Ethereum Blasts Past $2.4K – Rally Momentum or Risky Bull Trap in Disguise?

Ethereum surges past $2.4K, climbing over $1K in 30 days. Analysts debate whether it’s a breakout or a deceptive bull trap as RSI nears extreme levels.

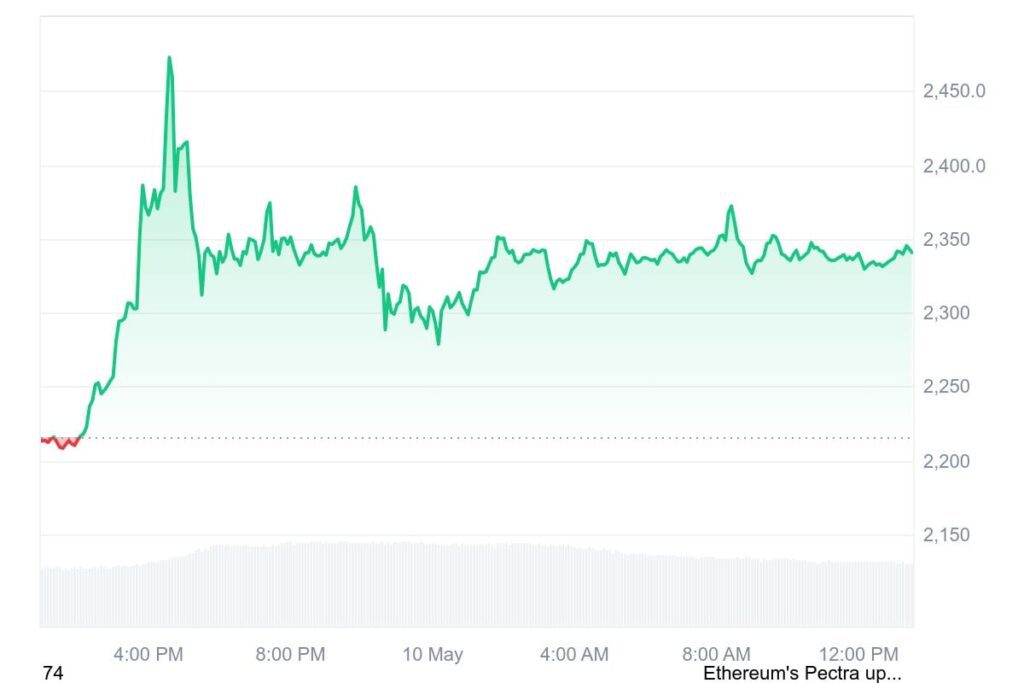

Ethereum ($ETH) has stunned the crypto market once again by soaring past the $2,400 threshold, marking a $1,000+ climb within just a single month. The rise has reignited optimism across the industry and left many traders in disbelief at the coin’s newfound momentum.

The breakout gained serious traction after a key recommendation on May 7, when market watchers suggested that investors begin dollar-cost averaging (DCA) around the $1,500 level. That strategy paid off handsomely, as Ethereum went on to gain over 66%, causing traders who followed the move to realize significant gains.

Online advertising service 1lx.online

However, caution now tempers that excitement. With the price spike, questions loom: Is this a genuine uptrend—or is Ethereum setting up a bull trap? Some profit-taking has already occurred, with seasoned traders wary of a potential pullback.

Much of this uncertainty stems from the volatile nature of the crypto markets. High leverage on both the long and short sides creates rapid swings in price, intensifying unpredictability. The market’s current rhythm is driven as much by emotion and fear as it is by technical indicators.

At the heart of this rally is the technical strength Ethereum has shown. In the past 48 hours, it not only defied bearish sentiment but also broke through multiple key resistance zones, reaching price levels not seen since earlier this year. Most notably, the Relative Strength Index (RSI) now sits in overbought territory—an indicator that both excites and alarms analysts.

Presently, ETH is trading at $2,343, with a market cap of $282 billion and $41 billion in daily volume, representing a 6% gain over 24 hours. Analysts identify the $2,000–$2,100 range as a vital support base. If Ethereum manages to hold that line during any corrections, it could validate the potential for a larger uptrend toward the $2,500–$2,600 zone.

Interestingly, amid Ethereum’s surge, alternative projects are also capturing investor attention. One example is Best Wallet, an emerging decentralized wallet with its $BEST token currently in presale. The project has already raised over $12 million, signaling robust community interest in next-generation wallet infrastructure.

Looking ahead, the outlook remains cautiously optimistic. While short-term corrections may occur due to market imbalances and overbought signals, Ethereum’s broader trend suggests continued strength—provided macro conditions remain favorable and investor sentiment holds.

Whether $ETH continues this vertical trajectory or retreats for consolidation, one thing is clear: Ethereum remains a central force in the ongoing evolution of the digital economy.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)

Online advertising service 1lx.online