Bitcoin Enters Rare ‘Optimal DCA’ Zone Amid Market Correction

Bitcoin sharp price decline has led key on-chain metrics to indicate an optimal dollar-cost-averaging (DCA) opportunity. With BTC trading at a discount, analysts highlight low-risk accumulation signals, drawing comparisons to past market cycles.

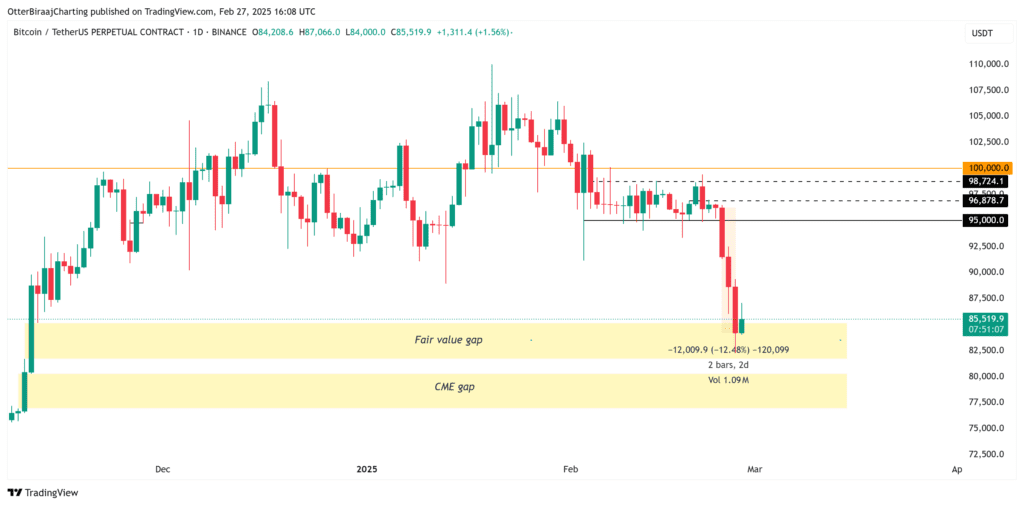

Bitcoin price recently plunged to a new yearly low of $78,258 on February 27, triggering discussions among analysts about its current valuation. On-chain indicators now suggest that this dip presents a strategic buying opportunity for long-term investors.

