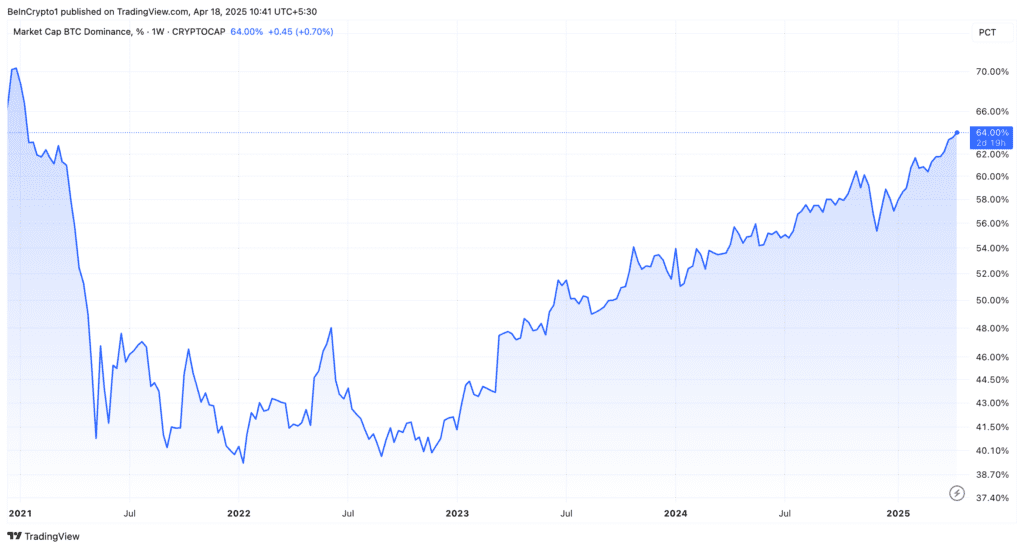

Bitcoin Dominance Hits 64% as Analysts Clash Over Fate of Altcoin Season

Bitcoin dominance soars to a 4-year high of 64%, fueling debate over whether altcoins are nearing a breakout—or bracing for more suppression.

Bitcoin’s grip on the cryptocurrency market has tightened, with its dominance metric rising to 64%—a level not seen since early 2021. While Bitcoin’s market cap continues to dwarf the altcoin sector, opinions are sharply divided on whether this marks the start of a deeper consolidation phase or the quiet buildup before an altcoin surge.

Understanding Bitcoin Dominance (BTC.D):

Bitcoin dominance measures the share of BTC in the total crypto market cap. A high dominance figure suggests Bitcoin is outperforming other cryptocurrencies, while a declining figure can signal rising interest in altcoins. Currently, with stablecoins excluded, that dominance reaches an even more striking 69%, according to Into The Cryptoverse founder Benjamin Cowen.

Online advertising service 1lx.online

“Excluding stable coins, Bitcoin dominance is now at 69%,” Cowen noted.

However, Cowen believes that altcoins are due for further downside before any serious rally begins.

“I think ALT/BTC pairs need to go down before they can go up.”

Caution From the Bears:

Nordin from the Nour Group emphasized that this is more than just a Bitcoin rally—capital is actively rotating out of altcoins.

“This isn’t just a BTC move. It’s capital rotating out of alts,” he explained.

He warned that breaching the 66% level could unleash heavier altcoin sell-offs, delaying any potential “altseason” until 2026.

“No Alt seasons in 2024 or 2025,” predicted analyst Alessandro Ottaviani.

Dueling Technical Views:

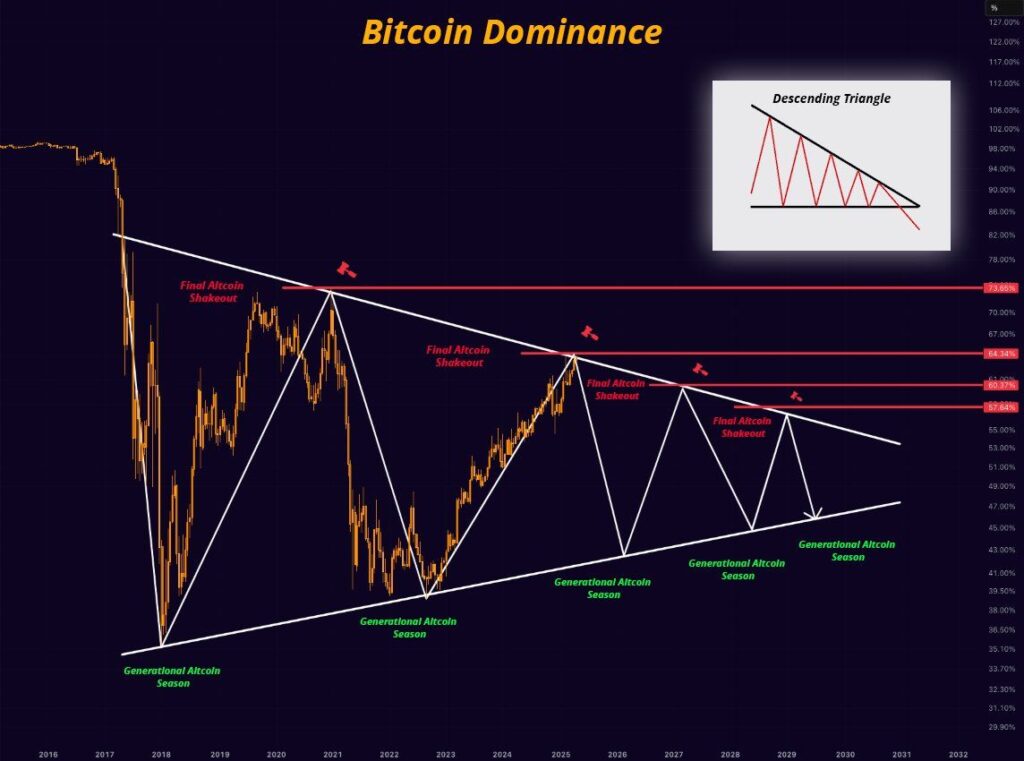

Not everyone shares the pessimism. Some traders believe Bitcoin dominance is forming a descending triangle—a historically bearish pattern—which could indicate a slowdown or reversal.

Online advertising service 1lx.online

Another analyst pointed out that BTC.D is currently testing a resistance zone between 64% and 64.3%, meaning the market is at a crossroads. A retracement could shift capital into promising altcoins.

“A breakout from this zone could mean further declines for alts,” the analyst added.

Junaid Dar, CEO of Bitwardinvest, took a more optimistic tone.

“If BTC dominance falls below 63.45%, altcoins could explode upward,” he claimed.

“For now, alts are stuck. Just a matter of time.”

Online advertising service 1lx.online

Stablecoin Signals: Altseason on the Horizon?

While Bitcoin takes center stage, stablecoins may hold the real clues. Analysts are tracking Tether dominance (USDT.D) and USD Coin dominance (USDC.D) for early signs of altcoin momentum. Both have reached key resistance zones.

“As long as USDT.D doesn’t close above 6.75%, it favors altcoins,” said one technical expert.

Others believe that declines in stablecoin dominance—especially when combined with Bitcoin stalling—could trigger a capital rotation into smaller tokens.

As summer approaches, investors remain glued to these critical metrics. Will Bitcoin tighten its hold on the market, or will the stage soon shift toward altcoins finding their moment in the sun?

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)