Bitcoin Institutional Revival: 67 % of Investors See a Major Rally Ahead

Bitcoin is no longer just a retail play — institutional investors are strongly positioning for a near-term surge, signaling a changing guard in crypto capital flows.

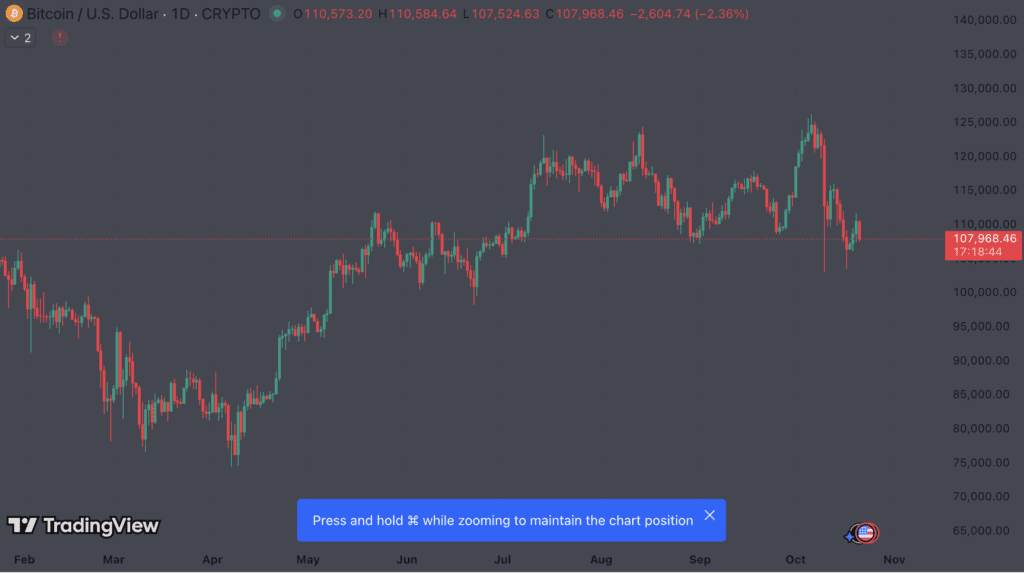

The world largest cryptocurrency, Bitcoin (BTC), is witnessing a powerful revival of institutional confidence. According to a recent institutional market survey, nearly 67 % of major investors expect Bitcoin to stage a substantial rally over the next three to six months. This shift signals that Bitcoin has matured far beyond its speculative retail phase and is now viewed as a strategic portfolio asset in global finance.

Online advertising service 1lx.online

Institutional allocators, including hedge funds, pension managers, and corporate treasuries, have significantly increased exposure throughout Q3 2025. The growing presence of Bitcoin on balance sheets highlights an expanding belief that the asset now behaves like a digital macro hedge, not just a risk asset.

From Speculation to Allocation

In parallel with these findings, reports tracking corporate reserves show a sharp rise in public company holdings of Bitcoin during the last quarter. While individual traders still contribute to short-term volatility, the volume data increasingly points to accumulation by large-scale players and ETF products.

This transformation illustrates how the “digital gold” thesis is becoming reality. Institutional demand has created new layers of liquidity, while derivative markets are providing smoother hedging tools — a setup that enhances Bitcoin’s long-term stability profile.

From a market-structure perspective, this ongoing institutional pivot could redefine Bitcoin’s risk-to-reward dynamics, setting the stage for the next expansion cycle. The deeper implication is that Bitcoin’s evolution from a speculative bet to a macro-relevant asset class is nearly complete.

What It Means for Investors

For readers, this trend underscores that the Bitcoin market is no longer primarily driven by sentiment — but by strategy. Institutional capital tends to move methodically, often in anticipation of long-term returns rather than short-term price spikes.

While retail traders react to headlines, institutional participants are quietly positioning for multi-quarter growth cycles, frequently using ETF inflows, custody solutions, and staking derivatives to scale exposure.

As the industry approaches 2026, the next major catalyst could come from portfolio rebalancing and the global liquidity cycle — factors that historically favor Bitcoin’s store-of-value narrative.

Online advertising service 1lx.online

For further insights, visit our category on Bitcoin news and analysis.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)