pressures.

The fee comes in the wake of weaker-than-expected Q2 earnings that triggered a 15% drop in Coinbase’s stock price. To manage the fallout and liquidity demands, the company also revealed a $2 billion convertible bond issuance plan.

Online advertising service 1lx.online

The user response was swift. Many criticized the change, comparing it to traditional banking fees and accusing Coinbase of straying into legacy finance territory. CEO Brian Armstrong defended the decision on social media, stating that the fee helps address the imbalance caused by Tether’s redemption model—USDC redemptions were significantly cheaper, making it a go-to path for large fiat conversions.

This new fee will be calculated based on net conversion volume—subtracting purchases from sales—within any 30-day window. Coinbase representatives described the policy as an “experiment” to better assess how fees impact large-scale USDC off-ramps. They also noted that competitors already charge steeper fees for similar services.

The broader context includes Coinbase’s ongoing struggles: a 39% plunge in retail trading volumes brought Q2 totals down to $764 million, while total revenue hit $1.5 billion—falling short of Wall Street’s expectations. Despite this, the company is pushing ahead with its transformation into an “everything exchange,” offering tokenized stocks, prediction markets, and crypto derivatives to diversify beyond spot trading.

Behind the new fee structure lies a deeper industry challenge: stablecoin warfare. Prominent crypto figure Cobie noted that Tether’s exit fees encouraged users to convert USDT to USDC and then cash out, putting strain on USDC supply while sustaining USDT’s dominance. Coinbase’s move aims to block this arbitrage loop by discouraging one-way USDC off-ramping and maintaining ecosystem liquidity.

Furthermore, Coinbase likened the policy to ETF creation/redemption fees, arguing that massive redemptions have real operational costs. Critics, however, pointed out the irony—USDC’s efficiency is now being penalized to keep it competitive.

Some users proposed that institutions seeking large conversions should turn to Circle’s OTC minting rather than use public exchange routes.

The Q2 report also showed an unexpected bright spot: XRP generated 13% of consumer transaction revenue, slightly outperforming Ethereum. Coinbase also continued its crypto accumulation strategy, purchasing 2,509 Bitcoin worth $222 million during the quarter, increasing total holdings to 11,776 BTC—making it one of the largest public BTC holders, ahead of Tesla.

Online advertising service 1lx.online

Still, this accumulation couldn’t offset broader revenue shortfalls. Even Ark Invest, led by Cathie Wood, sold $6.5 million in Coinbase stock on July 10, continuing its trend of trimming exposure to underperforming crypto investments.

To shore up resources, Coinbase is issuing $2 billion in convertible senior notes split across 2029 and 2032 maturities. Proceeds will be used for capped call transactions (to reduce stock dilution), corporate development, working capital, and possible acquisitions or debt repayments.

Despite challenges, Coinbase remains ambitious. It was recently named one of TIME’s 100 Most Influential Companies of 2025 for its role in shaping U.S. digital asset policy—a nod to its long-term impact, even in a volatile quarter.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)