Bitcoin Breaks $124K Record Amid Rising Rate-Cut Hopes and ETF Inflows

Bitcoin surged to a fresh all-time high above $124,000, driven by investors pricing in upcoming Federal Reserve rate cuts and strong institutional ETF flows.

Bitcoin soared to a new all-time high above $124,457 during early Asian trading, fueled by growing expectations that the U.S. Federal Reserve may soon ease monetary policy and bolstered by recent regulatory momentum. This move marks a 3.6% gain for the world’s largest cryptocurrency. Bitcoin has now achieved nearly a 32% gain in 2025, aided by favorable policy shifts under President Trump—who continues to position himself as the “crypto president”—and improved institutional sentiment toward digital assets.

Online advertising service 1lx.online

Markets are increasingly pricing in a potential Fed rate cut in mid-September, with some bets placing a strong chance on a larger half-point reduction. U.S. Treasury Secretary Scott Bessent has also publicly advocated for a “series of rate cuts,” further encouraging risk-asset rallies. Analysts believe such a policy shift would provide significant tailwinds for Bitcoin and the broader crypto market.

Institutional demand remains robust: spot Bitcoin ETFs recorded a daily net inflow of $86.91 million on August 13, bringing total net inflows to $54.76 billion since their launch. Assets under management now total roughly $156.69 billion, representing about 6.48% of Bitcoin’s total market cap. Among these funds, BlackRock’s iShares Bitcoin Trust leads with $89.11 billion, followed by Fidelity’s FBTC at $24.77 billion.

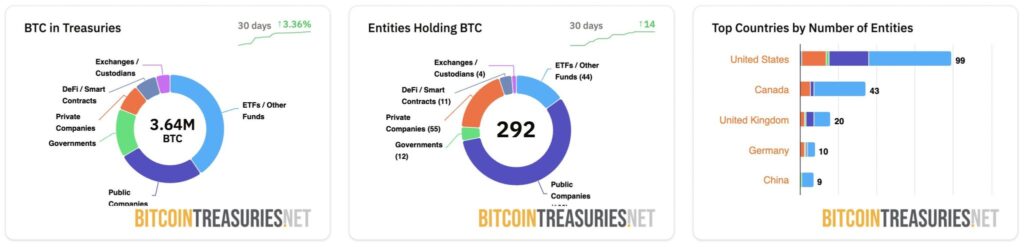

Institutional confidence is also reflected in growing corporate and public accumulation. According to BitcoinTreasuries.net, around 3.65 million BTC is held by a range of entities, including ETFs, publicly listed companies, governments, and private firms. Over the past month, the number of holdings has grown by 16 entities, with the U.S. leading in institutional participants.

Adding to the bullish environment, the Trump administration has adopted a pro-crypto stance—issuing an executive order encouraging 401(k) plans to include cryptocurrency options, nominating digital asset advocate Stephen Miran to the Federal Reserve Board, committing to end “debanking” practices, and clarifying that many liquid staking receipt tokens, like stETH, are not considered securities. These moves were widely lauded by industry groups as historic progress in crypto regulation.

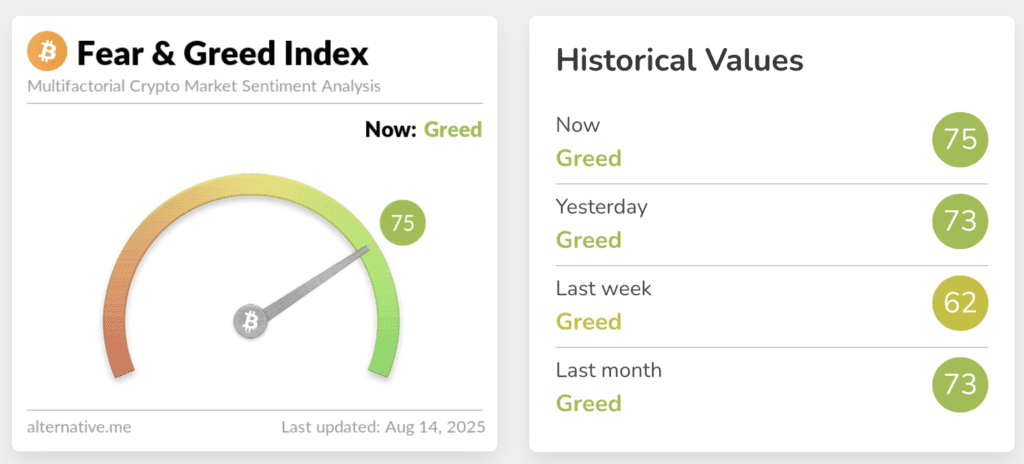

Investor sentiment reflects the optimism: the Fear & Greed Index remains firmly in “Greed” territory, currently at 75 (up from 62 last week), signaling strong market confidence even amid elevated enthusiasm.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)