Bitcoin Holds Strong Despite $9.6B Whale Selloff — 97% of Investors Still in Profit

Bitcoin liquidity passed a historic stress test as a Satoshi-era whale dumped 80,000 BTC, yet nearly all holders remain in profit.

Bitcoin (BTC) faced a historic liquidity challenge this past weekend as a massive Satoshi-era whale distributed 80,000 BTC, worth $9.6 billion. Despite the magnitude of the event, blockchain analytics firm Glassnode reports that the market remained structurally sound — with a “supermajority” of holders still sitting on unrealized profits.

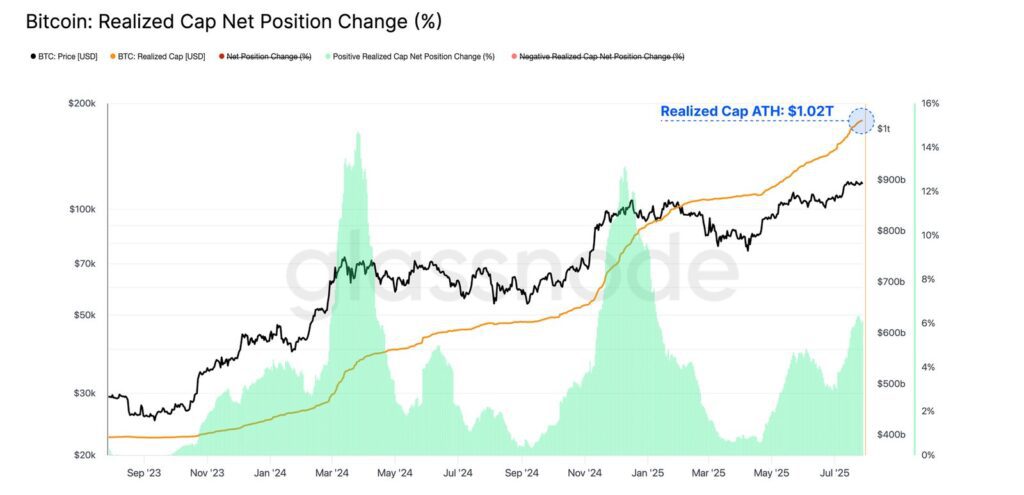

Glassnode’s analysts focused on the Realized Cap metric, which measures the total USD-denominated liquidity on the Bitcoin network. As of the report, it surpassed $1.02 trillion, showcasing Bitcoin’s expanding liquidity and market depth.

Online advertising service 1lx.online

This liquidity was stress-tested when the long-dormant whale transferred BTC via Galaxy Digital, likely through OTC desks and market channels. Glassnode described this as the largest single sell-side pressure event in Bitcoin’s history. Remarkably, the market “efficiently absorbed” the dump — a testament to Bitcoin’s evolved structure.

The event pushed Net Realized Profit/Loss to an all-time high of $3.7 billion, even before the coins fully hit the market. This spike highlighted how seasoned investors began moving funds in anticipation of the selloff.

