Bitcoin Faces Sharp Decline: Experts Weigh in on the Next Move

Bitcoin price has dropped below $80,000 for the first time since November, marking an 18% weekly decline. Analysts speculate on whether BTC will recover or continue to fall further, with key support levels in focus.

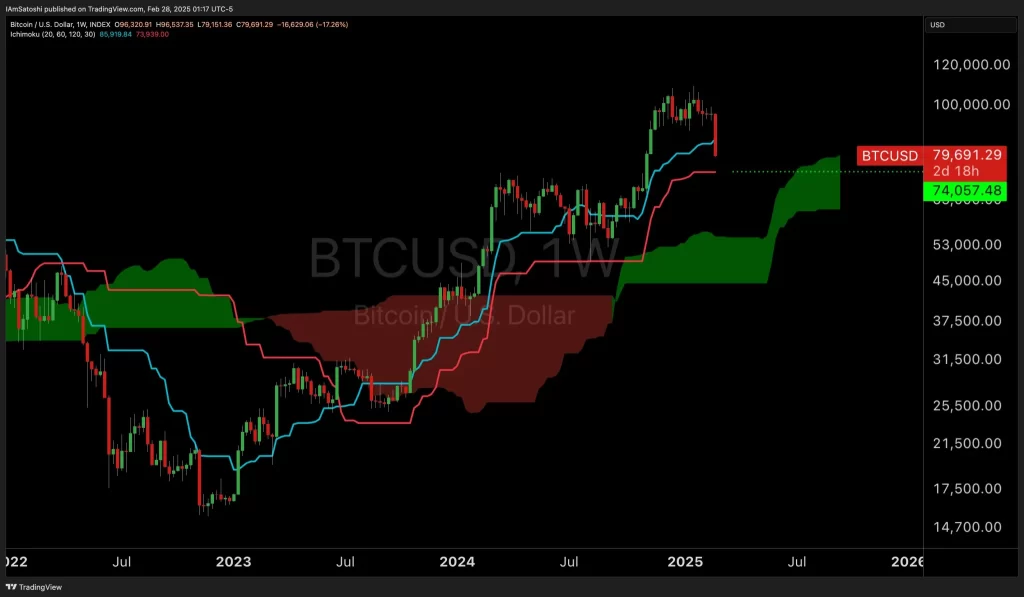

Bitcoin has faced a significant downturn in recent days. After peaking above $96,000 on Monday, its price plummeted to below $80,000, marking an 18% decline in just a week. From its all-time high of $109,588 in January, Bitcoin has now lost approximately 27% of its value.

Online advertising service 1lx.online

This sharp decline can be attributed to multiple factors, including newly imposed Trump tariffs, substantial outflows from spot BTC ETFs, and high liquidation levels in the futures market. The Fear and Greed Index has plummeted to 16, signaling “Extreme Fear.” Despite the negative sentiment, some analysts argue that these conditions could lay the groundwork for a potential rebound or further losses.

Where Is Bitcoin Headed Next?

Scott Melker, known as “The Wolf Of All Streets,” points out a developing bullish divergence across multiple timeframes. He stated: “BTC 4-HOUR: Bullish divergence still building after the hidden bearish divergence I was watching for. This could fail, obviously, but RSI is holding up well. If you have been following me for years, this is my favorite signal when confirmed. Oversold RSI with bullish divs building over multiple timeframes.”

Another analyst, Tony “The Bull” Severino, CMT, suggests that Bitcoin is following a familiar corrective pattern seen in 2021 and 2022. He warns that BTC could drop further to $75,000 if the pattern extends into late 2025. Additionally, Severino highlights the Parabolic SAR indicator, stating: “Bitcoin must hold above the $75,742 level. If this support fails, it could trigger a much deeper correction.”

Josh Olszewicz, an Ichimoku Cloud analyst, predicts a potential retest of Bitcoin’s weekly kijun level: “Weekly kijun support at 74K if we keep going.” He noted that Bitcoin last interacted with this level during the yen carry trade unwind in August 2024, which caused high volatility across global markets.

Signs of Potential Accumulation?

Daan Crypto Trades draws attention to Bitcoin’s RSI levels: “The last time BTC was this ‘oversold’ on the Daily RSI was in August 2023 at $25K. The time before that was during the FTX crash in late 2022. While this short-term indicator is not definitive, it should catch your attention.”

Online advertising service 1lx.online

He also points to significant buy orders appearing on Binance futures: “BTC ~$1.8 Billion in Bids has appeared on the Binance futures pair between $70K-$79K. These bids could indicate strong support, but they can also be withdrawn quickly.”

CryptoQuant CEO Ki Young Ju highlights liquidity concerns, stating: “Spot volume was highly active around $100K, but prices drop when new liquidity dries up.” He anticipates a prolonged consolidation phase, with BTC likely to trade between $75K and $100K until new bullish catalysts emerge.

Conclusion

Online advertising service 1lx.online

At press time, Bitcoin was trading at $78,856. Whether BTC finds support and rebounds or continues its descent remains uncertain. Traders and investors are closely watching key levels, liquidity flows, and macroeconomic factors that could influence Bitcoin’s next move.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)