Online advertising service 1lx.online

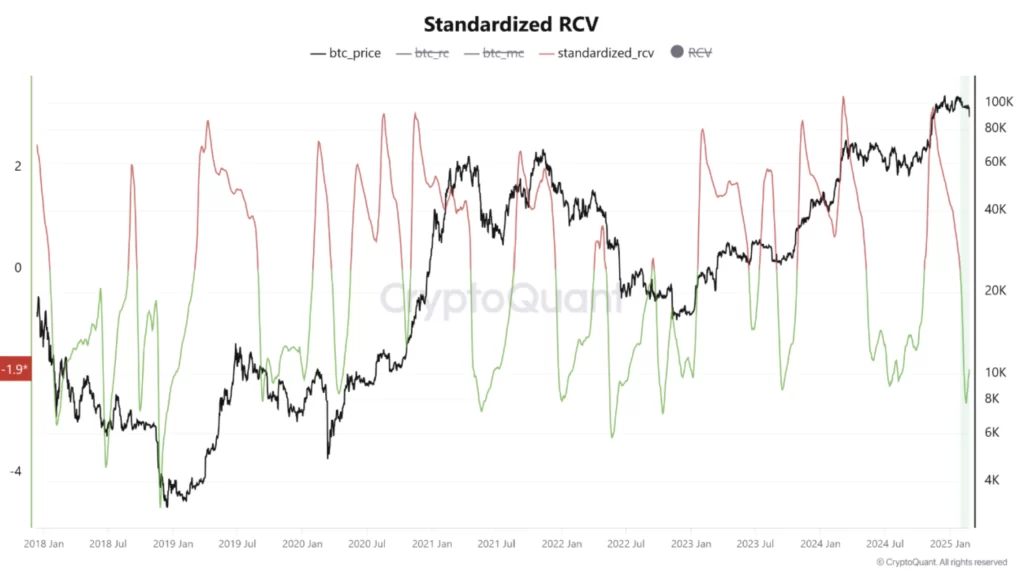

Bitcoin’s 60-Day RCV Signals a Prime Entry Point

A verified analyst on CryptoQuant, known as Crazzyblock, has pointed out that Bitcoin’s 60-day Realized Capitalization Variance (RCV) has hit -1.9, its lowest level since July 2024. This metric, which evaluates the rolling average and standard deviation of BTC’s price, signals an undervaluation phase when below 0.30. Currently, Bitcoin’s RCV level indicates a low-risk accumulation phase, making it an attractive entry point for investors looking to scale in via a DCA strategy.

Historically, similar RCV readings have aligned with market bottoms, though they do not necessarily indicate an immediate price recovery. However, past instances of such deviations have led to long-term price gains. The last time Bitcoin flashed this metric was between May and July 2024, when BTC ranged between $70,000 and $50,000 before eventually rebounding.

Short-Term Holder SOPR Hints at Potential Recovery

Crypto analyst Yonsei Dent has identified another key signal: Bitcoin’s Short-Term Holder Spent Output Profit Ratio (SOPR) has deviated sharply below the lower Bollinger Band. Historically, such deviations have been followed by Bitcoin rebounds ranging between 8% and 42%, indicating a potential for recovery in the coming weeks. This pattern was also evident during the 2022 bear market, reinforcing the probability of a short-term relief rally.

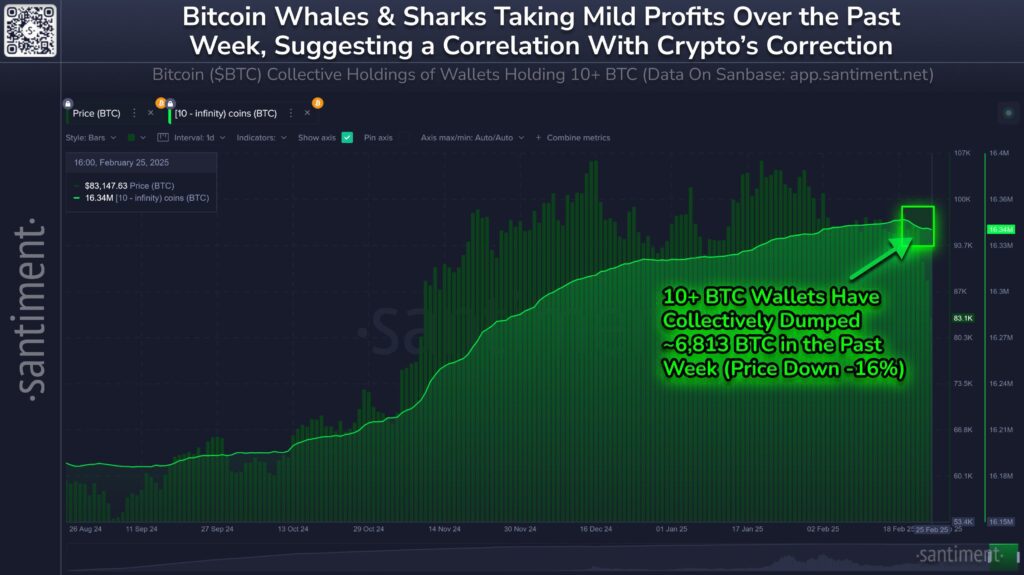

Bitcoin Whales Offload 6,813 BTC

While accumulation signals are emerging, market participants should remain cautious. Data from Santiment reveals that wallets holding 10+ BTC have collectively sold 6,813 BTC in the past week—their largest distribution since July 2024. Such large-scale sell-offs often exert downward pressure on price action.

Online advertising service 1lx.online

Moreover, CryptoQuant CEO Ki Young Ju has pointed out that Bitcoin’s spot ETF demand remains weak. This lack of institutional inflows suggests that a price recovery could take longer than expected, requiring a fresh catalyst to reignite upward momentum.

At press time, Bitcoin is trading at $78,856, with market sentiment remaining cautious but primed for a potential shift in investor positioning.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)