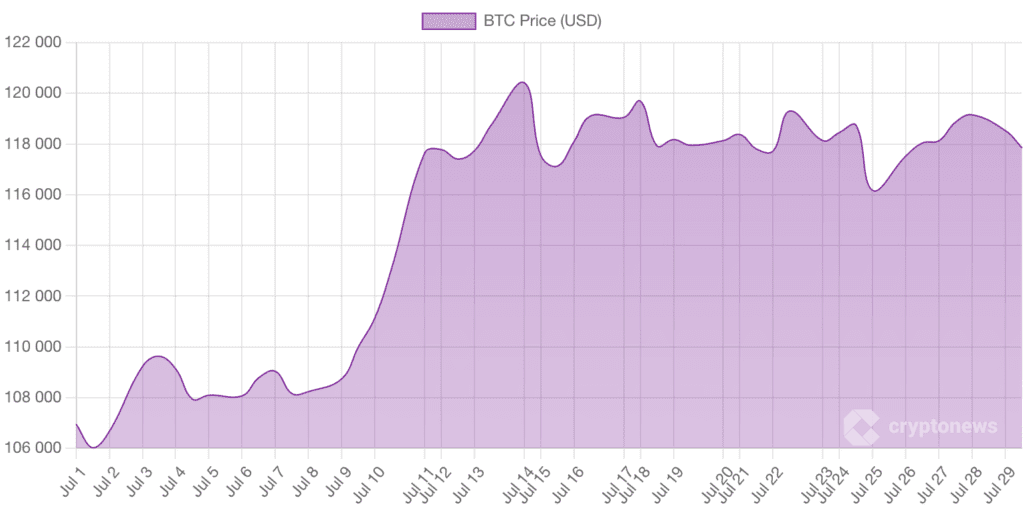

Still, the price of Bitcoin remained stable, only dropping to $115,000 before recovering to $119,000. Glassnode emphasized that more than 97% of BTC in circulation continues to be held above the acquisition price — confirming strong unrealized profits across the board. In fact, unrealized gains just hit a record $1.4 trillion in total.

The firm warned, however, that such elevated profit levels could create intensified sell-side pressure if prices rise further. A decisive breakout above the $125,000 level could send BTC as high as $141,000 — but also risk triggering aggressive profit-taking at those highs.

Currently, Bitcoin trades around $118,363 — flat on the day and week, up 10% monthly and 77% annually. The all-time high stands at $122,838, set on July 14.

Glassnode also noted that BTC is trading in a range between $105,000 and $125,000. A move above or below this band could shift market dynamics dramatically. A “light volume zone” between $110,000–$115,000 may act as a key area to watch for pullbacks.

Online advertising service 1lx.online

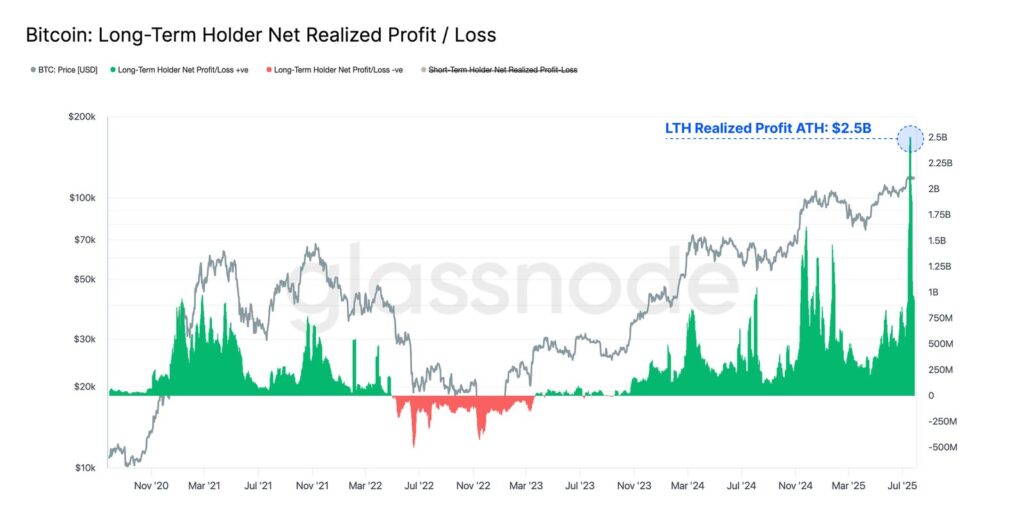

Long-Term Holders (LTHs) are also realizing profits at an accelerated pace, with their Net Realized Profit/Loss metric reaching a new ATH of $2.5 billion — eclipsing the previous record of $1.6 billion.

Additionally, the ratio between Long- and Short-Term Holder supply reflects a typical market cycle. After an accumulation phase, aggressive distribution begins. That distribution phase is now in full swing, as LTH/STH ratios continue to decline.

The Unrealized Profit metric signals that sentiment remains positive — but also foreshadows the rising temptation for investors to cash out ahead.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)