Bitcoin vs. Gold: Why the Correlation Is Breaking Down — And What It Means

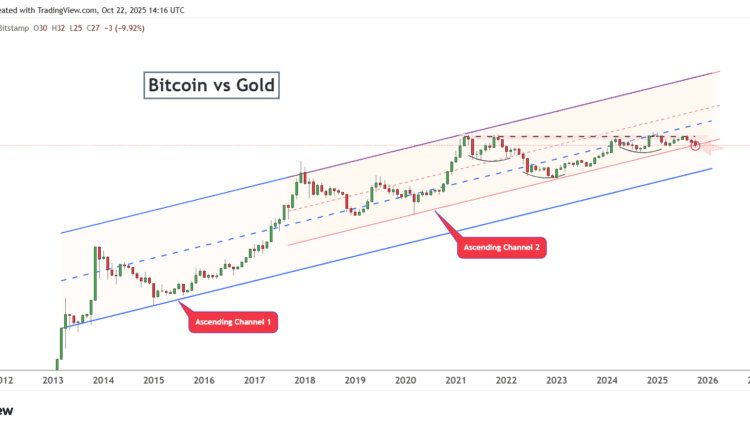

Bitcoin long-standing role as “digital gold” is being tested as its correlation with gold falls near zero — signalling a structural shift in how BTC responds to macro forces.

The comparison of Bitcoin and gold has been a staple of crypto commentary for years. However, in October 2025 the narrative appears to be shifting. According to recent data, the correlation between Bitcoin and gold has dropped to roughly 0.1, effectively decoupling the two assets and challenging the widely held view of Bitcoin as a direct digital alternative to gold.

This decoupling is made more complex by technical signals within the Bitcoin market itself. Bitcoin is currently trading below key indicators such as its 50-day exponential moving average (EMA), a condition that historically signals caution rather than outright bullish conviction. These two developments together suggest that while the “digital gold” narrative remains popular, it may no longer reflect how investors actually treat Bitcoin.

Online advertising service 1lx.online

A Divergence Between Two Stores of Value

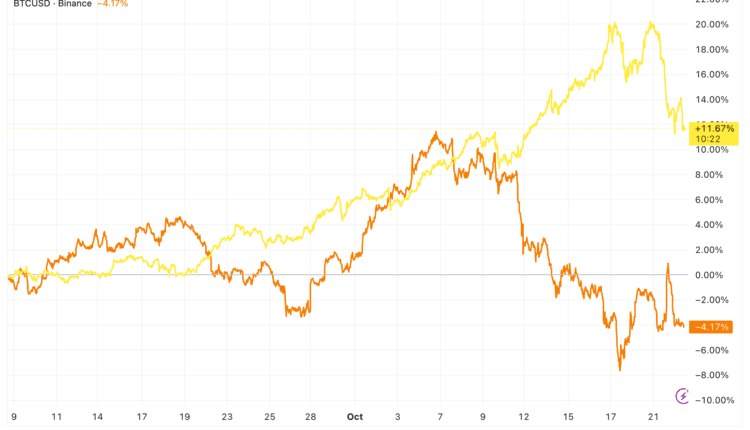

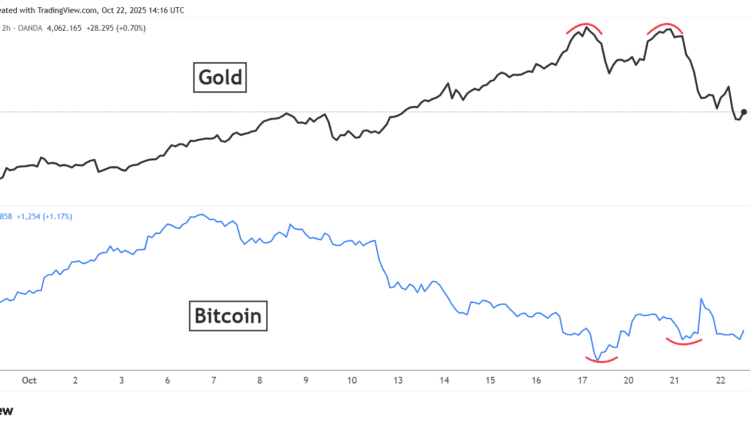

In recent weeks, gold has enjoyed a strong rally driven by safe-haven flows and inflation concerns, while Bitcoin has failed to maintain a tight upward correlation with that move. According to CryptoSlate, the two assets moved in temporally disjointed ways, with Bitcoin’s drawdown preceding gold’s correction—resulting in the very low correlation observed.

Simultaneously, technical data underscores that Bitcoin is not immune to internal market stress. As highlighted by VanEck’s analysis, futures open interest for BTC soared to near record levels in early October, and when deleveraging hit, Bitcoin’s drawdown accelerated despite gold being on a different cycle.

These factors combine to reshape how we should view Bitcoin: not simply as a digital version of gold, but as an asset with its own rhythm—driven by on-chain metrics, derivatives flows, and crypto-native liquidity rather than traditional safe-haven dynamics.

What This Means for Investors

For your audience at BTCNews.space, this moment marks a meaningful inflection point. If large-scale institutions begin allocating meaningfully to Bitcoin, the implications for long-term price durability, liquidity, and overall market depth could be profound. The asset’s next phase is less about headline-driven rallies and more about consistent capital deployment, structural liquidity, and its integration into traditional financial architecture.

For instance, if pension funds start holding Bitcoin alongside equities and bonds, that shift could redefine global portfolio construction and fundamentally alter risk-reward dynamics for digital assets. Conversely, if these inflows stall or reverse, the institutional narrative may quickly lose strength—underscoring why monitoring allocation flows, not just price action, is crucial.

For readers seeking historical context, revisit our earlier analysis on Bitcoin’s macro resilience and ETF adoption here: Bitcoin News.

Online advertising service 1lx.online

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)