Bitcoin Miners Face Profitability Struggles as Transaction Fees Hit Yearly Low

Bitcoin miners grapple with declining profitability as transaction fees drop to $3.3 million, the lowest weekly level this year, amid reduced network activity and rising production costs.

Bitcoin miners are currently facing significant profitability challenges as transaction fees have dropped to their lowest level this year. According to data from IntoTheBlock, Bitcoin fees fell by nearly 5% this week to $3.3 million, marking the third consecutive week of declining fees. This downward trend follows a recent drop in Bitcoin’s price and a slowdown in network activity, further exacerbating the difficulties faced by miners.

Online advertising service 1lx.online

The decline in transaction fees has been ongoing since the Bitcoin halving event in April. Initially, the halving spurred a surge in fees, driven by the Runes protocol, which enabled Bitcoin to surpass Ethereum in daily fees for a brief period. However, as attention shifted away from Runes and other Bitcoin-based protocols like Ordinals, fees have steadily decreased.

With the reduced network activity, the average fee for medium-priority transactions has fallen to just 4 sats/byte ($0.33), significantly lowering miners’ revenue. Ycharts data indicates that average transaction fees have remained below $500,000 since the beginning of August, with the last time Bitcoin recorded over $1 million in daily fees being July 13.

This decline in fees has added to the growing list of challenges for Bitcoin miners. Many had hoped that transaction fees would become a viable alternative revenue source as block subsidy rewards diminish following the halving. However, this has not materialized, leaving miners struggling to break even amid high production costs and volatile Bitcoin prices.

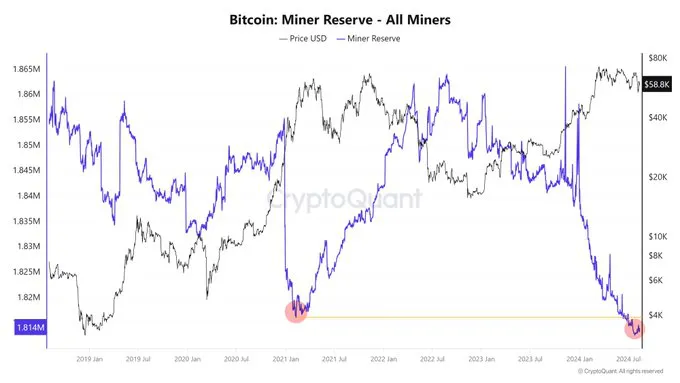

As a result, many miners have resorted to selling off their crypto holdings to sustain operations. Data from CryptoQuant reveals that miners’ reserves are at their lowest level ever, even lower than during Bitcoin’s all-time high in 2021. Despite this, some companies, like Marathon Digital, are planning to raise funds to acquire more Bitcoin.

The decline in mining revenue and fees has also led to a slowdown in Bitcoin production. The network’s hashrate, which measures computing power, reached a record high of 700 EH/s on August 15 but has since fallen to 573.11 EH/s, an 8.5% drop. Additionally, mining difficulty has decreased from 90.66 T to 86.87 T, reflecting the reduced activity.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)