Vitalik Buterin $1B ETH Stake Spurs Liquidity Battle Among Crypto Whales

Vitalik Buterin Ethereum holdings have surged past $1 billion, igniting intense competition for scarce ETH supply. Tight OTC markets are forcing big players to rethink Ethereum’s market position versus Bitcoin.

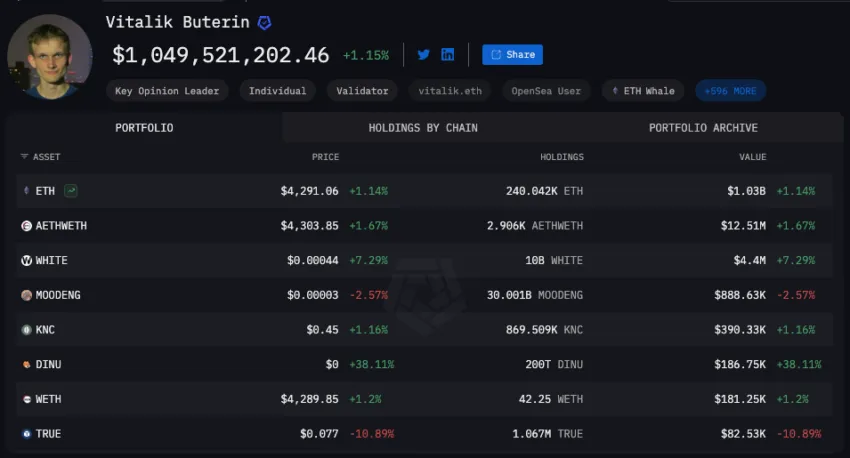

Vitalik Buterin Ethereum portfolio has officially crossed the $1 billion threshold, a milestone that comes as over-the-counter (OTC) liquidity for ETH tightens dramatically. This scarcity is drawing heightened scrutiny from traders, with large institutions and crypto whales competing fiercely for the limited supply — and reexamining Ethereum’s standing in comparison to Bitcoin.

Online advertising service 1lx.online

Both on-chain analytics and industry intelligence reports validate the figures. Major blockchain explorers provide full transparency into Buterin addresses, while community discussions are fueling speculation over what this scarcity could mean for Ethereum’s price trajectory.

A Billion-Dollar ETH Portfolio with Public Access

As of mid-2024, publicly known Ethereum addresses linked to Buterin collectively hold more than $1 billion in value. Blockchain data aggregators, including Arkham, list over 240,000 ETH in his wallets, along with details of his validator activity and transaction history. This transparency makes Arkham’s entity data a key reference point for tracking Buterin on-chain wealth.

Yet, while Buterin holdings attract headlines, OTC trading desks are telling a different story — one of supply shortage. Reports from trading circles indicate that private markets for large ETH deals are under severe pressure.

“In the past hour, Binance, Coinbase & Bitstamp moved approximately $160M in ETH to Galaxy Digital’s OTC desk. Largest single transaction: 4.5K ETH ($18.99M). Ethereum whales are moving heavy today,” reported CryptosRus.

Other voices confirm similar trends:

“WinterMute, a well-known market maker, has run out of Ethereum on their OTC desk. This means the only way to acquire ETH now is via the public market. I’m wondering if Ethereum can punch $5,000 soon?” commented yourfriendSOMMI on X.

Such statements highlight growing speculation that sustained demand, coupled with dwindling OTC supply, could drive more buyers toward public exchanges.

ETH vs. BTC: The Rivalry Rekindled

Whenever liquidity tightens, the long-running debate about Ethereum’s role relative to Bitcoin tends to reignite. This conversation also gains traction when ETH shows signs of increasing market dominance.

Online advertising service 1lx.online

One popular post recalls a near-historic moment:

“You may not know, but Ethereum almost surpassed BTC in market capitalization on June 18, 2017. Back then, BTC’s market share stood at 37.8%, while ETH reached 31.2%. In the end, BTC maintained dominance, widening the gap ever since,” shared ThuanCapital.

The anecdote is now resurfacing, with some analysts suggesting that today’s OTC squeeze could bring Ethereum closer — at least temporarily — to challenging Bitcoin’s lead.

For now, all eyes remain on both public market activity and the transparent on-chain data that confirm Buterin substantial commitment to Ethereum. The months ahead will reveal whether limited supply and robust demand can truly disrupt the established balance of crypto power.

Online advertising service 1lx.online

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)