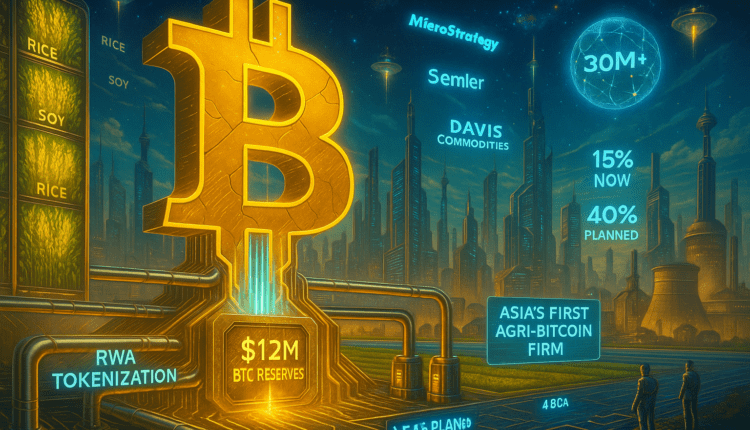

Singapore Davis Commodities Invests $12M in Bitcoin to Hedge Inflation and Tokenize Real Assets

Davis Commodities shifts $12M into Bitcoin, blending agriculture with blockchain to hedge inflation and lead Asia push into RWA tokenization.

In a bold move that fuses traditional industry with digital finance, Davis Commodities Limited (Nasdaq: DTCK), a leading Singapore-based agricultural commodities trader, has announced plans to allocate $12 million into Bitcoin. The decision marks a significant pivot for a sector not commonly associated with blockchain innovation.

The allocation comes on the heels of a $30 million fundraising round and reflects the company’s commitment to evolving its financial model. Davis Commodities will start by investing $4.5 million—equivalent to 15% of its newly raised capital—into Bitcoin. The firm plans to gradually increase its BTC exposure to 40% of total funds over time.

Online advertising service 1lx.online

According to the company, this strategy aims to leverage Bitcoin as a scarce and inflation-resistant asset while laying the groundwork for future Real-World Asset (RWA) tokenization. In doing so, Davis Commodities joins a small but growing list of traditional corporations exploring cryptocurrency as both a balance sheet reserve and a financial innovation tool.

The integration of Bitcoin into a commodities firm’s treasury strategy is virtually unprecedented in Asia. While publicly traded companies like MicroStrategy and Semler Scientific have become known for their Bitcoin reserves, Davis Commodities represents a new frontier—where blockchain intersects with agriculture and global food trade.

“This is not about chasing hype,” said a company spokesperson. “It’s about building resilience and expanding our financial architecture in a digital age.”

The initiative also signals broader industry implications. As inflation concerns persist globally, and RWA tokenization gains traction, Davis Commodities could become a model for other asset-heavy enterprises seeking inflation hedges outside fiat currencies.

Furthermore, by moving toward tokenization, the firm could eventually digitize agricultural supply chains, streamline settlements, and create new layers of liquidity in global trade.

For now, the company’s dual positioning—as both a leader in commodity markets and an early adopter of crypto treasury management—places it at the cutting edge of financial transformation in Southeast Asia.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)