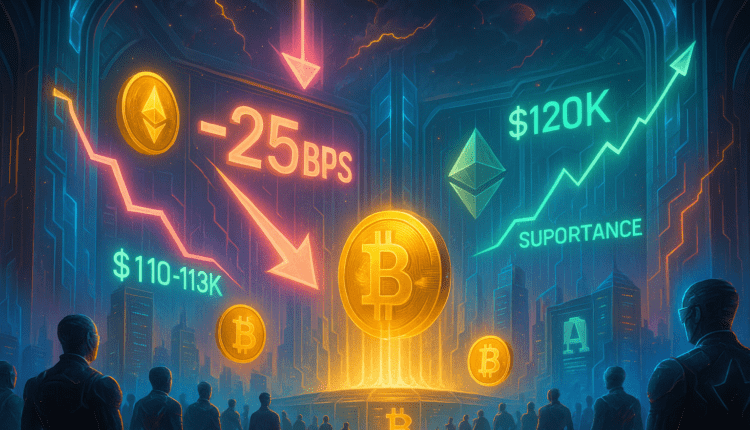

Bitcoin Rallies, But Can It Sustain Gains After Fed’s 25bps Rate Cut?

After the U.S. Federal Reserve first interest rate cut since December—a 25 basis-point drop to 4.00-4.25%—Bitcoin saw a muted upside bump. The question now: can BTC build on that or will macro headwinds push it back down?

On September 17, 2025, the U.S. Federal Reserve enacted a 25-basis-point cut in its benchmark federal funds rate, dropping the target range from 4.25% to 4.00-4.25%, its first rate reduction since December 2022. The move, described by Fed Chair Jerome Powell as a “risk management cut,” came amid signs of a softening labor market and heightened economic uncertainty.

Bitcoin reacted with modest strength following the decision. Although traders had priced in the cut, the reaction was not as dramatic as some expected, with BTC briefly climbing above $115,000 but struggling to hold the level.

Online advertising service 1lx.online

Analysts point out that mixed inflation data is complicating the outlook. August’s U.S. CPI rose 0.4% month-over-month (MoM) vs. 0.3% expected, and 2.9% year-over-year (YoY), signaling inflation remains sticky. Core inflation also remains elevated. These dynamics make any further cuts less certain, especially if inflation expectations remain unanchored.

Technically, key levels are emerging. Support is being eyed around $113,500-$114,000, while resistance is forming near $117,500-$120,000. If Bitcoin breaches resistance and volume confirms the move, a rally toward $125,000 might be possible. Conversely, failure to maintain support could bring a retest of the $110,000 zone.

For investors and traders, this presents a classic risk-reward scenario: weighed between inflation prints, Fed forward guidance, and macroeconomic releases. Given the current landscape, any new inflows — particularly into ETFs — could amplify upside. But vigilance is required.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)