Bitcoin Breaks Down: Bearish Continuation Toward $78K–$72K Now in Play

Bitcoin failure to hold the $90K–$85K region has shifted momentum decisively into bearish territory. As on-chain flows worsen and market liquidity weakens, a downside continuation toward $78K–$72K becomes the dominant scenario for late November.

You can explore more daily updates in our dedicated Bitcoin News section.

Market Overview: Defensive Mode Deepens Across Key Indicators

Online advertising service 1lx.online

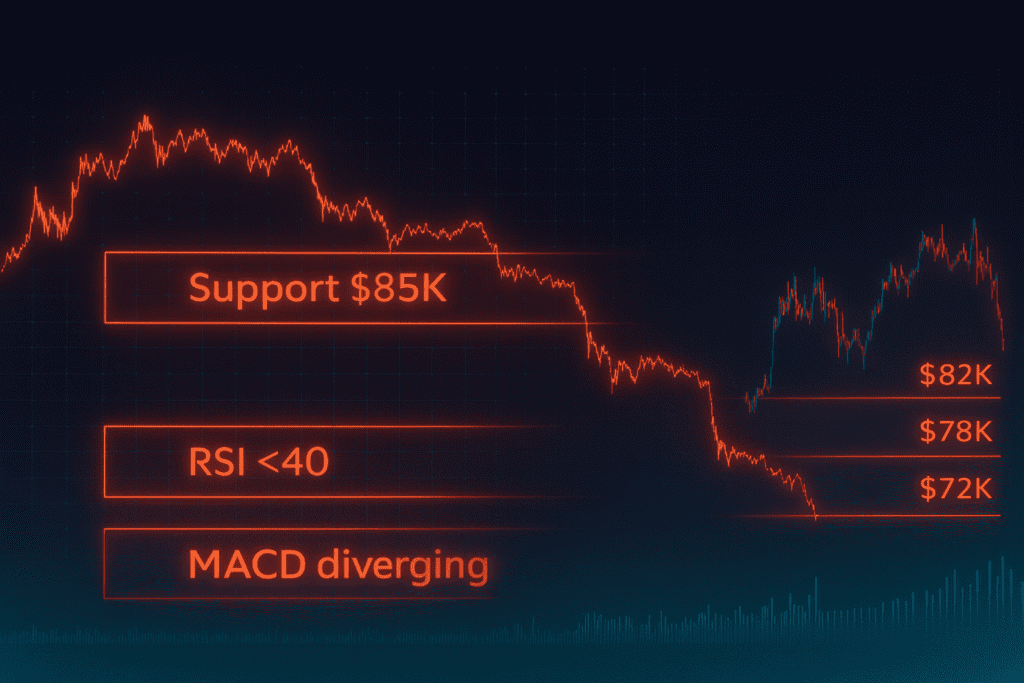

Bitcoin’s recent breakdown highlights a clear deterioration in bullish structure. Multiple technical and on-chain metrics reinforce this shift:

- RSI (1D) dropped into the 35–40 zone — oversold, but lacking reversal strength.

- MACD crossed bearishly and continues expanding downward momentum.

- Volume spiked sharply during the selloff, indicating strong distribution, not panic-only selling.

- EMAs (20/50/100) are all sloping down, with price now trading below each — a structurally bearish alignment.

- On-chain flows worsen:

- CryptoQuant reports increasing exchange inflows from whales and miners, a classic precursor to sell pressure.

- Glassnode shows declining stablecoin reserves, meaning buy-side liquidity is weakening.

Top analysts echo the shift:

- @rektcapital: “BTC has lost mid-range support — the next macro support cluster sits lower.”

- @CryptoTony_: “Below $90K, the market becomes vulnerable to an extended corrective move.”

Sentiment is clearly defensive — but not yet capitulated — which often precedes another leg down.

Scenario 3 — Bearish Continuation Toward $78K–$72K

If Bitcoin fails to defend the $85K support, bearish continuation takes control of the market.

Why This Scenario Is Increasingly Likely

Online advertising service 1lx.online

- Exchange inflows rising → whales positioning to sell.

- Stablecoin liquidity declining → weaker buy-side pressure on major dips.

- RSI remains below 40 → momentum is still decisively bearish.

- MACD divergence expanding → trend weakening with confirmation.

- Macro backdrop turning risk-off as equities slide and volatility rises.

Downside Targets

- Target 1: $82K

- Target 2: $78K

- Target 3: $72K → major weekly demand & liquidity region.

These levels align closely with high-timeframe liquidity pools and historical support clusters.

Invalidation (Bullish Recovery Threshold)

Online advertising service 1lx.online

A fast reclaim of $90K–$92K would neutralize the bearish setup and return Bitcoin into a neutral or recovery phase.

Technical Setup: Liquidity Will Decide December

High-timeframe analysis shows Bitcoin has broken below its 2024 parabolic trendline, forming:

- A macro lower high →

- Followed by a decisive lower low, ending the prior parabola.

Additional structural elements:

- Bollinger Bands show strong expansion → volatility spike confirms trend acceleration.

- Liquidity pools:

- Below: $82K, $78K

- Deeper: $72K major demand

- Above: $94K, $101K

The first major liquidity pool breached will determine December’s directional momentum.

You can follow evolving technical setups in our

Weekly Crypto Price Forecast archive.

Weekly Outlook: Bears Maintain Control Unless $90K–$92K Reclaimed

After one of the strongest corrections in months, Bitcoin remains in a fragile recovery zone where sellers continue to dominate.

This week’s key drivers:

- ETF inflow/outflow shifts

- U.S. macro signals (yields, equities, risk appetite)

- Whale flows + stablecoin liquidity

- Market reaction around the critical $85K boundary

Without strong reversal signals, downside pressure remains the path of least resistance.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)