TeraWulf Revenue Soars 102% Amid Bitcoin Mining Expansion

Bitcoin mining giant TeraWulf has reported a staggering 102% year-over-year revenue growth, reaching $140.1 million in 2024. This surge is attributed to increased BTC production, improved market prices, and the company’s strategic elimination of legacy debt. With a growing balance of digital assets and a focus on high-performance computing (HPC) hosting, TeraWulf is solidifying its role as a leader in next-generation digital infrastructure.

Bitcoin mining company TeraWulf has released its fourth-quarter earnings report, showcasing an impressive financial performance driven by higher bitcoin production and favorable market conditions. Compared to 2023, when the company reported $69.2 million in revenue, TeraWulf’s total earnings skyrocketed to $140.1 million in 2024, reflecting a 102% year-over-year growth.

One of the company’s major financial milestones was the complete elimination of its legacy term loan debt, which stood at $139.4 million at the end of 2023. Additionally, TeraWulf reported a significant increase in adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), which surged from $31.9 million in 2023 to $60.4 million in 2024.

Online advertising service 1lx.online

At the close of 2024, TeraWulf held $274.5 million in cash, cash equivalents, and bitcoin on its balance sheet. Its BTC holdings alone nearly quadrupled, reaching a total of 1,801 BTC by year-end. This rapid accumulation underscores the company’s strong liquidity position and strategic financial planning.

Looking ahead, CFO Paul Prager emphasized TeraWulf’s commitment to expanding its infrastructure to accommodate AI-driven computing needs. “With the delivery of 72.5 MW of HPC hosting capacity scheduled for 2025, we are well-positioned to capitalize on the rising demand for AI-focused compute infrastructure,” Prager stated in a press release. He highlighted TeraWulf’s ability to leverage its low-cost, predominantly zero-carbon energy infrastructure, reinforcing its leadership in digital asset mining and high-performance computing services.

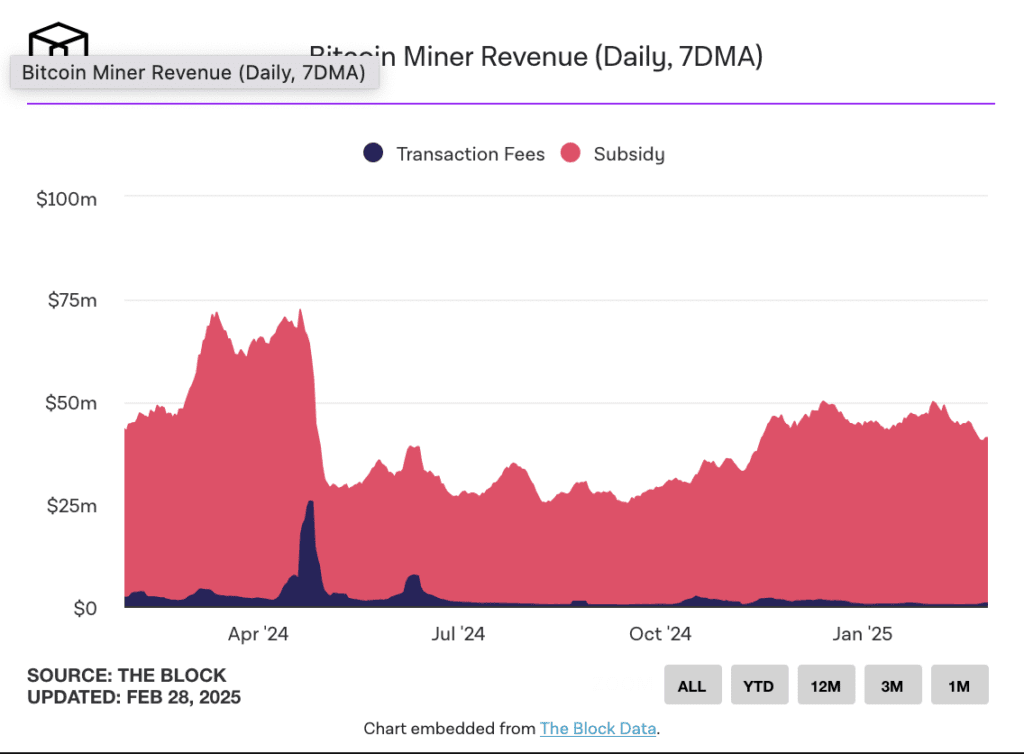

The recent Bitcoin halving event in April 2024 has prompted many mining companies to diversify their operations, shifting toward AI and HPC hosting to sustain profitability. TeraWulf’s strategic expansion into HPC aligns with this industry trend, ensuring resilience despite fluctuating crypto revenues.

Meanwhile, other industry players have reported mixed financial results. Riot Platforms disclosed a 34.2% year-over-year revenue increase, while Bitdeer Technologies and Cipher Mining struggled with profitability challenges. Marathon Digital Holdings (MARA) recorded a 69% revenue surge, reaching $656.4 million, whereas Core Scientific’s stock surged following a $1.2 billion data center expansion deal with CoreWeave.

TeraWulf’s stock saw a notable 14% rise following the earnings announcement, pushing the company’s market capitalization to $1.57 billion, according to The Block’s WULF price data.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)