Bitcoin Hits Key Support: Bull Run or Bear Trap Unfolding?

Bitcoin bounce back above ~US $110 K looks promising — but technical signals reveal fresh fractures beneath the surface.

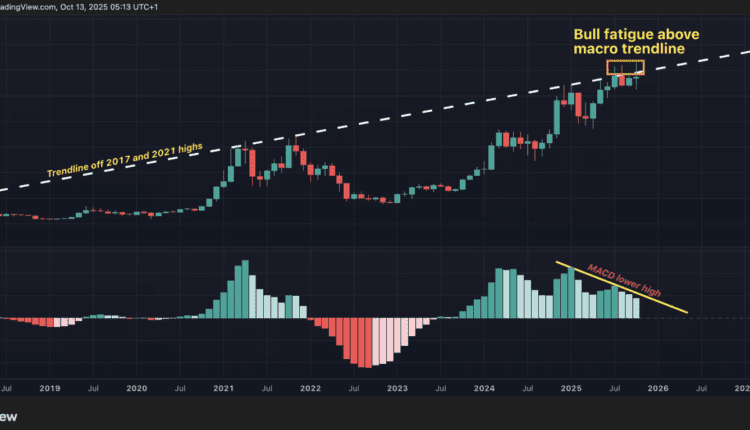

The world’s largest cryptocurrency, Bitcoin (BTC), is again in the spotlight after recovering to the US $110,000 level amid renewed volatility. Yet technical analysts warn that the recent rally may be losing momentum, with crucial support around US $100,000 now under scrutiny.

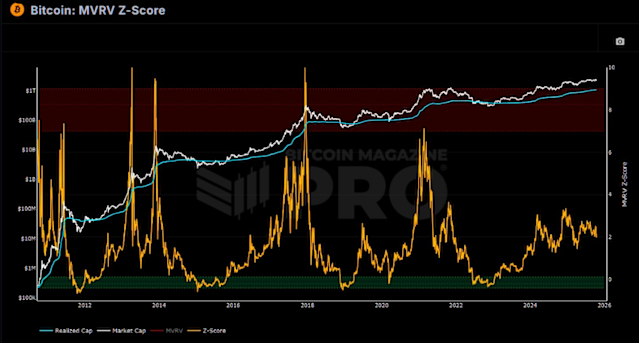

Market observers note that Bitcoin’s short-term structure reflects exhaustion following weeks of “Uptober” optimism. The once-popular narrative — fueled by seasonal bullishness — has begun to fade as liquidity tightens and correlations with tech equities weaken. This shift suggests that Bitcoin may soon enter a consolidation phase rather than continuing its explosive ascent.

Online advertising service 1lx.online

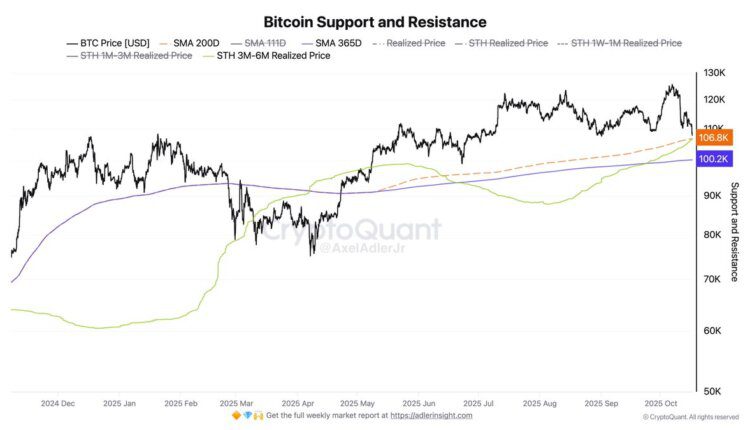

The $100K Line in the Sand

Bitcoin’s key support zone between US $100K and US $105K has repeatedly acted as a psychological anchor for traders. A decisive break below could open the door to deeper corrections, potentially testing US $96K–98K levels. On the other hand, a rebound from this range could reaffirm market strength and set the stage for another leg higher before year-end.

Technical data from on-chain analytics platforms show that long-term holders remain largely unmoved, while short-term speculators have begun trimming exposure. This divergence indicates that the broader market may be transitioning from speculative trading to long-term accumulation — a natural step in Bitcoin’s market maturity cycle.

Macro Friction and Market Sentiment

Global macro indicators are adding pressure to the charts. Rising U.S. yields, stronger dollar performance, and persistent regulatory noise have made risk-on assets less attractive. Yet Bitcoin’s reaction has been more stable than in previous cycles, underscoring its gradual shift from speculative behavior to institutional resilience.

In contrast to past downturns, derivatives markets now show reduced leverage ratios, implying that this correction phase could be a healthy reset rather than a collapse. Analysts argue that Bitcoin’s ability to hold the $100K region through this macro turbulence would demonstrate unprecedented structural strength. For continuous updates and technical insights, readers can follow the dedicated category on Bitcoin news and analysis.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)