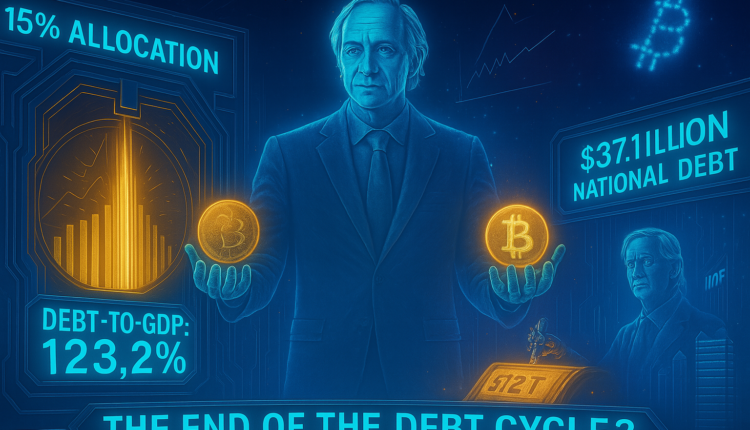

Ray Dalio Now Says 15% in Bitcoin or Gold—A Radical Shift From 2022 Strategy

Ray Dalio now recommends holding 15% of your portfolio in Bitcoin or gold. His warning? A debt-fueled crisis is near.

American billionaire and hedge fund titan Ray Dalio has revised his stance on Bitcoin, advising investors to allocate roughly 15% of their portfolios to either Bitcoin (BTC) or gold as a strategic hedge against currency devaluation in today’s debt-ridden economy.

Although Dalio personally favors gold over Bitcoin, he underscored both assets as essential tools for diversifying risk. Speaking on the Master Investor Podcast, the Bridgewater Associates founder confirmed he owns a small amount of Bitcoin and believes its scarcity and global transferability offer real advantages in a volatile world.

Online advertising service 1lx.online

“If you were neutral on everything, in other words, you didn’t have a point of view and you were optimizing your portfolio for the best return to risk ratio, you would have about 15% of your money in gold or or Bitcoin,” Dalio explained.

Dalio acknowledged Bitcoin’s benefits, such as its capped supply and borderless utility. However, he remains skeptical about Bitcoin as a global reserve currency, raising concerns about transparency, surveillance, and code integrity.

“I doubt that any central bank will take it on as a reserve currency because everybody can understand and watch. Governments can see who is doing what transactions on it,” he warned. “It’s being perceived by many as an alternative money, but I can’t say exactly how effective it is as a money.”

The billionaire’s 15% allocation recommendation represents a massive leap from his previous advice in 2022, which suggested just 1–2% exposure to Bitcoin.

This pivot comes amid skyrocketing concerns over U.S. public debt. As per the U.S. Debt Clock, national debt has reached $37.1 trillion with a staggering 123.2% debt-to-GDP ratio. Dalio predicts the government will be forced to issue nearly $12 trillion in new Treasuries next year just to manage the mounting burden.

He emphasized that we’re nearing the end of a long-term debt cycle—a point at which the weight of accumulated debt becomes unmanageable without sparking systemic collapse. According to Dalio, this will likely mean higher interest rates, a weakening dollar, and falling equity markets as investors respond to the fiscal chaos and absence of meaningful solutions.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)