Bitcoin ETF Absorb $867M in Weekly Inflows, Dominating Institutional Crypto Allocations

Bitcoin ETF captured nearly all institutional crypto inflows last week, totaling $867M out of $882M, amid growing macro risks and strategic reserve adoption in the U.S.

Bitcoin ETFs emerged as the clear winner in last week’s institutional investing activity, pulling in a staggering $867 million of the $882 million total net inflows into digital asset funds, according to the latest data released by CoinShares.

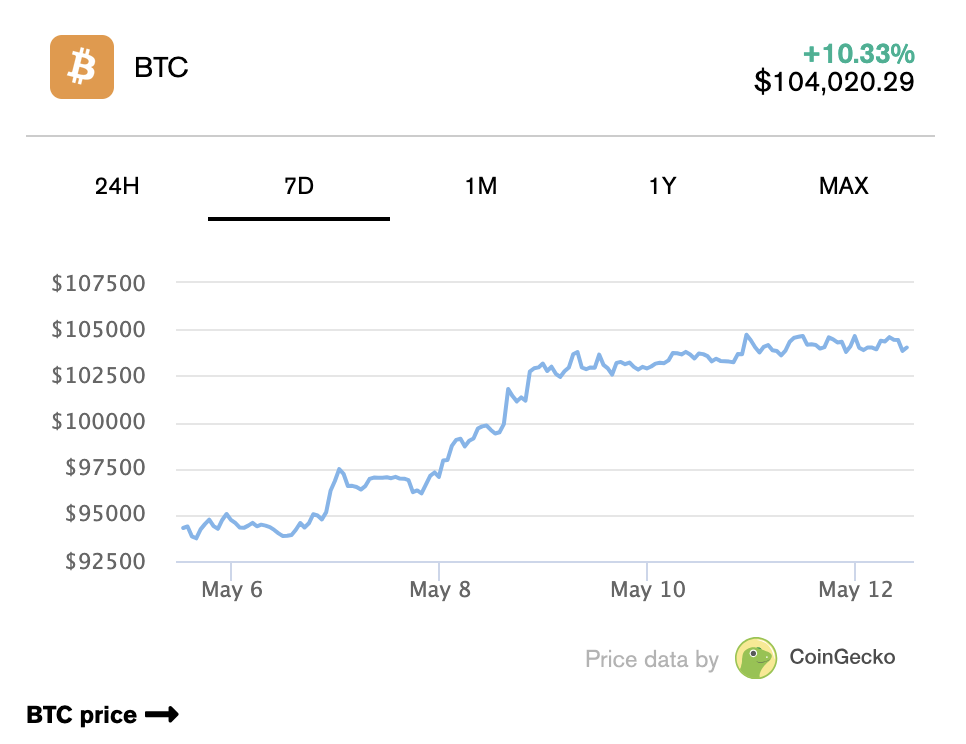

Despite Bitcoin’s price holding steady around $104,368, the leading cryptocurrency has surged 10.9% over the past week and 25.1% over the past month, per CoinGecko. The price momentum appears to be closely mirrored by surging capital inflows into BTC-linked ETFs.

Online advertising service 1lx.online

In his commentary, James Butterfill, head of research at CoinShares, attributed the massive investment surge to a combination of macroeconomic and policy catalysts. These include a global increase in M2 money supply, emerging stagflation concerns in the United States, and several U.S. states formally adopting Bitcoin as a strategic reserve asset.

M2 represents a broad measure of money supply that includes savings deposits, small time deposits, and retail money market funds. It’s a metric watched closely by economists to assess liquidity in the system. After declining in late 2023, M2 has since reversed course, indicating renewed capital availability for investment.

Butterfill also highlighted a new milestone: U.S.-listed Bitcoin ETFs have now attracted $62.9 billion in net inflows since launching in January 2024, surpassing the previous record of $61.6 billion set in February. This cements Bitcoin’s dominance as the institutional favorite among crypto investment vehicles.

However, not all assets benefited equally from investor attention.

While Ethereum (ETH) saw an impressive 40% price gain last week, institutional fund flows failed to follow. ETH-linked ETFs brought in just $1.5 million, a figure dwarfed by other emerging assets.

Sui (SUI) funds, for instance, brought in $11.7 million, while Solana (SOL) funds suffered $3.4 million in net outflows during the same period. This suggests a shifting landscape where investors are beginning to favor next-gen blockchain platforms over legacy Layer-1 alternatives.

Currently, all SUI ETFs are offered by non-U.S. issuers, though that may change soon. Canary Capital filed to launch a U.S.-based SUI ETF in March, followed by 21Shares, which submitted its application two weeks ago. Neither has received regulatory approval yet.

As of now, the U.S. Securities and Exchange Commission (SEC) has more than 70 crypto ETF applications pending review. The most recent approval came in July 2024, when the agency gave the green light for Ethereum ETFs to begin trading.

Online advertising service 1lx.online

With the regulatory climate warming and macroeconomic forces driving capital into scarce digital assets, Bitcoin’s role as a global financial hedge is only being reinforced—especially by the sharp rise in ETF allocations.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)