Nvidia & AMD 15% Revenue Deal with U.S. Sparks Trade War Fears

Nvidia and AMD have struck a groundbreaking deal with the U.S. government, agreeing to hand over 15% of their China chip sales revenue in exchange for export licenses. The move could reshape U.S.–China trade policy and influence global tech and crypto markets.

Nvidia and AMD have entered into an unprecedented arrangement with the U.S. government, agreeing to allocate 15% of revenues from certain chip sales in China directly to Washington, according to the Financial Times. In return, both companies will be granted export licenses to sell Nvidia’s H20 and AMD’s MI308 chips to the Chinese market.

Online advertising service 1lx.online

Sources report that Nvidia CEO Jensen Huang met with President Donald Trump last week to finalize the terms. In a statement to the Financial Times, Nvidia confirmed: “We follow the rules the U.S. government sets for our participation in worldwide markets.”

The agreement comes at a time when Trump has been threatening to impose a 100% tariff on all imported semiconductors and chips unless manufacturing shifts to U.S. soil. This revenue-sharing model is being interpreted by analysts as a possible alternative path for companies to bypass hefty tariffs.

In the wake of Trump’s tariff threats, major players like Bitmain have started exploring new production lines in Texas and Florida. Such moves could not only help avoid tariffs but also stimulate the U.S. economy and create new job opportunities.

The H20 chip, designed as a lower-tier AI product specifically for the Chinese market to navigate earlier U.S. export restrictions, was banned from export in April. However, in June, after a White House meeting between Trump and Huang, the administration reversed its stance—though no export licenses were issued for weeks.

Now, with Nvidia and AMD agreeing to a revenue-based license fee rather than a profit share, the scale of the concession has caught attention. The Kobeissi Letter highlighted that if other nations cannot absorb U.S. tariffs, they might seek similar revenue-sharing agreements. This could lead to companies surrendering a portion of their sales to avoid export controls.

Industry observers suggest this model could redefine the trade dynamics between the U.S. and China, particularly in the high-tech sector. The arrangement might also influence market stability and strategies within the crypto and blockchain industries.

Given the current backdrop—Bitcoin trading above $119,000 and the global crypto market cap nearing $4 trillion—analysts see a potential for AI-driven blockchain innovation to move further into the financial mainstream.

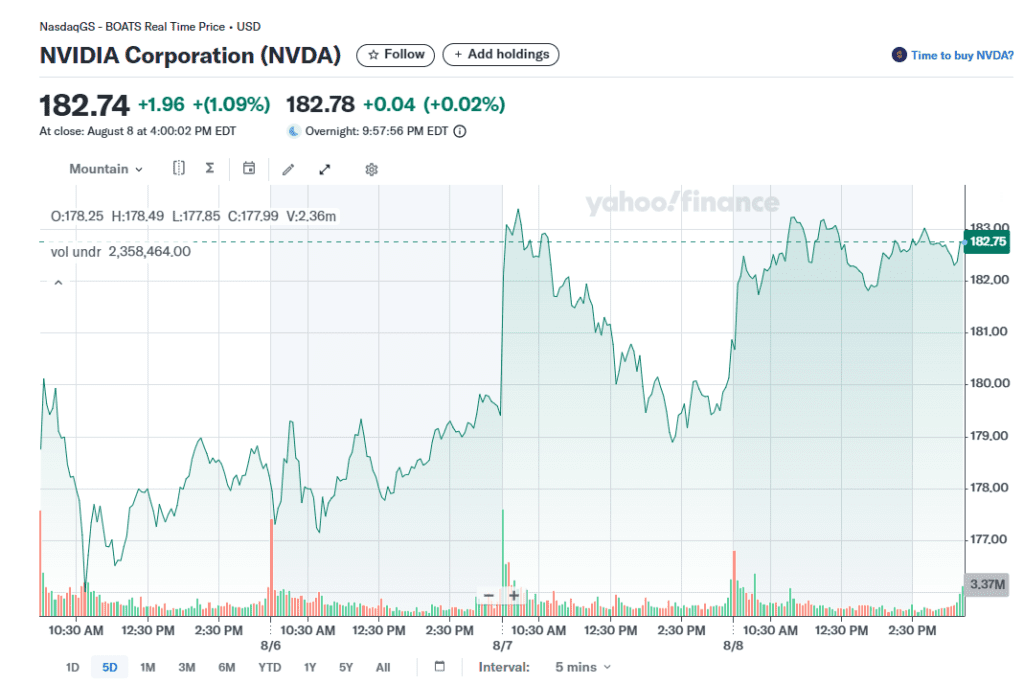

Investors reacted positively to the announcement. Nvidia’s stock closed at $182.74 on August 8, up 1% for the day, after reaching a record high between $179 and $183 last week.

Online advertising service 1lx.online

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)